Whenever we talk about critical resources, we also talk about recycling. The current global political situation has reminded us that recycling is not only sensible from an ecological perspective, but can also make a significant contribution to building more resilient supply chains. Supported by analyses from Ludwig-Bölkow-Systemtechnik GmbH (LBST, a consulting firm specializing in energy, hydrogen, mobility, and sustainability), the Hydrogen Council, together with the World Bank, already provided an overview in 2022 of which critical materials are used in the hydrogen economy.

Automotive industry: EU increases pressure, manufacturers resist

European policy has been working for years on many levels to strengthen the circular economy. This includes not only recycling, but also minimum quotas and clear responsibilities for those placing products on the market, for example in the WEEE Directive for electrical and electronic equipment, the Battery Directive, and the End-of-Life Vehicles Directive. In practice, however, the rules have often been circumvented, including through illegal disposal and export.

The entire European automotive industry has also failed to meet its responsibilities. In April of this year, the European Commission imposed antitrust fines of nearly €460 million because the automotive industry had, over a period of almost ten years up to 2017, evaded its responsibility to ensure proper recycling of its vehicles. Particularly noteworthy is the justification used within the industry. It was broadly assumed that recycling was inherently profitable for scrap processors and that market-based interests would therefore “automatically” lead to sufficient recycling. As a result, the automotive sector saw no need to engage further with the issue.

© LBST

Catalytic converter is the prime asset in vehicle recycling

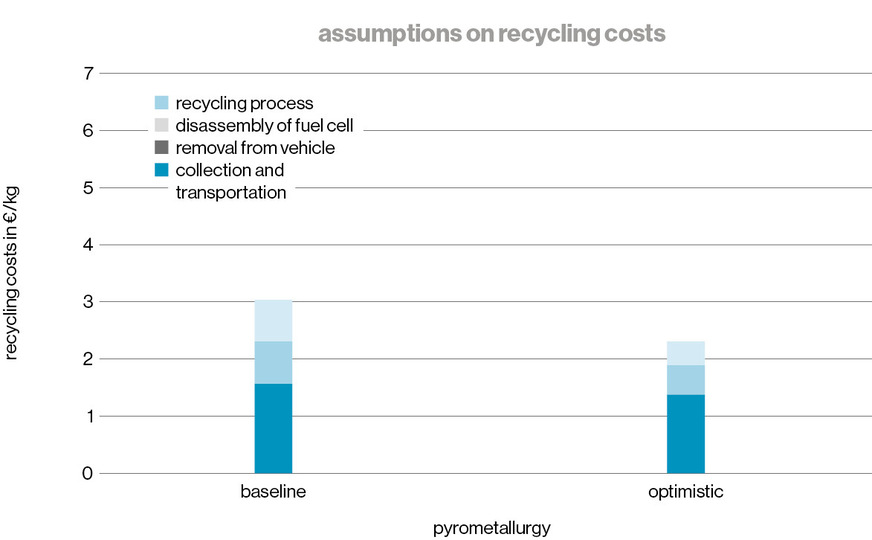

There is no doubt that entrepreneurs have been able to make money in the past by recycling vehicles with internal combustion engines. A key source of revenue has been, and continues to be, the potential material value—especially that of exhaust gas catalytic converters with their relatively high platinum and rhodium content. The advantage in recovering these precious metals lies in the use of the simplest recycling method: complete combustion followed by leaching, known as pyrometallurgical processing. This results in recycling costs of only €2.30 to €3.00 per kilogram of scrap. The main cost driver here is not the process itself, but the collection and transport of the scrap to the recycling facility.

However, things become more difficult with other components. For example, steels and copper streams become increasingly contaminated with frequent recycling and thus gradually lose value. They can then no longer be used in exactly the same applications.

To prevent such downcycling due to cross-contamination—or other causes—a recycling process must go through relatively complex technical steps. The best method for this is hydrometallurgical, i.e. leaching. The associated costs are higher, at around €4 to €5 per kilogram of scrap. In particular, the additional manual processing and the use of expensive leaching chemicals drive up the costs. In return, a wider variety of materials, including non-metallic ones, can be recovered.

