The bipolar plate is one of the most used components in a fuel cell stack, alongside the gaskets and the membrane electrode assembly. This is why it’s important in the overall scheme of things to bring down their cost. Manufacturers, regardless of whether they produce metal or graphite solutions, are increasingly looking to automate and link up individual processes on the one hand and to optimize the products themselves on the other, for instance by further reducing sheet thicknesses. Already plans are afoot to scale up production and could result in several million bipolar plates being manufactured for use in over 100,000 stacks every year.

In a proton exchange membrane fuel cell, the bipolar plate is a key component. It accounts for up to 80 percent of stack weight and up to 65 percent of stack volume, hence its enormous importance in terms of the power density. It’s equally significant for the functioning of the fuel cell: The bipolar plate or BPP separates and distributes process gases and removes product water. Not only that, this component is responsible for performing the essential tasks of conveying the generated current and evenly distributing all media.

BPPs are principally made from graphite carbon or metal. The various materials are associated with different properties and have different advantages for plate functionality. Because of low efficiency benefits and a lack of manufacturing processes for competitive metal BPPs, it is the graphite variant that has dominated in the past. However, graphite-based BPPs exhibit volumetric and gravimetric shortfalls compared with their metal counterparts, particularly when it comes to demanding applications. Plus, graphite is extremely brittle and can therefore break easily. Nevertheless, graphite plates are frequently deployed in stationary applications in which the volume of the structure is not a limiting factor.

On matters of cost, it’s metal plates that take the lead. “With the right production process the sheet thicknesses can be reduced down to 0.05 mm. Here, metal is at a completely different price level to graphite,” emphasizes German manufacturer CellForm. Given that several hundred plates are used in a single stack, the financial ramifications for the final application are huge. A further advantage of metal BPPs cited by CellForm is their positive impact on the cold-start capability of the fuel cell.

The company, based in Baienfurt in Baden-Württemberg, covers the entire manufacturing process for metal BPPs with a multistage forming process and subsequent laser welding. Commenting on working with metal, company representatives point out that the “extremely thin” sheet thicknesses are a particular challenge: Shaping such fine initial sheets and creating the highly precise and complex geometry of the channels can, due to physical constraints, quickly lead to fractures that would render the BPP unusable. On top of this come the stringent quality requirements with low margins for error which need to be met when producing in large volumes. “Only those who satisfy this requirement will be able to maintain their position in this growing and fiercely competitive market,” says the company.

These challenges, according to CellForm, are putting a certain degree of selective pressure on the manufacturing processes which are still under development. “Physical restrictions – such as heat generation – will limit how much these processes can make in future mass production,” states the manufacturer. This problem, it says, isn’t noticeable when dealing with small volumes, but will become increasingly evident in the years ahead as demand grows.

CellForm asserts that its custom technology, however, can be easily scaled and confidently claims that: “When combined with a thickness down to 0.05 mm, we are able to create flow fields for the most efficient fuel cell systems.” Each part is produced using sophisticated machinery within a fully air-conditioned facility, it explains.

Passive hydroforming

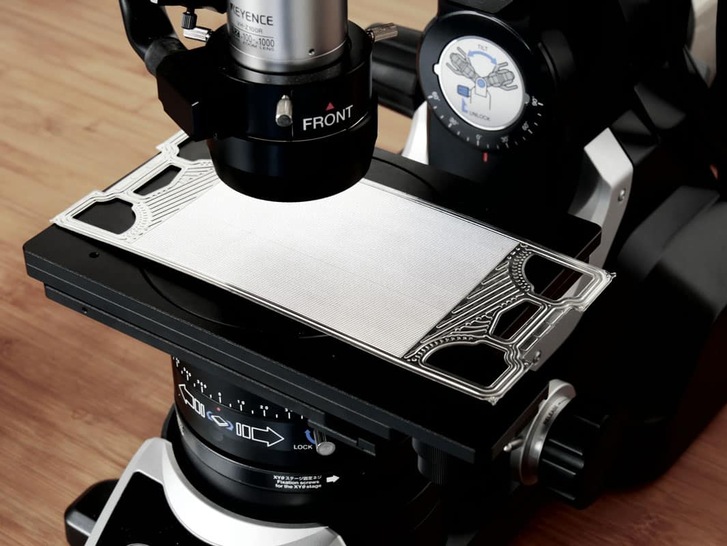

The passive hydroforming process now means that presses which weren’t originally designed for high-pressure sheet metal forming can also be used for manufacturing bipolar plates (see fig. 2) – without the need for water hydraulic systems and pressure intensifiers. This method requires forming pressures of around 200 megapascals. The special feature of the process, which was developed by the Fraunhofer Institute for Machine Tools and Forming Technology IWU in Chemnitz, is its tool concept: The movement of the displacing piston as the press closes results in the compression of the active medium that is enclosed in the tool. This allows sufficient pressure to be created to form the BPP. A particularly challenging technical aspect is, according to IWU, the sealing of the active medium between the sheet being formed and the filling plate.

