In order to meet the forecast demand of 130 TWh of green hydrogen by 2030, it is estimated that around 70 percent of this will have to be imported. However, it is far from certain that the other 30 percent – despite subsidies – can be produced domestically at economically viable prices.

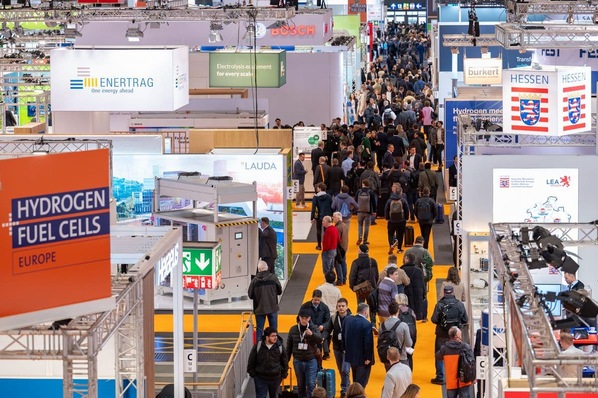

According to a study by the Potsdam Institute for Climate Impact Research, H2 programs have now been implemented in over 60 countries. However, of the production capacity announced for 2023 of over 1,200 projects worldwide, only a small fraction of seven percent have been established. One reason for this is that it is still uncertain how energy prices, CO2 taxes and state subsidies will develop in the next few years, since the global production budget of almost one trillion euros required for the expansion plans over the next six years (up to 2030) is far from being committed – and will be increasingly difficult to raise in times of increasing public debt.

In the HYPAT research project, which is developing a "global hydrogen potential atlas", the Fraunhofer Institute for Solar Energy Systems in Freiburg has estimated the respective costs for various locations in potential supplier countries – from Brazil to the United Arab Emirates. Depending on the power-to-X product examined (a total of five, in addition to liquid hydrogen e.g. ammonia or methanol) and storage or transport option (pipeline or ship), hydrogen prices per kilo are expected to be between 3.50 and 6.50 euros in 2030, which could fall to between 2.00 and 4.50 euros by 2050.

One of the influencing factors here is water consumption, as each kilogram of hydrogen requires up to 20 liters of water for electrolysis (incl. cooling of the systems), which in some regions can only be obtained by complex procedures such as seawater desalination.

Listed companies in the H2 sector

With the exception of large corporations such as the French industrial gas producer Air Liquide SA or Linde plc, in which there is only a fraction of the turnover based on hydrogen, most of the listed companies that have to do with research, production or infrastructure in the area of hydrogen have been writing losses for years. It is therefore not surprising that the shares – see key figure table for 21 companies – often fell by more than 50 percent in the twelve months from February 2024 to January 2025, with two even by 96 percent. In relation to the maximum price shares of three to four years ago, the prices are often over 90 percent lower.

Many expectations have not been met or projects have been delayed greatly. But despite increasing balance sheet losses, the stock market values are usually still significantly above the last annual sales figures.

Linde plc

Air Liquide SA

Some smaller companies had to register bankruptcy years ago, e.g. the Canadian pressure tank manufacturer Dynetek Industries, the Berlin Heliocentris Fuel Cells AG, Syngas International or the Norwegian fuel cell manufacturer Teco 2030, which had planned a "gigafactory" for truck and ship drives. The non-listed Hydrogen Emobility AG (based in Schönbrunn Castle) was also liquidated in 2023. The stock market values of some small caps such as the Swedish Cell Impact or the US Hydrogen Engine Center have dropped to a few million euros or even less than EUR 1 million.

Other companies, such as the Danish Nel spin-off Everfuel A/S, which has been listed since October 2020 and whose shares were last traded at the end of 2024, were taken over. In 2023, Everfuel increased sales by 128 percent to around 5.7 million euros with around 75 employees, but the loss of almost EUR 16 million also rose to around EUR 28 million. The share price on the home exchange Oslo sank from over NOK 183 (early 2021) until May 2024 to under NOK 11 (which corresponded to a stock market value of almost 80 million euros).

At this point, a hydrogen pipeline between Denmark and Germany was planned, for which Everfuel was to supply around 10,000 tonnes of green hydrogen (RFNBO, i.e. non-biological origin) annually (which would have required an electrolyzer capacity of at least 100 MW). Now the free Everfuel shares – forcibly – hiked to a price of NOK 13 via the Faro Bidco APS in infrastructure investment funds that will be advised by Swiss Life Asset Management AG.

