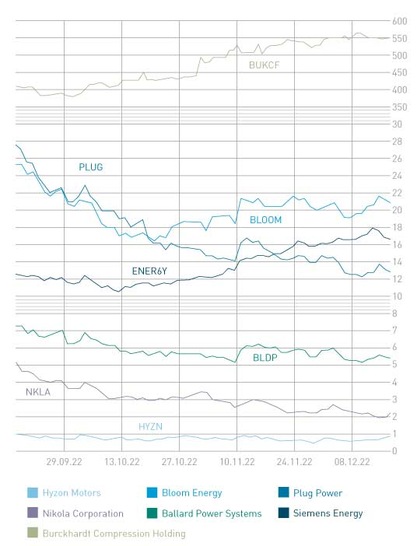

The turnaround we’ve been forecasting for some time is in sight. Year 2024, according to the predictions of board chairman Christian Bruch, will bring profit. The share price has turned around noticeably and rose nearly 50 percent compared with the lowest price. The numbers: The turnover of 29 billion EUR lay in the realm of expectations (minus 2.5 percent is due to extraordinary developments – to Ukraine alone is attributed a loss of 200 million EUR). There was a loss in the amount of 647 million EUR, which is a consequence of integrating the nearly 1 billion EUR reported loss from Siemens Gamesa.

The order volume is excellent: This rose in the fourth quarter, based on 2022/09/30 data, to an equivalent of 97.4 billion EUR – a good basis for the future of the corporation. Growth of three to seven percent is now expected and depends on Siemens Gamesa being able to be fully integrated in the next 12 to 24 months and ultimately also generate a positive profit contribution.

Stock market valuation was a joke

Siemens Energy was still valuated a few weeks ago at just 8 billion EUR, but the current value of around 12 billion EUR does not correspond to the potential of this big business. For the weak stock market price, the planned acquisition of the remaining shares in the wind subsidiary Siemens Gamesa was to blame, as there were audits by the Spanish regulatory authority (CMMV) that dragged the integration, or full takeover, out even longer. And clear is also: 2,900 jobs (10% of total workforce) will be cut and the company Gamesa will become part of Siemens Energy.

The positioning of Siemens Energy in important future markets such as hydrogen (order boom!), however, will sooner or later need to lead to a revaluation of the corporation – in accordance with the sustainable profit and increasing sales. Based on the current ridiculous valuation, Siemens Energy could even be a candidate for takeover. Nothing is impossible.

Those who bet on the turnaround will build up new positions or cheapen existing ones. This will not be a quick fix but should be an investment over a period of at least one to three years. There will still be many a quarter of losses, which is the fault of the costs of reorganization and the integration of Siemens Gamesa. On the other hand, there are many exciting technological developments such as rotor blades for wind turbines that can now be recycled, which has been a major problem so far.

Since a few days ago, you can see a turnaround in the stock. The stock market anticipates future developments, so little by little there will be better prices again. Since big investors like BlackRock have the area Siemens Energy is in in focus, a lot of new capital will flow in from here. In addition, Siemens Energy is back in the DAX. Stay tuned. My price target within the next 12 to 18 months: 30 euros plus.

Disclaimer

Each investor must always be aware of their own risk when investing in shares and should consider a sensible risk diversification. The FC companies and shares mentioned here are small and mid cap, i.e. they are not standard stocks and their volatility is also much higher. This report is not meant to be viewed as purchase recommendations, and the author holds no liability for your actions. All information is based on publicly available sources and, as far as assessment is concerned, represents exclusively the personal opinion of the author, who focuses on medium- and long-term valuation and not on short-term profit. The author may be in possession of the shares presented here.

Author: written by Sven Jösting December 12th, 2022