High-precision, stable, cost-optimized production

These challenges are also very familiar to the team at EKPO, a joint venture between ElringKlinger and the French company Plastic Omnium. “The BPP is one of the critical components that has a direct influence on stack performance and service life. The optimal distribution of media and cooling water uniformly across the stack and in the cells maximizes the performance of the membrane electrode assembly (MEA) and facilitates reliable control of the thermal load, even when operating at full power,” says Joachim Scherer.

According to the head of component product development at EKPO Fuel Cell Technologies, the high number of repeating units means that high-precision, stable and cost-optimized fabrication of BPPs is essential in order to achieve the necessary stack quality at a salable price. By integrating the sealing function as well as incorporating a robust design for metal BPPs, the time and effort needed for stack manufacture can be reduced which thereby lowers the inspection requirement and the costs.

EKPO refers to the flow simulation based on computational flow dynamics and a BPP design which is optimized with the help of finite element method. This, it says, makes for a dependable and error-free production process without affecting the properties of the product. In Scherer’s view this is necessary to reduce or avoid control processes while at the same time minimizing the rejection rate for each step in an up to 10-stage manufacturing process in the parts per million range.

“Robust processes for forming, joining, coating and sealing BPPs will decrease deviations and chances for error in production and thereby prevent defects, which in some cases could only be identified previously by carrying out laborious tests on the final product,” shares Scherer. This also particularly affects inspection costs, he continues, which can account for between 5 percent and 25 percent of the total cost depending on product readiness, in other words whether the product is a prototype or a mass-produced article.

At its site in Dettingen, Germany, EKPO has achieved an annual production capacity of 10,000 stack units in a setup which employs a number of different manufacturing stages. These include producing metal BPPs from coil with high-precision series tools in progressive die stamping operations and the joining of thin metal foils in a rapid laser process as well as testing interim products and ready-to-install BPPs through in-line process controls. In addition, spot checks are carried out to determine whether the dimensions and tightness comply with the usual principles and requirements for the automotive sector. In this case, the conductive coatings are either applied in advance to the coil or applied to the joined BPPs. There are also two different ways in which the company seals the cell, opting either for an integrated gasket on the BPP or a gasket that is integrally formed on the gas diffusion layer, otherwise known as the seal-on-GDL method.

Future production with fully interlinked systems

According to development chief Scherer, all processes and technologies are based on decades of experience gained at ElringKlinger/EKPO in large-scale production for the automotive industry. This brings with it benefits such as high-precision products, in-house tool production and the application of automotive quality and management techniques, he says. The company has already run through the appropriate Production Part Approval Process or PPAP for the NM5evo stack, a vehicle fuel cell module with a power output of up to 76 kilowatts. Scherer also highlights that suppliers are validated in line with automotive series processes. All manufacturing procedures at EKPO for metal BPPs are already highly automated.

Even so, Joachim Scherer believes that the high degree of production flexibility that is required to cover the wide range of BPP designs and variations means that it is does not make sense to further interlink individual processes at this stage. He does indicate, however, that dedicated BPP lines with fully interlinked production systems for individual stack platforms will be installed for the future manufacturing of very high part volumes.

What’s more, the component production manager reports that for individual production steps work is already underway to create innovative processes for the next-plus-one generation that should make it possible to decrease cycle times even further. Such processes will be needed for volumes ranging up to tens of millions of BPPs a year.

EKPO is already envisaging the mass production of 100,000 stacks annually. The company points out that this will require procedures that enable components to be processed and checked in less than a second, an undertaking that will understandably come up against limiting factors, as Scherer underlines: “This up to 10-Hz production goes well beyond today’s scale in terms of the critical requirements for processing speed, stability and control.” It would also spark increased demands on the materials and tools used.

Scherer is well aware of what this signifies: “In the years ahead, further developments are expected with regard to lower material costs, higher material quality, improved supply security and efficient tool production.” This calls for measures to optimize the component design, new methods of measurement and control that are integrated directly in the production systems and a further minimization of time-consuming component inspections.

Schaeffler focuses on functional coatings

Automotive supplier Schaeffler has chosen to focus on a pressing method for forming BPPs combined with the application of functional coatings. “Here we can leverage our core competencies. For instance every year we coat over a billion parts for conventional powertrains,” explains Benjamin Daniel who heads up the company’s fuel cell division. The job of a BPP coating is to maintain a high level of electrical conductivity throughout the entire service life as well as to stop metal ion contamination of the MEA. Otherwise the ions would accumulate over time on both the active catalyst material and at the sites in the membrane through which the protons can pass.

Schaeffler has been developing several coating systems especially for BPP modules as part of its Enertect range. One is based on platinum group metals for very high service life requirements, and another is based on a low-cost carbon coating. According to Daniel, this is advantageous for customers: “Thanks to our expertise in surface technology, we are in a position to offer application-specific coating development and also to balance this against costs and performance according to requirements.”

The coating systems are applied using the physical vapor deposition process which has already proved suitable for large-scale production – such as in the fabrication of heavily loaded valve train components, states Daniel.

