Which country will be the first to establish a hydrogen economy? It’s not just the German energy sector that has been plagued by this question. Following the introduction of new legislation in the United States – the Inflation Reduction Act – which sets out highly attractive conditions for creating a hydrogen industry, Germany once again risks being left on the sidelines. That’s why representatives from German businesses and associations have joined forces to argue the case for swift political action.

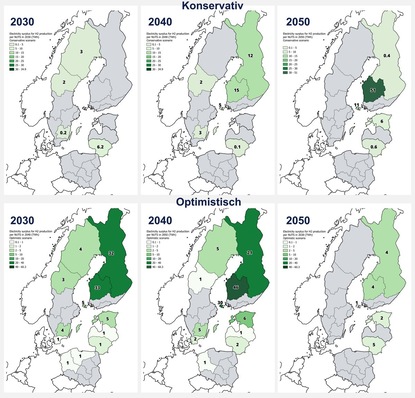

The challenge is immense, given that the targets for ramping up future electrolyzer capacity have increased at both a German and a European level: Originally it was a case of reaching 40 gigawatts in Europe by the year 2030. Since May 2022 the goal has been to expand production capacity for electrolyzers tenfold by 2025. In Germany the new expectation is to install 10 gigawatts by 2030. The previous target was just 5 gigawatts. However, to get even close to these figures (the European Union currently has 3 gigawatts installed) would require specific measures to foster the required scaling and create incentives for investment in a hydrogen economy – something that is lacking at present.

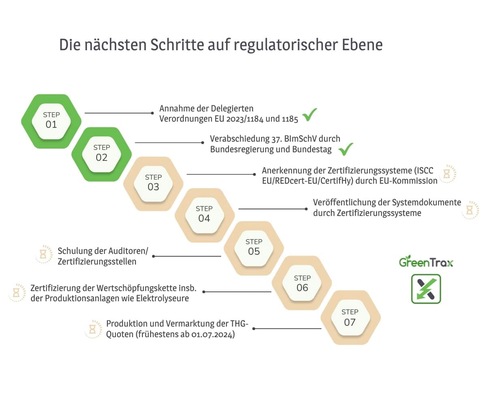

One demand put forward by the German hydrogen and fuel cell association DWV, which is now being reiterated by its chairman Werner Diwald at every event, calls for the rapid implementation of the 37th BImSchV (37th Ordinance on the Implementation of the Federal Immission Control Act). For months, the DWV has been pointing out that industries act on a global scale and primarily invest where the best conditions can be found. So long as an absence of clarity prevails in Germany (with regard to the EU’s revised Renewable Energy Directive RED II and the 37th BImSchV), industry does not have the necessary planning certainty to make investment decisions, explained Diwald.

Andreas Rimkus, hydrogen representative from the SPD parliamentary group, has also repeatedly made the following appeal to German environment minister Steffi Lemke in unison with the DWV: “Please release the 37th BImSchV!”

“Everything speaks in favor of quickly creating the legal framework for the use of green hydrogen in refineries. Yet the German environment ministry has been avoiding taking the decisive step for years.”

Werner Diwald, DWV chairman

Meanwhile the US has acquired a far greater level of planning certainty following the Biden administration’s announcement of the Inflation Reduction Act. Since then, an increasing number of European electrolyzer manufacturers are openly considering expanding their production capacity there rather than investing in Germany. Against this backdrop, Diwald warns that in just a few weeks circumstances could arise that mean Europe would lack the capacity to establish a hydrogen economy because the order books of manufacturers may potentially be already filled with US commissions.

The US Inflation Reduction Act, according to the DWV head, is based on Germany’s renewable energy law EEG. According to his remarks, those responsible in the US looked extremely closely at the EEG and adapted its principle for hydrogen. What the German response to it could look like is still undecided. Ingrid Nestle, head of the climate protection and energy working group of the Greens parliamentary faction, declared that now isn’t the time to provoke a one-upmanship battle.

Hydrogen strategy overhaul

German industry, however, is hoping for a revision of the country’s national hydrogen strategy. Various ministers have, time and again, stated that a new draft is in the pipeline. The original aim was to present the second version before the winter break, though at the time of writing that seems unlikely since the German economy ministry especially is busy tackling issues on several fronts.

To underline the urgency of the current situation, a total of 30 companies and associations from the energy sector sent an open letter to German economy minister Robert Habeck on Nov. 10, 2022. In this communication, a copy of which has been seen by H2-international, the DWV asks on behalf of all signatories not only for a rapid enactment of the 37th BImSchV but also for more planning certainty in general. Diwald stated: “Germany needs an immediate response to the USA’s Inflation Reduction Act which is supporting the scale-up of the hydrogen economy by providing over USD 50 billion in secure resource funding. Unless the German government takes immediate action there is a risk that the hydrogen industry will relocate to the USA.”

Taxonomy

In early 2022 – notably before the Russian invasion of Ukraine – the gas sector had been delighted when Brussels decided that natural gas and nuclear energy are sustainable. Chairman of the German gas and water industries association DVGW Gerald Linke said at the time: “The EU Commission’s proposal shows both consideration and foresight: Investment security creates the necessary conditions for the continued reliable and affordable supply of heat, power and fuels to 450 million EU citizens. The gas infrastructure in Germany is critical to the success of the energy transition in connection with the essential use of hydrogen.”

AFIR decision

On Oct. 19, 2022, meanwhile, members of the European Parliament voted in favor of the Alternative Fuels Infrastructure Regulation or AFIR, demonstrating their agreement with the targets proposed by the European Parliament’s transport committee. In doing so they endorsed the recommendations put forward by report author Ismail Ertug and his colleagues from the Committee on Transport and Tourism. One such suggestion is that in future the maximum allowable distance between individual hydrogen refueling stations in Europe should be fixed at 100 kilometers (62 miles).

Hydrogen Europe called the decision to adopt the AFIR proposal “a clear signal that clean hydrogen mobility is a practical and realistic solution to move away from fossil fuels in the transport sector.” The association reckons that up to 1,780 hydrogen filling stations could be made available across Europe by the end of 2027 as a consequence. These stations could supply up to 59,000 hydrogen trucks, six times more than had been originally planned. The hope is that the construction of sufficient numbers of hydrogen filling stations will encourage vehicle manufacturers to bring more fuel cell vehicles onto the market at an earlier date.

Jorgo Chatzimarkakis, CEO of Hydrogen Europe, seemed equally pleased with the result of the vote on another legal act – FuelEU Maritime. He said: “Today’s vote represents the parliament’s strong position and one that goes further than the commission’s proposals and sends a positive signal for the introduction of hydrogen in road and maritime transport.”

Transformation of the automotive industry

The likelihood and extent to which the German economy ministry is interested in taking a different political approach compared with previous times can at least be partially inferred from the makeup of a new committee of experts. Initiated at the end of June 2022, the 13-member working group entitled “Transformation of the automotive industry” is part of the strategy platform set out in the coalition agreement that is dealing with the readjustment of the automotive and mobility sector. Its members, who were appointed by minister Robert Habeck for this legislative period, include relatively few representatives from large automotive concerns (only the VDA automotive industry association and VW Commercial Vehicles), yet four university professors and two representatives from research institutes. Nonetheless 30 percent of its members are women. The group’s task is to smooth the way for around 15 million fully electric cars to be on the road by 2030.

Author: Sven Geitmann