H2Apex, a hydrogen project developer, has entered into a strategic partnership with Copenhagen Infrastructure Partners (CIP) for a large-scale electrolysis project in Lubmin, in the Federal State of Mecklenburg-Pomerania. CIP is participating in the first development phase of the project through its Energy Transition Fund (CI ETF I) with a 70 percent stake. This phase is expected to achieve an electrolysis capacity of 100 megawatts (MW) and an annual production capacity of up to 10,000 tonnes of green hydrogen.

The agreement includes securing the pre-financing of the European Union’s IPCEI funding in the amount of EUR 167 million, as well as additional investments. CIP initially plans to contribute EUR 15 million to the project development up to the final investment decision. Construction is scheduled to begin in 2026, with commissioning planned for 2028, according to the company.

Site with access to offshore wind and pipeline connection

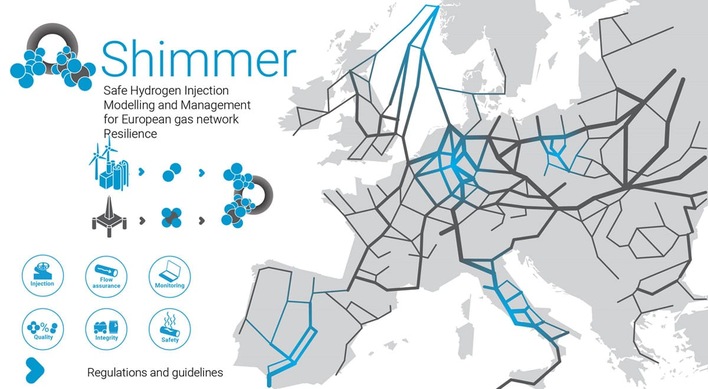

Lubmin is considered a strategically advantageous location for hydrogen production due to its proximity to the Baltic Sea and existing infrastructure. H2Apex has access to offshore wind farms there and plans to feed the hydrogen produced into the so-called Flow pipeline, which will be part of Germany’s core hydrogen network. This pipeline is intended to transport green hydrogen from northern to southern Germany in the future. According to H2Apex, offtake for the first development phase has already been secured through preliminary agreements.

In the long term, the company plans to expand the electrolysis capacity at the site to over 1,000 MW. By the start of construction, components are to be ordered and the permitting process further advanced.

“The strategic partnership with CIP is a milestone both for the development of our own hydrogen production capacities and for the entire H2Apex Group,” says Peter Rößner, CEO of H2Apex. The collaboration is “the perfect symbiosis of a financial investor with sound technological and industry expertise and a long-term investment horizon” and H2Apex as project developer.

CIP also sees the project as an important contribution to Germany’s hydrogen strategy. “Together with H2Apex, we are developing a project in Lubmin with excellent infrastructure connectivity and confirmed IPCEI funding,” says Felix Pahl, Partner at CIP.

According to its own information, CIP is the world’s largest specialized fund manager for early-stage green infrastructure projects. The company currently manages 13 funds with a total volume of around EUR 32 billion.