In 2009, the Desertec Industrial Initiative (Dii) started, with a lot of media hype. Especially German corporations wanted to build solar power plants in the southern Mediterranean countries. Concentrating Solar Power (CSP) was the technology of choice at the time. It was cheaper than photovoltaics and could, with thermal energy storage, produce electricity continuously. The power plants were to supply electricity not only to the region, but also for export to Europe.

But it went more haltingly than some had hoped. Most of the German companies, among them Deutsche Bank, MunichRE, Eon, Bosch and Siemens, left Desertec in 2014 – still during the construction phase of the solar plant Noor in Morocco. Innogy remained as the last German company, until its acquisition by Eon and incorporation into Dii.

Since then, hardly anything has been heard in Germany of Desertec. Many got the impression that the idea had been abandoned. But in fact, activities have since shifted increasingly to the Arabian Peninsula and the new office in Dubai – even if the official headquarters of today’s Dii Desertec Energy GmbH is still in Munich. Also there meet the core members of the initiative for a conference year after year. Dii founder and president Paul Van Son as well as Cornelius Matthes, CEO of the organization since January 2021, courted the idea of desert energy with the oil states of the Persian Gulf.

Today, Dii Desert Energy is a political and economic network that stretches over several continents in which many major companies from the energy and hydrogen industries are engaged. For a long time, the shareholding partners were exclusively the Saudi Arabian state-backed energy corporation ACWA Power and the Chinese utility State Grid. To the “Lead Partners,” the gold sponsors so to speak, today belong four holdings, of which two are from Saudi Arabia, one from Morocco and one from the Netherlands. The extended circle consists of a good 50 “Associate Partners.” Among them are research institute Fraunhofer ISE, PV manufacturer Suntech, Shell and the Norwegian H2 company Nel. Also Thyssenkrupp, as a market leader for electrolysis plants, had been one of these partners since 2017 – and became a shareholding partner at the beginning of 2022. That made the German press, after a long time, pay attention again.

Jorgo Chatzimarkakis of Hydrogen Europe called years ago for hydrogen pipelines that would transport fuel gas from Africa to Central Europe and stated, “We (Germany) will be an importing country of renewable energies, but an exporting country of electrolyzers.” On the other hand, Carsten Körnig, managing director of BSW Solar (German solar association) said that to import renewable energies in large quantities would not be possible, because other European countries would also stake demand for it. Because of this, according to Körnig, more emphasis should be placed on domestic green electricity generation. (S. Geitmann)

The desert power grid has also changed technologically. Instead of plans for power lines, Dii Desert Energy presented at the beginning of 2020 the “MENA Hydrogen Alliance.” It’s for ammonia and methanol in addition to green hydrogen. Van Son, however, stressed that electricity generation is still a substantial part of the Desertec vision today – also and especially for local needs. Depending on the distribution of peaks in the load profile, he also sees a niche for solar thermal power plants in some regions.

The portents for energy coming out of the desert are better today than they were during the first attempt. The pressure for climate protection has grown strongly. Governments and businesses around the world have already included in their climate plans megatonnes of green hydrogen as replacement for oil and gas. And concrete projects are also popping up ever faster on the map. The best known of these is probably the futuristic conceptualized city Neom, which is to appear in the Northwest of Saudi Arabia on the Red Sea. Wind and solar power plants with a capacity of over four gigawatts are to supply not only the city. Also, around 650 tonnes of hydrogen daily is to be generated in Neom, mainly for further processing to green ammonia.

As to the participating businesses and persons, the same names can always be encountered. The electrolyzers are to come from Thyssenkrupp. Managing director of the project partnership is Peter Terium, formerly with Innogy and RWE. Project partnership Neom, the energy corporation ACWA Power and the technical gas producer Air Products announced in July 2020 that they would together invest 5 billion USD in the project. Construction has now begun – operations are to start mid-decade.

To learn a little more about the current status of this project, H2-international interviewed Cornelius Matthes, the CEO of Dii Desert Energy.

H2-international: Mr. Matthes, you say in lectures and publications that companies involved in Desertec will within this decade be able to supply the quantities of hydrogen that Europe requires. It sounds sincere. What is the basis for your confidence?

Matthes: We know the announcements and plans of our partners. These include projects such as Neom Green Hydrogen, which alone is to produce 650 tonnes of hydrogen daily, but also other projects from ACWA Power, Masdar, DEME, Linde or EDF. These are large companies whose track records show that they can handle such projects. If we include projects that are already between the stages of announcement and implementation planning, that comes to more than the 10 million tonnes per year that Europe wants to import by 2030. With the introduction of the Hydrogen Accelerator, as part of the REPowerEU plan, the production and import targets for Europe have been approximately quadrupled. That means, from the 2x40-GW initiative that we, together with our partner Hydrogen Europe, presented to Frans Timmermans in April 2020, is now a 2x160-GW initiative. So by the end of the decade, the MENA region will be able to supply the hydrogen that Europe needs.

Production capacity is one thing. But for green hydrogen to become an alternative to fossil hydrogen or other energy sources, it must also be affordable.

