The German government has set itself ambitious goals: 10 GW of electrolysis capacity in Germany is to be set up by 2030. The reality looks bleak: At the end of 2024, final investment decisions for just 1 GW were available. That is only ten percent of the aimed goal – a blatant deficit that is due to a variety of problems: excessive bureaucracy, unclear regulatory requirements and high costs. Colleagues and industrial players are hesitating to conclude long-term delivery and acceptance contracts. They lack the certainty that hydrogen projects will pay off economically. Without scale effects, the production costs remain high and competitiveness is low.

The new federal government must now act and send investors clear signals. In addition to reducing electricity costs – one of the largest cost factors for hydrogen – the EU requirements of additionality, locality and temporal correlation must be met in order for the ramp-up to not be delayed unnecessarily. The European Commission has set strict guidelines for the classification of green hydrogen, but in practice they slow down the development instead of promoting it. Only when hydrogen can be affordable can it displace fossil alternatives. In addition, we need the possibility of using grid electricity based on hourly emission values for the production of low-carbon hydrogen, which does not meet the requirements for green hydrogen.

Bureaucratic hurdles blocking ramp-up

However, it is clear that the regulatory framework for the hydrogen market is currently one of the largest hurdles for investments. In addition to adapting the EU criteria, urgently needed is implementation of European proof of origin systems for hydrogen in Germany, in the sense of a book & claim system. This is the only way to meter and track hydrogen – similar to electricity – and use it across borders.

Approval procedures must also be accelerated massively. There is currently no uniform legal framework for electrolyzers, pipelines and hydrogen infrastructures. While wind and solar parks already enjoy regulatory privileges, complex approval requirements still apply to electrolyzers. In our view, the incoming federal government must resume the work on the hydrogen acceleration law and introduce binding management periods for approval procedures.

Industry and mobility need reliable markets

The hydrogen market will not get going without a stable demand. Industry is one of the greatest potential customers, but so far there is a lack of concrete incentives. The implementation of the RED III (Renewable Energy Directive) industry quota must be implemented sensibly to ensure reliable demand. Sitting out the poor economic situation is not an option, because the competition does not sleep in China and the USA.

Hydrogen also remains essential in the mobility sector. From our point of view, the introduction of a binding subquota for renewable hydrogen in the transport sector by 2030 must create a stable minimum demand. At the same time, financial incentives are needed to improve the economy of hydrogen-powered vehicles – for example by maintaining the toll exemption for emissions-free commercial vehicles or adapting the taxation of hydrogen compared to diesel. The construction and expansion of hydrogen refueling stations along the TEN-T network must be promoted more ambitiously in order to ensure a nationwide supply.

Without storage and infrastructure, hydrogen remains inefficient

The expansion of storage capacity is essential to ensure safe hydrogen supply. Existing natural gas stores can be converted, but that is not enough to meet the increasing demand. A clear and binding storage strategy is needed that defines the transition from the natural gas to the hydrogen economy. At the same time, approval processes for new constructions and conversions must be drastically accelerated.

The expansion of the H2 infrastructure must not stall either. The first successes have been achieved with the approved H2 core network, but there is no strategy for connecting industry and business. Many companies are faced with the question of whether they should invest in hydrogen technologies – these investments will not appear without clarity about the infrastructure. Alternative transport solutions must be developed in particular for decentralized production systems that are not connected to the core network.

Germany needs to revamp its import strategy

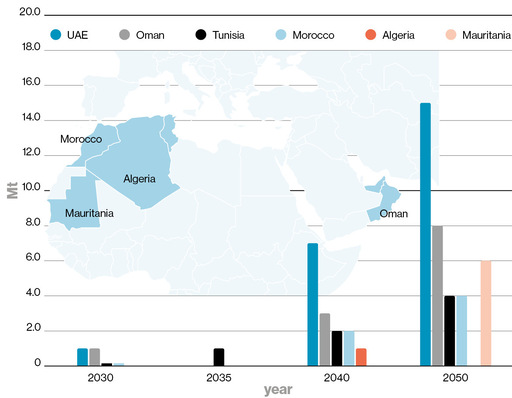

Germany will not be able to cover its hydrogen requirements solely by domestic production. The import via pipelines and ship carriers will be essential. But the German port infrastructure is insufficiently prepared for hydrogen imports. The federal government must therefore provide financial support for the expansion of H2 import terminals and port infrastructures.

At the same time, existing natural gas pipelines should be upgraded for the transport of growing quantities of renewable hydrogen. Within Europe, close synchronization of grid expansion with the European hydrogen grid is necessary to ensure a reliable supply.

Improve financing instruments, make investments easier

A functioning hydrogen market needs stable financing instruments. Practice shows that many advanced projects are currently not coming to the final investment decision. Increasing construction costs, shortage of skilled workers and regulatory uncertainties inhibit progress. Increased use of the European Hydrogen Bank and better integration with existing support programs could eliminate structural disadvantages for German companies.

The ramp-up of the hydrogen economy is crucial for the future of industrial location Germany. So far, however, there has been no resolute implementation. In many places, policymakers are hesitant, overly cautious and too slow. The direction is clear: Costs must be reduced, bureaucracy must be reduced, storage and infrastructure must be expanded and stable demand secured. Only then can hydrogen become a real alternative to fossil fuels – and Germany take on a leading role in the global hydrogen economy.

A strong voice for the hydrogen economy

The ramp-up of the hydrogen economy requires a strong and united voice that effectively brings the interests of the industry into the political debate. The German hydrogen association DWV is taking on this task: As a representative of the entire value chain – from the production to transport to use – it is committed to ensuring that the right course is set for a successful hydrogen future. The DWV ensures that the demands of the industry are heard in politics and brings companies, research institutions and political decision-makers to one table. Only with a clear strategy, coordinated measures and a common voice can Germany survive in the global competition for the hydrogen markets of the future – at the DWV, we’ve taken on the duty of working towards this goal.

On October 30, 2024, Friederike Lieben succeeded Werner Diwald, who had managed and shaped the DWV since 2014. Diwald developed the association from a band of idealistic H2 friends to an industrial lobby association that belongs to both the German and the European level. Now, the DWV is in a phase of restructuring and renewal.

Author: Friederike Lassen, Deutscher Wasserstoff-Verband, Berlin