Just a few hundred meters from the fine sandy North Sea beach with its impressive dune landscape, Europe’s largest hydrogen plant to date is under construction: Holland Hydrogen 1 (HH1). It is located in a gray hall on Shell’s site, situated 42 kilometers west of Rotterdam on the artificial island of Maasvlakte. Inside the hall, Thyssenkrupp Nucera is building an electrolysis plant consisting of 20 modules of 10 megawatts each.

To get there, the approximately 80 representatives of the hydrogen industry – all participants of the World Hydrogen Summit – traveled by ship from downtown Rotterdam for a good three and a half hours, which alone gives an idea of the scale of Europe’s largest port. The superlative, however, refers to cargo throughput. Around 120,000 ships call at the port each year, and it is also a vast industrial area with more than 3,000 companies. It generates 2.9 percent of the Netherlands’ gross domestic product.

In particular, oil refineries, gas and chemical companies are located here, as Rotterdam serves not only as a trading hub but primarily as an energy port. There are four crude oil refineries, 45 petrochemical companies, four vegetable oil refineries, and three biofuel plants. This already makes Rotterdam home to the largest biofuel cluster in Europe.

North Rhine-Westphalia directly benefits from Rotterdam’s H2 plans “Thirteen percent of the entire energy consumption of the European Union passes through the Port of Rotterdam,” says Erik van der Heijden, Business Manager for Energy and Infrastructure at the Port Authority. “And the largest share of that goes to Germany. For now, it’s mostly fossil energy, but we’re going to change that.”

This also applies to the 0.5 million tons of hydrogen produced here annually. Rotterdam is working with various partners on a large-scale H2 network that aims to establish the location as an international hub for the production, import, use, and transport of hydrogen to other countries in Northwestern Europe. The H2 pipelines will largely consist of repurposed natural gas pipelines. From 2030, a connection is planned with the chemical site Chemelot in the North Rhine-Westphalian region of Limburg, as well as with other regions in Europe. In addition to pipelines, ships and trains will also be used to transport hydrogen to future customers.

The port authority bases its H2 strategy on several pillars. Electricity from offshore wind farms in the North Sea is to supply multiple electrolyzers via new power lines to produce green hydrogen. Blue hydrogen is already being produced in the port. The CO2 generated during production from natural gas is to be captured in the future and stored under the North Sea as part of the Porthos project.

Porthos project for CCS Rotterdam also plans to import hydrogen produced worldwide via new terminals. The main consumers of the low-emission gas are industrial sectors: for the production of fuels, fertilizers, steel, and chemicals. The mobility sector also has a high demand for hydrogen to produce fuels for shipping, aviation, and trucks. In addition, it is to be used for power generation and as a feedstock in industrial processes.

The port authority aims to decarbonize its own administrative area and become climate-neutral by 2050. It is relying on green and “low-carbon” hydrogen, i.e., blue and turquoise hydrogen as well as H2 derivatives, primarily ammonia and methanol. Carbon dioxide capture through CCS (Carbon Capture and Storage) was part of the plan from the outset. The pipelines for CO2 are already under construction, as are the new ones for hydrogen: they are being laid simultaneously and in some sections in parallel. The carbon dioxide pipeline, approximately 30 kilometers long on land, leads to the North Sea, where the climate gas is to be stored in a depleted gas field 20 kilometers off the coast.

Wouter van Betuw from the gas supplier Gasunie jokingly refers to the construction work as a kind of “pipeline pick-up sticks,” only to add that it is, of course, a serious matter: when laying new pipelines, the employees of Hydrogen Network Netherlands repeatedly encounter existing pipelines for gas, water, and electricity during excavation work in the port. Extreme caution is required. The first section of the hydrogen network is scheduled to be operational next year. It will also be connected to the European hydrogen network and, through it, to the German hydrogen core network.

When it comes to terminal facilities for the import and processing of hydrogen and its derivatives, the port authority is taking a very pragmatic approach. “We have examined various hydrogen carriers. Each has its own advantages and disadvantages,” says a representative of the port authority. “That’s why we decided to go with all of them.” As a result, facilities are now being built to receive hydrogen in the form of ammonia, methanol, liquid hydrogen, or bound to Liquid Organic Hydrogen Carriers (LOHC). A total of 14 terminals are planned; five of them are already in operation, including one for ammonia. The successful first ship-to-ship transfer of cold ammonia in April 2025 is a source of pride for all involved.

Power2X and Advario, specialized in the storage of chemicals, gases, and fuels, are developing a large-scale production and storage facility for sustainable aviation fuel (e-SAF), which is based on green hydrogen or e-methanol. Air Products, a major supplier of hydrogen and other industrial gases, has been building Europe’s largest blue hydrogen plant at its existing production site in Rotterdam since 2024. Starting in 2026, it is to supply, among others, the Rotterdam refinery of Exxon Mobil. The plant will be connected to Porthos.

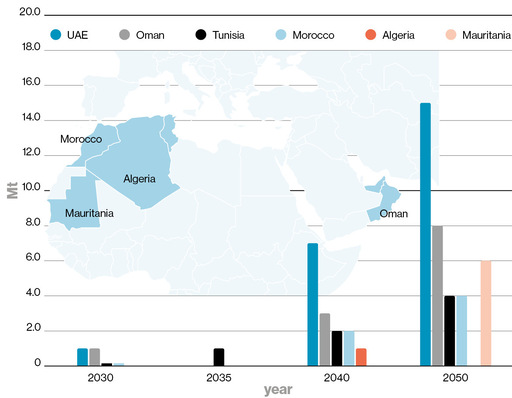

At least 2 GW of electrolysis capacity By 2032, offshore wind farms in the North Sea with a total capacity of 7.4 gigawatts are to be connected to Rotterdam. Electrolysis capacities on the Maasvlakte island are expected to increase to two to two and a half gigawatts starting in the early 2030s. Even more ambitious is the vision for 2050, when the Netherlands plans to have installed 70 gigawatts of wind energy in the North Sea. The combination of onshore and offshore wind energy with electrolysis plants is expected to enable an H2 production capacity of 20 gigawatts. On the import side, Rotterdam is calculating with 0.1 to 1.7 million tons of hydrogen and derivatives entering Europe via its port by around 2030; and 18 million tons by 2050. The first hydrogen imports are expected later this year.