Just as at EKPO, Schaeffler is also looking increasingly to scale up production. For example, at the beginning of the year a pilot plant at its headquarters in Herzogenaurach entered operation that will make more than 700,000 BPP modules for fuel cell applications on a yearly basis. The plant’s design means that it also has the potential to manufacture even greater numbers of BPPs for electrolyzers. According to Daniel, the individual processing stages of the pilot plant, which was designed by Schaeffler’s own specialized machinery department, are already highly automated. Furthermore, the pilot facility is embedded within a new hydrogen center of excellence at the Herzogenaurach site. The center includes a large area for testing electrolyzer technologies and fuel cells at the component, stack and total system levels.

The durability issue

The automotive and industrial supplier is pressing ahead with further development at various levels. In addition to the joint venture agreed with Symbio, which will hopefully see the annual production of around 50 million BPPs by 2030 (see interview), a range of initiatives have been launched that will improve the efficiency and economy of manufacturing processes. Areas in which Daniel sees room for technical improvement include BPPs and the MEA. This is where the subject of component durability comes to the fore. It’s a key issue for Schaeffler, according to the division head, and one where years of expertise acquired in surface coatings is reaping dividends.

There is also considerable potential, he says, when it comes to the selection of material for the substrate, coating and gasket as well as choices relating to the manufacturing processes and process management in general. Even the use of the material itself can be optimized, he explains, for instance by further reducing the sheet thickness to less than 100 micrometers for the substrate.

Daniel is convinced: “Our core competencies in forming technology, functional coatings, joining technology and high vertical integration using our own tools are the key to successful and optimized industrialization.” In this regard, Schaeffler has specified other core competencies that are to be cultivated as part of pre-development activities in the lead-up to series production. One related example mentioned by Daniel is a passive hydrogen recirculation unit.

Additionally, engineers in Herzogenaurach are busy investigating how different fuel cell components interact – not just in the fuel cell system but also in the overall vehicle. This strategy also capitalizes on the development of a learning platform relating to the proprietary complete fuel cell system for motive applications. “That helps us to understand the requirements of higher integrated levels and their interaction with our components and subsystems and also assists us in supporting our customers in this area,” elucidates Daniel.

Injection molding machines for graphite BPPs

It was back in 2006 that German company Eisenhuth had its first dealings with graphite BPP production. Based in Osterode am Harz, the company has primarily concentrated on two main areas in the past couple of years, as its director Thorsten Hickmann reports: “On the one hand we have optimized our injection molding technology and can now produce graphite BPPs on relatively small injection molding machines in a similar way to how standard plastic components are produced. The second way is to systematically develop the continuous production of graphite compound plates with all material combinations: for high-temperature applications, applications in aggressive media or standard applications.”

In the meantime Eisenhuth has a handful of series production projects, according to Hickmann. “We can use injection molding to produce plates in various sizes, be they components for relatively small-scale applications with a plate size of 60 mm x 320 mm or large plates with an area of over 1,000 cubic centimeters,” explains the director. These advancements also have an effect on component costs. For example, the company recently offered an injection molding solution for graphite compound plates that has allowed the customer to suddenly decrease its costs by a factor of three, reports Hickmann. “So instead of having to pay 30 euros a plate for a stack with 102 cells, it now only has to pay 10 euros. That’s a saving of over 2,000 euros for one stack.”

Despite this progress, at the moment the degree of automation in plate production for graphite compound plates is fairly minimal. The reason for this lies in the volumes which entail a lower level of automated production. Nevertheless, Eisenhuth is already deploying smart automation solutions for the manufacturing of plastic parts, for instance by using articulated robotic arms to insert components. The next step is to automate injection molding applications. Also on the agenda is the rollout of continuous plate manufacturing for high-temperature applications.

Risk of offshoring?

And how big a risk is it, in Hickmann’s view, that BPP production will be transferred abroad sooner or later? “When we’re in a position to further roll out injection molding so that plates can be produced fully automatically, then I see no difficulty in competing from Germany in the international marketplace,” he explains in his analysis. He goes on to say that this only makes sense, however, if the entire “stacks for fuel cells” technology stays in Germany or indeed Europe.

EKPO, too, makes the case for a localized approach: “As things shift to several tens of millions of bipolar plates a year, it will make sense for their production to be located in the same place as the stack manufacturing. The global presence of manufacturing plants belonging to EKPO’s parent companies means it will be possible to expand BPP production to wherever in future fuel cell stacks are being produced for global markets,” says Joachim Scherer.

Likewise Schaeffler mentions its position in a global market. “Today there are already highly competent hydrogen technology players particularly in Asia. We’re right at the start of global competition,” sums up Benjamin Daniel. What’s important is to extend our own technological expertise and continually expand competitive advantages, he says, stating that this is where Schaeffler is making the most of its many decades of experience in mass production. However, Daniel also makes clear: “We have a global setup and have sites around the world. We want to manufacture where our customers are – also for reasons of sustainability.”

Author: Michael Nallinger