Still other stocks, such as that of the Canadian Powerap Hydrogen Capital Corp. (www.powertapcapital.com), formerly a cannabis startup, have hardly been traded after the plan to set up an H2 gas station network in the USA and Canada could not be realized. The share price dropped from around USD 50 (2021) to below USD 0.01.

PowerTap Hydrogen Capital Corp.

Sunk strongly from NOK 25 to under NOK 1 is also the price of Havila Kystruten AS, founded in 2017 and listed since 2021, which operates four hydrogen battery-powered passenger ships (mainly for tourists) along the Norwegian coast from Bergen to Kirkenes and has been making more losses every year since its launch (2023 e.g. over NOK 900 million) than turnover (approx. NOK 764 million).

Havila Kystruten AS

In the following are details of more or less important H2 shares – in alphabetical order:

Ballard Power Systems

The company, founded in 1979 (initially with the aim of researching and developing lithium batteries) and, which has been listed since 1993, has repeatedly financed losses in billions in the area of fuel cells through capital increases. The Automotive Fuel Cell Cooperation (AFCC), the division for automotive drives, was sold to Daimler and Ford in 2008 and dissolved again in 2018, with the majority of the machine park going back to Ballard Power. In 2018, Weichai Power took a stake in Ballard Power with around 20 percent in order to use its technology for trucks and buses in China. At the end of 2024, the fuel cell pioneer received another delivery order for 98 hydrogen engines from the railway operator Canadian Pacific Kansas City, which are intended to replace the diesel engines of the locomotives – for refueling, there are already the first hydrogen gas stations on the route.

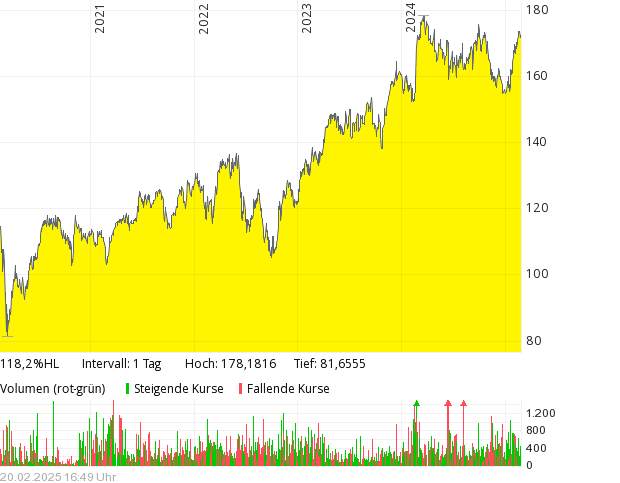

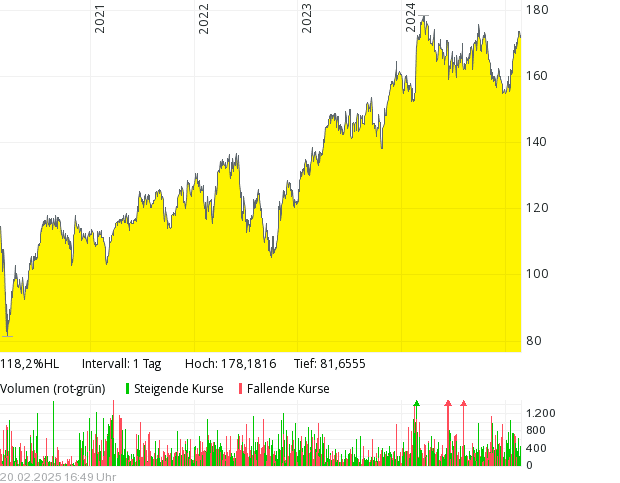

(Ballard Power Systems, in Euro)

Bloom Energy

Bloom Energy from San Jose, California, is one of the few share price winners in 2024. The company, founded in 2002 by four former NASA employees, specializes in the production of fuel cells for stationary power supply. Despite a lower turnover of USD 330 million (‑18%), the loss of USD 169 million in the previous year was reduced to less than USD 15 million in the 3rd quarter of 2024.

