What must now follow is the transposition into national law. The hope is that this will lead to a significant acceleration in the expansion of renewable energies – mandatory 42.5 percent by 2030 – and a faster reduction in greenhouse gas emissions.

“ reduction of net greenhouse gas emissions by at least 55 % compared to 1990 levels by 2030. Renewable energy plays a fundamental role in achieving those objectives, given that the energy sector currently contributes over 75 % of total greenhouse gas emissions in the Union.”

The German government has shown that it is willing to pick up the pace. For example, federal economy minister Robert Habeck during the German worker’s day event called for acceleration of the expansion of the hydrogen economy. Stefan Wenzel, parliamentary secretary of the federal ministry for economy and climate protection (BMWK, see photo) stated in Berlin that the motto of the BMWK is “faster, more digital, simpler.”

Also Dr. Christine Falken-Großer, department head at the BMWK, explained at an EEX workshop in Berlin: “We have achieved an incredible amount in recent years. There may be little in the ground, but we have funding instruments, strategies, etc.” Furthermore, an H2 acceleration act (H2-Beschleunigungsgesetz) is on the way. This legislative package will “contain things that will bring about substantial acceleration.”

There has been a reform backlog in many areas for years, for example in the revision of the ordinance on the implementation of the emissions reduction law (37th BImSchV). Werner Diwald, chairman of the German hydrogen and fuel cell association DWV, has long pointed out the enormous importance of this ordinance. “We have been waiting twelve years for the 37th BImSchV,” said Diwald.

Commission adopts 6th PCI list

Not quite as long, but also too long, many companies have been waiting for notification of their funding applications for IPCEIs (Important Projects of Common European Interest). Only with this explicit “go” may the EU member states approve subsidies that go beyond what is normally permitted under competition laws. There are now individual cases of pre-approval for an early project start, but the risk then lies with the companies. Only a handful of companies have already received a funding decision; the majority of players are still waiting for positive feedback from the EU.

Alexander Peters, managing director of the Neuman & Esser Group, said recently in Berlin: “I know many companies that have since left the IPCEI procedure.” Similarly, it has been reported from other sources that a number of players would no longer submit their funding applications in the same form today in view of the higher prices. Stefan Wenzel holds the view, however, that at least for the infrastructure projects the commitments from the EU should turn up at the turn of the year.

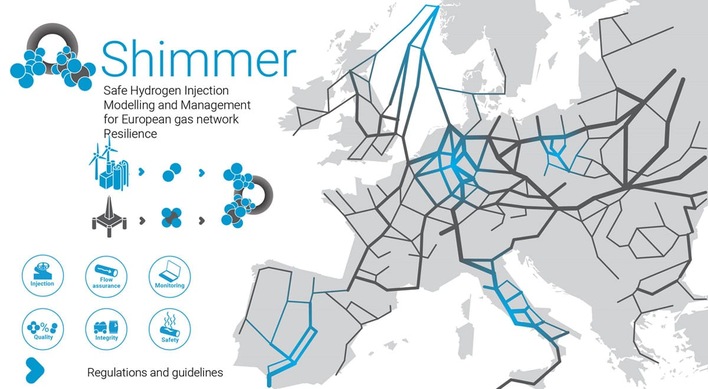

Nevertheless, at the end of November 2023, the news came from Brussels that the European Commission had adopted the sixth PCI list (Projects of Common Interest). Among the total of 166 infrastructure projects it contains are 85 projects for an offshore and intelligent electricity network as well as 14 for a CO2 network – and 65 hydrogen-related projects, most of them in Western Europe.

A total of 179 applications for hydrogen were submitted. However, as activities such as the continued operation of natural gas projects are no longer supported, the overall success rate was “only” 37%.

Daniel Fraile, head of policy at the association Hydrogen Europe, said: “The adoption of hydrogen projects in a PCI list for the first time is a big step forward and shows the commitment of the EU to laying the foundations for a European hydrogen backbone. This first selection process is also a valuable lesson that we have learned. We will work with our members to ensure that the next list includes more diversified projects (both in terms of type and geographical distribution).”

Now, a corresponding delegated act with the 6th PCI list lies before the European Parliament as well as the European Council. The vote should then take place two, maximum four months from now.

Author: Sven Geitmann