Fuel cells: platinum content is key

If vehicle catalytic converters are attractive to recyclers, does that mean fuel cell stacks from vehicles can also be recycled economically in the future?

To approach this question, the LBST team first estimated under which price scenarios and platinum loadings cost-covering recycling would be possible. In the base scenario, a stack was assumed with around 0.26 g/kW, roughly corresponding to the platinum loading of a first-generation Toyota Mirai.

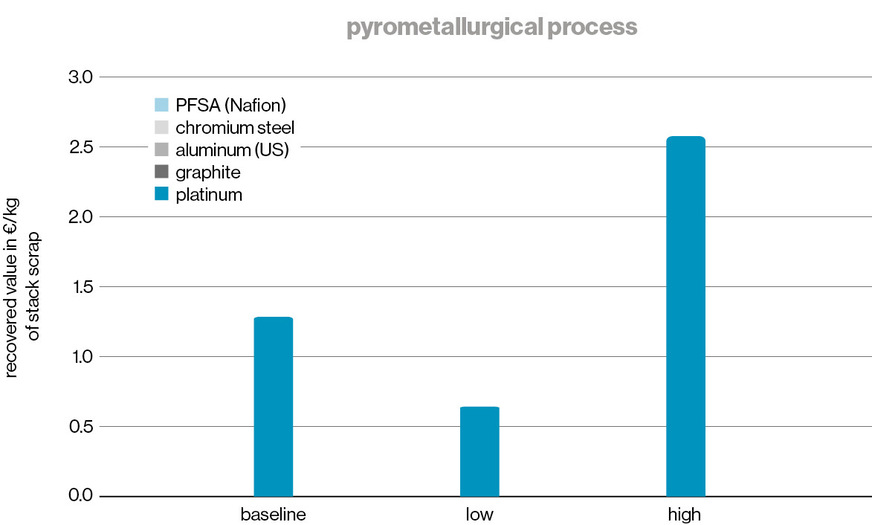

The underlying recycling rates, i.e. technical efficiency, are particularly high for platinum. Regardless of the recycling method used, they are approximately 95–100%. However, this does not apply to components made of graphite, which can only be recovered using the hydrometallurgical method. Figure c shows that when using the pyrometallurgical process selected here as an example, the potentially recoverable value of a fuel cell stack lies almost entirely in the platinum used.

Raw material prices also influence the value of the recycled material—and these fluctuate. The development of raw material prices is broken down into three different price scenarios. The base scenario “Base” corresponds to today’s prices, around €32 per gram or €1,000 per ounce of platinum. “High” corresponds to historically high prices of €64 per gram, which is rather unlikely. “Low” corresponds to historically low prices of around €16 per gram of platinum. Assuming that internal combustion engines will increasingly be replaced by electric drives, this scenario is quite likely, as the peak in demand would then be surpassed. Depending on the platinum price, a value of between approximately €0.50 and €2.50 could be recovered per kilogram of dismantled stack scrap.