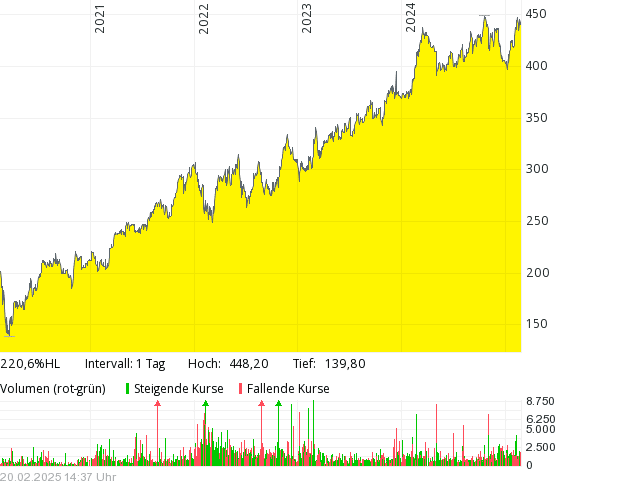

Bloom Energy

Ceres Power Holdings plc

The British company, founded in 2004, develops electrolysis technologies for green hydrogen and fuel cells for electricity production in the business areas SOFC (solid oxide fuel cell) and SOEC (solid oxide electrolysis cell). It belongs to around 37 percent of the two main shareholders Weichai Power and Robert Bosch GmbH.

Ceres Power Holdings plc

Enapter AG

The company, headquartered in Germany with a research and production location in Italy, has developed electrolyzers in single- and multi-core systems and has now sold to over 350 customers in over 50 countries, from energy and transport to heating and telecommunications companies. After projects were delayed, management in November reduced the sales forecast for 2024 from EUR 34 million to EUR 22 to 24 million – the annual loss could reach the ten million-euro mark. Part of the order volume of around 50 million euros comes from the US subsidiary Clean H2 Inc. (www.cleanh2.energy), which is benefitting from the Inflation Reduction Act, including the funding of hydrogen applications.

Enapter AG

FuelCell Energy

The company based in Danbury, USA, which is primarily active in the field of industrial production, was founded in 1969 and employed 591 employees at the end of the last financial year. Jason B. Few held the chairmanship. The largest shareholders are The Vanguard Group, Inc., BlackRock Fund Advisors and Legal & General Investment Management Ltd.

FuelCell Energy

H2 Core AG

H2 Core Systems GmbH, a spin-off of the TC Hydraulik Group, was assessed as a contribution in kind with EUR 36 million and against 10 million stocks (to the shareholders TC Holding GmbH, World Wide Green Holding GmbH, BluGreen Company Ltd. and Enapter AG) brought into MARNA Beteiligungen AG, which had left the previous business area (ship financing) and has been renovated to H2 Core AG. Together with the previous share of around 1.5 million stocks and a capital increase in mid-2024 (324,826 new stocks were issued at EUR 2.20 per share), there were over 11.8 million stocks at the end of 2024. In the first half of 2024, the sales of the system integrator (with customers in Europe, Asia, South America and the USA) rose by 48 percent to around EUR 3.13 million, with the loss to EUR 2.5 million. Enapter AG is the main supplier of the electrolysis blocks (stack modules) necessary for the hydrogen-based plug-and-play supply solutions from H2 Core.

H2 Core AG

HydrogenPro ASA

The main product of the company specializing in hydrogen and renewable energies is an alkaline high-pressure electrolyzer. Innovative coatings were developed with the acquired Danish Advanced Surface Plating APS. The systems can be adapted to the customer's request. The main shareholders are the Austrian plant engineer Andritz AG (23%) and the Japanese Mitsubishi Heavy Industries (17%).

HydrogenPro ASA

Industrie De Nora S.p.A

The Milan company, founded in 1923 (by Oronzio de Nora) and has been listed since 2022, is one of the world market leaders in the field of electrochemistry. In addition to electrodes and coatings for various industries (e.g. chlorine chemistry), electronics components, water filters and disinfection technologies, the product range also includes components for hydrogen electrolysis. De Nora is present in ten countries – there are also research centers in Italy, Japan and the USA – and after the Thyssenkrupp Group with almost 25 percent, is the second largest shareholder of the Thyssenkrupp Nucera AG & Co. KGaA. In 2023, sales rose only minimally to a good 856 million euros, but the profit by 158 percent to EUR 231 million. In 2022 and 2023, dividends (each 0.12 euros per share) were distributed. The equity ratio is relatively high with 68 percent recently, but the profit may have decreased considerably (estimated to be less than 80 million euros) in 2024 – as well as the share price, from over 20 euros (mid-2023) to less than 7 euros in February 2025.

Industrie De Nora S.p.A.

