The integration of wind subsidiary Gamesa will still need time until synergies (supply chains, joint purchasing power) and cost reduction potentials become visible in good, or initially at least better, figures. Nothing else is to be expected. The increased loss in the first quarter (Sep. 30, 2022) of fiscal year 2022/23 (fiscal 2023) of 598 million EUR (−246 million EUR in Q1 2022) seems to be owed to the transition phase, but we think will be able to improve over the course of the year.

Remarkable is the order intake totaling 12.7 billion EUR in the first quarter of the fiscal year, which allowed a plus of over 50 percent from the same period the previous year, so we assume that only new such orders will be taken, from which a reasonable return or profit margin is possible.

In the USA, the Inflation Reduction Act (IRA) is providing positive incentives, as green hydrogen is be subsidized with 3 USD per kg and certain projects can become worth starting. Since Siemens Energy operates production facilities in the USA, the company benefits from or can participate in IRA programs. Siemens Energy is represented in the USA with 84 locations and 26 production facilities with a total of 9,600 employees, so there are a large number of support opportunities in the IRA that Siemens Energy can take advantage of. Similar programs will soon be ready for implementation in Europe, so the company can also expect some support there.

Now, it is first a matter of creating an inflow of capital by issuing new shares. Up to 363.3 million new shares could be placed, to generate more than 2 billion EUR in new capital. For this, Siemens Energy is likely bargaining with various big sovereign wealth funds, according to an article in Handelsblatt.

The financing via new issuance of shares should not be a problem, as many institutional investors want to more strongly invest exactly in companies like Siemens Energy in the future. The story is a story of growth and, at the same time, of recovery from a speculation (Gamesa). At the end of the day, Siemens Energy will be a success story – accompanied by rising prices. The stock market will anticipate the future. Analysts see the share at 25 EUR – I see it at over 30 EUR in two years – a good 50 percent chance.

Notes about my own dealings

There are many interesting applications: power supply for wind measuring system from SFC

I am often asked to include other companies in this analysis and to discuss securities like Nel ASA, SFC, ITM Power, Powercell, and many others. For me, however, subjectively, many of these players unfortunately do not possess the charm of those discussed here.

The concentration on just a few players in the H2 cosmos is also necessary in view of the abundance of information, which is not only about performance indicators and growth prospects. As a whole, they all will benefit from the megatrend that is hydrogen – including in the development of their share prices.

Allow me to point out that investors can acquire or invest in all these securities together with those of big companies, such as those from the gas industry (Linde, Air Products, Air Liquide), via funds and ETFs. Most investors would do well to invest in hydrogen in the form of funds, instead of speculating with individual shares (risk tolerance). The cost averaging system is greatly suited for this, as for example one can invest fixed monthly amounts and thereby attain a good average rate and earn good money from the hydrogen megatrend in the medium to long term, and achieve a high return. Every bank offers suitable funds for this or brokers them.

My analysis has yielded that many H2 funds hold the same H2 shares and in the same ratio in the portfolio, since there are not yet so many listed companies in this industry anyway. My own Wikifolio BZVision (BZ is the German abbreviation for fuel cells) at www.wikifolio.com, in contrast, is very concentrated, highly speculative and has only the three securities Bloom Energy, Ballard Power and Nikola Motors in the portfolio.

The reason for this speculative asset allocation: These three companies together cover hydrogen and hydrogen-related areas perfectly. This refers to the different markets, applications and H2 production. These shares possess for me – subjectively – the greatest potential in the coming years.

Disclaimer

Each investor must always be aware of their own risk when investing in shares and should consider a sensible risk diversification. The FC companies and shares mentioned here are small and mid cap, i.e. they are not standard stocks and their volatility is also much higher. This report is not meant to be viewed as purchase recommendations, and the author holds no liability for your actions. All information is based on publicly available sources and, as far as assessment is concerned, represents exclusively the personal opinion of the author, who focuses on medium- and long-term valuation and not on short-term profit. The author may be in possession of the shares presented here.

Written by author Sven Jösting, March 5th, 2023

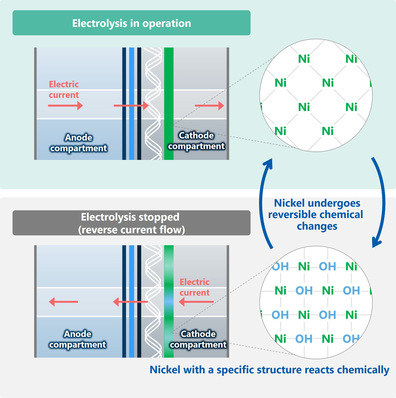

Scheme of a future energy supply Source: Siemens Energy