© LBST

Stack recycling likely not economically viable

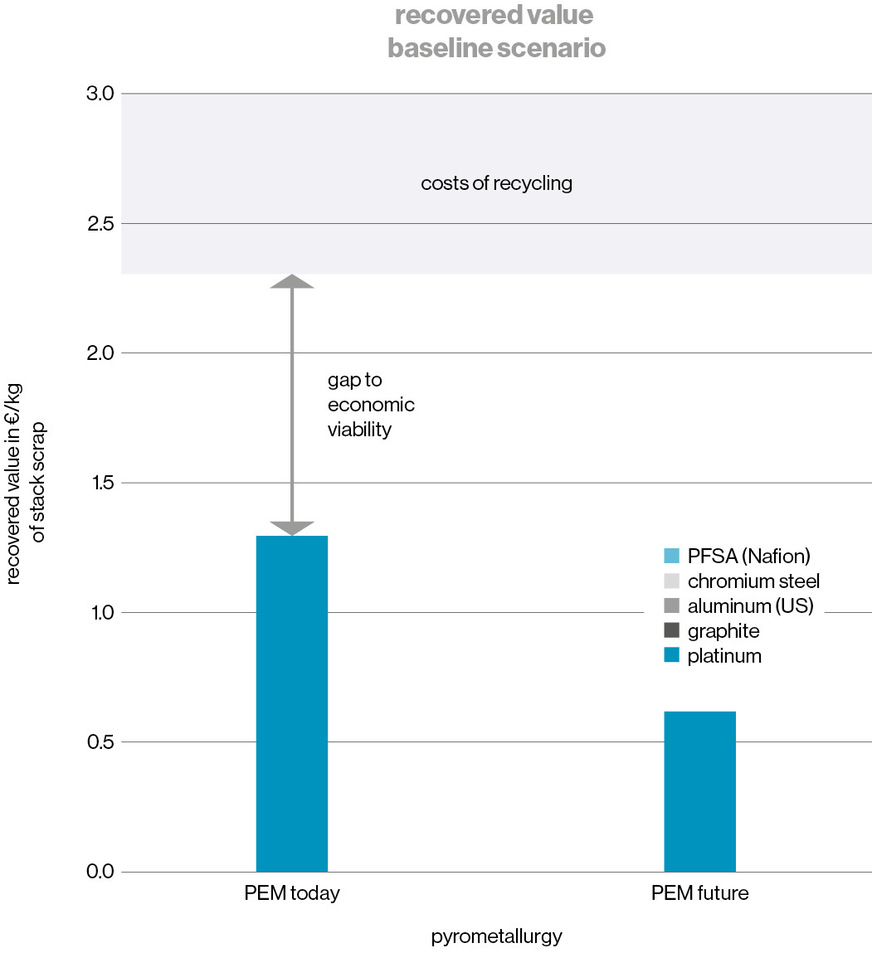

However, the amount of platinum is not a constant. For manufacturers, the use of platinum in a fuel cell is initially a cost factor. It is therefore generally accepted that a fully optimized fuel cell will contain less platinum in the future. If one considers such an optimized fuel cell, as described for example by the US Department of Energy in 2020, it contains only 0.125 g of platinum per kW. This reveals that the costs of recycling could far exceed the recoverable values in the future (Figure c).

This is already the case if the platinum price remains unchanged (base scenario). If it is assumed that the price will continue to fall in the long term, then economically viable recycling based solely on the value of platinum is not possible.

Before drawing conclusions, further factors affecting economic viability must be considered. The use of hydrometallurgical methods can enable the recovery of additional value. For example, several projects in Europe are actively working on the recovery of ionomers, and the Horizon funding program includes a dedicated topic area for this.

In addition, steel and copper components of a fuel cell vehicle can still be recycled as a whole. This reduces the costs, which in the example given are fully attributed to the recycled stack. Nevertheless, the costs of recycling a fuel cell vehicle will in all likelihood exceed the recoverable values.

Less is not always better

Where there is no individual economic incentive to bear the costs of collecting and transporting fuel cell stacks, the regulatory framework can only partially compensate. Thus, the statement made by our esteemed former colleague, the energy specialist Werner Zittel in 2012 remains valid. In a progress report for the Austrian Climate and Energy Fund, he warned that the recycling of metals is “increasingly problematic [because] their more efficient use also reduces the metal content in the discarded products.” If the quantities become even smaller and eventually only traces of the element remain, technological limits are also reached. As a result, the likelihood of platinum dissipation increases: it disappears from the raw material cycle and ultimately ends up in landfills or simply in our environment.

What is the solution? A circular and therefore resilient European economy must question fundamental principles of action and truly design product development with the end in mind. The additional parameter “economic viability of recycling” could change overall optimization, especially since ever-lower platinum content also comes at the expense of performance and service life. Industrial-scale catalytic converters could serve as inspiration for a circular model. These are already offered today in a kind of leasing model. In such cases, manufacturers have a strong interest in recovering their platinum.

Can this approach be transferred to fuel cell stacks? What other ideas are there? Join the discussion: linkedin.com/company/hzwei-magazin