ITM Power PLC

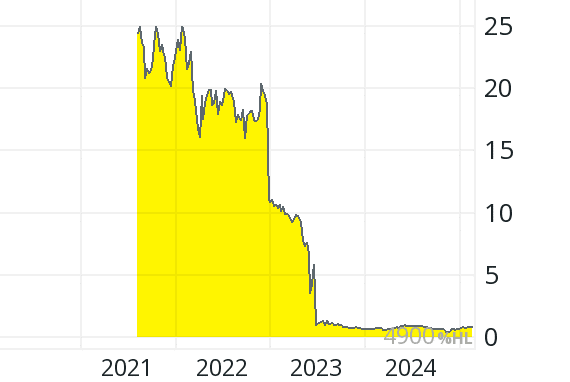

The British company, founded in 2001 (www.itm-power.com), is one of the most established companies in the electrolysis industry in Europe, even if sales are still very low compared to the stock market value. ITM Power, whose three major shareholders also include Linde, has, among other things, founded a joint venture (50/50) with Linde: ITM Linde Electrolysis GmbH (ILE GmbH) wants to implement the world's largest electrolyzer system in Leuna, Germany. ITM Power offers several electrolyzer models, from Trident (2 MW) and Neptune to Poseidon (20 MW) for major projects. The share price dropped from GBP 7.17 (early 2021) by over 95 percent to less than 0.35 (February 2025), which corresponds to a market value of almost GBP 220 million, almost ten times the turnover of the last four quarters.

ITM Power PLC

McPhy Energy S.A.

The company, headquartered in Grenoble and having several subsidiaries such as McPhy Energy Deutschland GmbH, sees itself as "developers and manufacturers of systems for the production and distribution of carbon-free hydrogen." In addition to electrolyzers, the locations in France, Germany and Italy also offer storage containers and systems, including for the energy and transport area. The sales forecast for the financial year 2024/02/01 to 2025/01/31 was reduced from 18 to 22 million euros to EUR 11 million in autumn 2024.

McPhy Energy S.A.

Nel ASA

After electrolysis, the Norwegian company, founded in 1927, also specialized in infrastructure (construction of hydrogen refueling stations and injector systems, mainly for transportation) and founded with Hexagon Composites and PowerCell Sweden the joint venture Hyon for the area of watercraft with fuel cell drives in 2017. As part of the PosHYdon consortium, an offshore hydrogen production system (on the oil and gas platform Q13a-A of Neptune Energy) is also planned. After Nel CEO Håkon Volldal in 2024 only saw "limited synergies between the business areas of refueling and electrolyzers," the refueling division under the name Cavendish Hydrogen was outsourced and separately brought to the stock exchange in Oslo. In 2023, Cavendish generated and announced an equally high loss with NOK 330 million turnover (+59%) and announced the releasing of around 45 percent of the employees in the 1st quarter of 2025.

Nel ASA

Cavendish Hydrogen ASA

Nikola

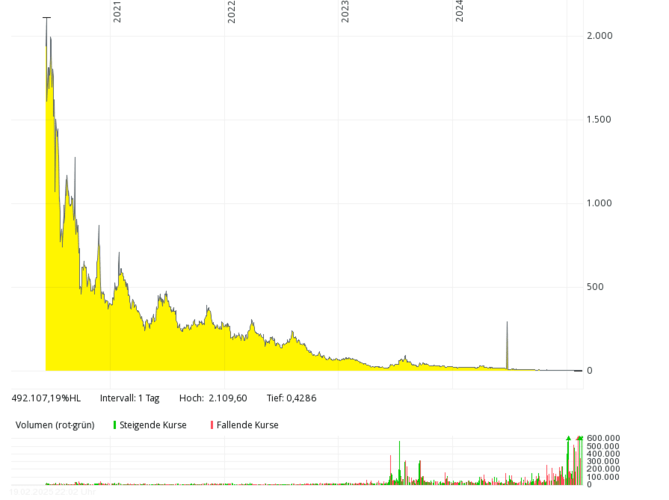

A tragedy is the share of the US company named after Nikola Tesla based in Phoenix, Arizona. Already at the presentation of the first "hydrogen-powered" truck, it turned out that the advertising video was a fake (a moving Nikola truck was shown that was not operated with hydrogen). There are collaborations with German companies and with the Norwegian Nel (for a hydrogen refueling station network in the USA). After a hype with share prices of over USD 80 (split-adjusted would have been around USD 2,000) and judicial convictions of the first CEO, the stock is now a penny stock. The stock market value has shrunk from at one time tens of billions to around USD 50 million, which is not surprising: In 2023, a record loss of over USD 864 million at not even USD 36 million turnover.