Our CTO Fadi Maalouf has developed models to calculate the costs of hydrogen, e-fuels and ammonia. Included are the announced H2 production costs for the projects planned for the coming years. Neom wants to produce hydrogen starting 2026 for about 1.5 USD per kilogram. That’s very ambitious. In Morocco, according to our model, costs under 2 USD per kilogram are possible. In Egypt, it could be a little more. Overall, however, we assume that there are many locations in the MENA region that will be able to generate hydrogen for 1.50 to 2.50 USD per kilogram by the middle of this decade, so the mid-2020s.

Then, however, the hydrogen is still in North Africa. By what means and at what cost does it come to Europe?

A transport by ship, including conversion, according to our estimate, would cost 1 to 2 USD per kilogram. With a pipeline, it would be significantly cheaper. If considering a new pipeline that would transport hydrogen from Egypt, Saudi Arabia and Jordan across the eastern Mediterranean, to be fed into the planned Hydrogen Backbone in Europe, the transport costs would lie at 50 US cents per kilogram, calculating over the entire lifetime of the pipeline, including capex and opex. With low production costs, as projected for Neom or even for later projects, it will therefore be possible to bring hydrogen all the way to Central Europe for 2 USD per kg.

The data on this comes from industry insiders in the oil and gas sector, like the King Abdullah Petroleum Studies and Research Center (KAPSARC) or ILF Beratende Ingenieure. ILF has already planned some pipelines in the region and can therefore make realistic assumptions on the costs. A possible specific route for the Africa-to-Europe line has also been quite well investigated.

Wouldn’t it be easier to repurpose existing pipelines or to blend the hydrogen into them?

There are parallel initiatives to repurpose existing lines and, for example, to bring hydrogen from Morocco to Spain. But just the current supply relationships alone are politically very complicated. Normally, gas from Algeria flows through Morocco and the Strait of Gibraltar to Spain. But Algeria has broken off diplomatic relations with Morocco and also stopped the supply of gas to it in November 2021, so Morocco was cut off from the direct means of supply. Now instead, Algerian gas comes first to Europe and then via Spain to Morocco. At the same time, Algeria is actually to be delivering more natural gas to Europe.

Also the blending of hydrogen in natural gas lines will presumably not play a large role. The natural gas would indeed be somewhat “greener” this way, but the real value of the flexible raw material that is hydrogen would be lost. That’s why this form of transport is not very attractive.

Nothing further needed there. So can we do without the billions in subsidies for the hydrogen economy?

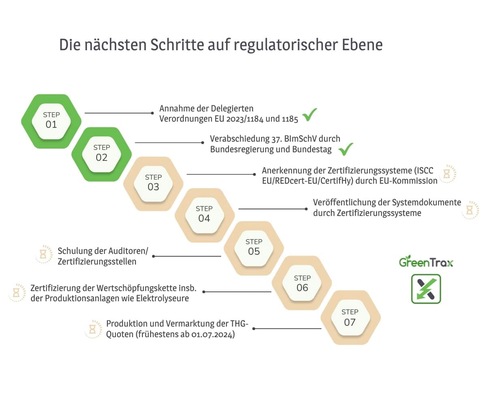

It will not work without political support. Above all, a secure supply of green hydrogen needs to be ensured in Europe for the projects to be economically attractive – aided by clear regulation as well as internationally well-coordinated certification. The current Delegated Acts on hydrogen of the EU is rather an example of how to delay the necessary development. Countries like India act much more pragmatically here. Also the countries along the route need to be on board, particularly Greece, where the pipeline would come ashore, and Italy. Guarantees and private-public partnerships would be necessary. Many discussions are already underway, and I think the COP27 climate conference in November will bring further progress. Clear is that the major infrastructure changes must be on the political agenda – they won’t happen on their own.

This kind of thing can take time. How will hydrogen be coming to Europe in the next few years?

Pipelines, ammonia and e-fuels are all technologies for this decade. Besides pipelines, the most developed technology is definitely ammonia. There are over a hundred ships around the world that can carry it, many import and export terminals, and also a storage infrastructure. For the direct use in the chemical industry, for example at Covestro or BASF as well as the fertilizer industry, this is ideal. The technology reaches its limit when the ammonia is to be converted back into hydrogen. The cracking is energy intensive and not yet established on a large industrial scale.

LOHCs, that is Liquid Organic Hydrogen Carriers, also have a chance, but their success hinges on still many open questions. Liquid hydrogen, on the other hand, will not have a role in this decade. The technology is not yet mature enough for mass production. The test ship from Kawasaki has shown that intense development of many components is still necessary. But liquid hydrogen could have more significance in the 2030s.

Cornelius Matthes studied business administration and has been on the management team of the Desertec Industrial Initiative (Dii) since 2010 and CEO of Dii Desert Energy since January 2021. He started his professional career at the Deutsche Bank Group. As Managing Director MENA for the Italian project developer Building Energy from 2013 on, he established a new location for them in Dubai. Starting in 2016, he has also been founding his own project development and investment companies for renewable energies with various partners. Matthes advises renewable energy companies and investment funds, is a guest lecturer at various universities and was named Solar Pioneer 2015.

Interviewer: Eva Augsten