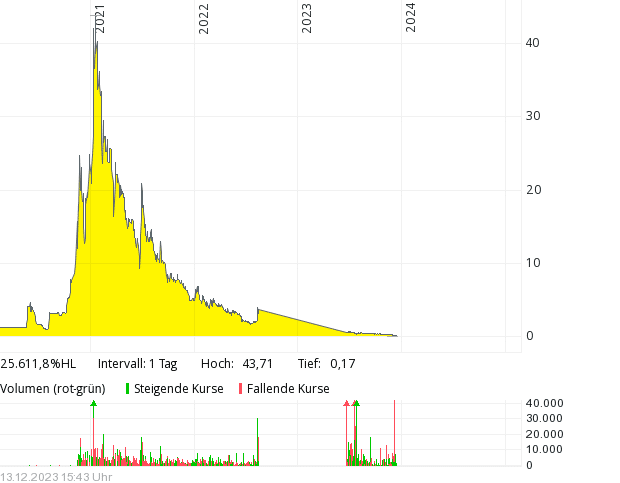

Nikola

Plug Power

The US company is one of the world's largest buyers of liquid hydrogen, but after the takeover of United Hydrogen (2021) it also produces it itself. At the beginning of 2025, the US energy ministry (DOE) via the Loan Programs Office (LPO) and in accordance with the Justice40 initiative of the Biden Administration gave the green light for the requested loan guarantee of USD 1.66 billion. This is intended to finance the development, construction and ownership of up to six systems for the production of green hydrogen. A sign of hope after reducing the sales forecast for 2025 from USD 1.5 billion to 850 to 950 million at the end of 2024.

Plug Power

PowerCell Sweden AB

The company, founded in 2008, produces fuel cell systems that can convert fossil as well as renewable energy sources into hydrogen. So far, it has produced losses, with one exception in 2019: The sale of around 50 million euros was achieved by selling an exclusive production and sales license for the S3 fuel cell stack to Robert Bosch GmbH. In the first three quarters in 2024, sales rose by four percent to over SEK 190 million, but accrued a loss, like in the previous year's time with SEK 53 thousand, of around SEK 50 million.

PowerCell Sweden AB

Proton Motor Power Systems plc

The British fuel cell company with the German subsidiary Proton Motor Fuel Cell GmbH, which also develops products in the area of hydrogen, has hardly been over annual sales of over GBP 2 million in the past seven years. In 2018 and 2019, there were only around 0.8 million pounds – with mostly higher, often double-digit million losses. The equity ratio has been negative for many years. The share price dropped from over 50 pence (early 2021) by more than 99 percent to around 0.1 pence (February 2025). In order to save costs, the management considered at the end of 2024 to take the stock off the stock exchange soon.

Proton Motor Power Systems plc

SFC Energy AG

The company (formerly SFC Smart Fuel Cell AG) offers systems and components with small fuel cells (10 to 250 watts of power) that can be used to produce electricity independently and noiselessly, for example on campsites, but also for military applications.

In the first three quarters in 2024, company turnover rose by 20 percent to over 105 million euros, with the profit by 35 percent to EUR 8.7 million.

SFC Energy AG

Snam S.p.A.

The company, which was founded by the energy corporation Eni in 2001, operates a natural gas transport network of around 38,000 km in and also outside of Italy and gas storage of 15 percent of natural gas reserves in Europe. In the hydrogen sector there is a joint venture with Industrie De Nora S.p.A., and participating in the large SouthH2 Corridor project are Snam along with partners Gas Connect Austria GmbH, Bayernets GmbH and TAG GmbH.

Snam S.p.A.

Thyssenkrupp Nucera AG & Co. KGaA

In 2024, the electrolysis company split off the Thyssenkrupp Group (Thyssenkrupp AG remained as a good 50-percent main shareholder) gained Fraunhofer IKTS as a strategic partner for "highly innovative high-temperature electrolysis" (SOEC technology) – and the US energy ministry has selected Thyssenkrupp Nucera “to advance the mass production of water electrolysis cells and to build up an automated assembly line of these cells." In financial year 2023/2024 (as of 2024/09/30), an operational loss of EUR 22 million was generated with a turnover increase of 32 percent to EUR 862 million (including over 500 million euros in the area of alkaline water electrolysis).

Thyssenkrupp Nucera AG & Co. KGaA

Weichai Power

This vehicle technology group, founded in 1953, was called Weichai Diesel Engine Factory until 1992 and still produces diesel engines in China today. With participations such as that of Ballard Power and Ceres Power, they now also deal in the production of fuel cell products or hydrogen applications. The share prices of the H2 stocks also listed on German stock exchanges swung between 0.93 and 2.78 euros in recent years, most recently at around 1.70 euros.

Weichai Power

The author Max Deml (born 1957) has been editor-in-chief of the Öko-Invest stock exchange letter since 1991 and author of the manual " Grünes Geld" (green money, 8th edition since 1990). In 1997, he developed the international nature stock index NX-25 (with 25 members) and in 2001 the solar stock index PPVX, which contains the 30 largest listed PV production, supply and operator companies.