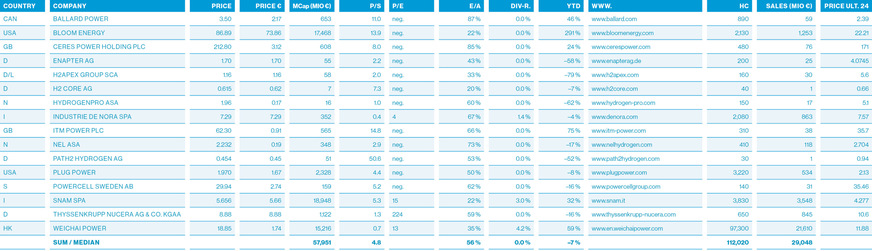

Of the more than 20 companies discussed in the article “Further dry spell for hydrogen stocks?” (HZwei 2/2025), several are missing here. Reasons include insolvency or a switch from hydrogen to natural gas, as in the case of fuel cell company FuelCell Energy. Also no longer included are McPhy Energy SA, Nikola, Proton and Motor Power Systems plc, as well as the two major industrial gas producers Air Liquide SA and Linde plc, which generate only a fraction of their revenues in the hydrogen sector. Some stocks such as Bloom Energy rose by well over 200 percent in 2025 – at times even by more than 500 percent. Others lost more than 50 percent. The 16 companies from Europe, the USA and Asia listed in the key figures table, with a combined workforce of around 112,000 employees, most recently achieved annual revenues of around €29 billion and a market capitalisation of around €58 billion. Only four of these companies are profitable, with China’s Weichai Power accounting for by far the largest share of both revenues (around 74%) and employees (around 87%).

In the “P/S” (price-to-sales ratio) column, eight of the 16 companies show figures ranging from five to 50, meaning their market capitalisation is five to 50 times higher than their most recent annual revenues. However, a stock generally appears more attractive the lower its P/S ratio. When annual revenues rise subsequently, earnings and thus share prices usually increase as well. The following section provides details – in alphabetical order – on hydrogen stocks of varying significance.

Key to table

MCap = Market capitalization in millions of euros

E/A = equity-to-asset ratio

P/S = Price/sales ratio

P/E = Price/earnings ratio

Div.-yield = Dividend yield

HC = Headcount

YTD (year-to-date):

Share price performance from January 1, 2025

to December 31, 2025.

The figures refer to the last financial year

(usually 2024).

Share prices in euros or currency on the

home stock exchange.

Exchange rates

CAD = 0.6208 Euro

GBP = 0.01468 Euro

HKD = 0.0925 Euro

NOK = 0.08463 Euro

SEK = 0.09148 Euro

USD = 0.85000 Euro

As of December 31, 2025

© Course data: comdirect.de / Graphics: NEONBOLD

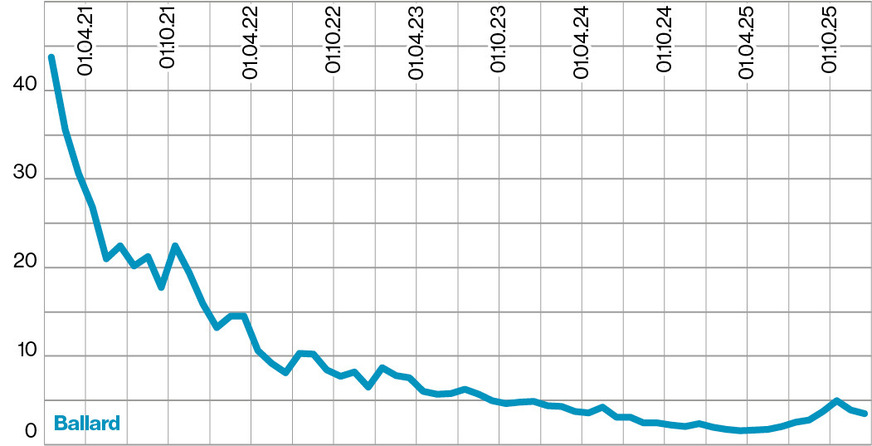

Ballard Power Systems

Founded in 1979 (initially to research and develop lithium batteries), the company has been publicly traded since 1993 and has repeatedly financed its billions in losses in the fuel cell sector through capital increases over more than 30 years. In 2018, Weichai Power acquired a 20 percent stake in Ballard Power in order to use the technology for trucks and buses in China. The year 2024 was also heavily in deficit: the loss was 4.6 times higher than the revenue of just under 60 million euros. In the third quarter of 2025, sales rose by 120 percent to around USD 32.5 million, mainly due to more rail orders, while losses fell sharply to around USD 28.1 million.

© Course data: comdirect.de / Graphics: NEONBOLD

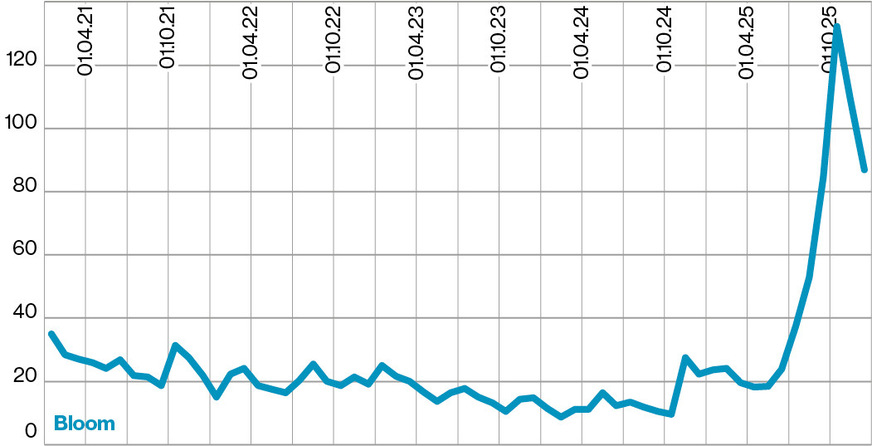

Bloom Energy

As in 2024, the California-based company, founded in 2002, was one of the few stock market winners in 2025. The manufacturer of fuel cells for stationary power supply is benefiting from the growing demand for data centers in the wake of the AI boom. In 2024, sales rose by a good ten percent to over $1.25 billion, while losses were significantly reduced from over $300 million to less than $30 million.

In the third quarter of 2025, sales rose by 57 percent to around $519 million, but losses also rose by 57 percent to around $23.1 million. At the end of 2025, Bloom Energy placed a billion-dollar convertible bond with a very high conversion price of around $195. Despite a decline in the share price towards the end of the year, the stock was by far the best performer in the table in 2025, with a gain of over 250 percent.

© Course data: comdirect.de / Graphics: NEONBOLD

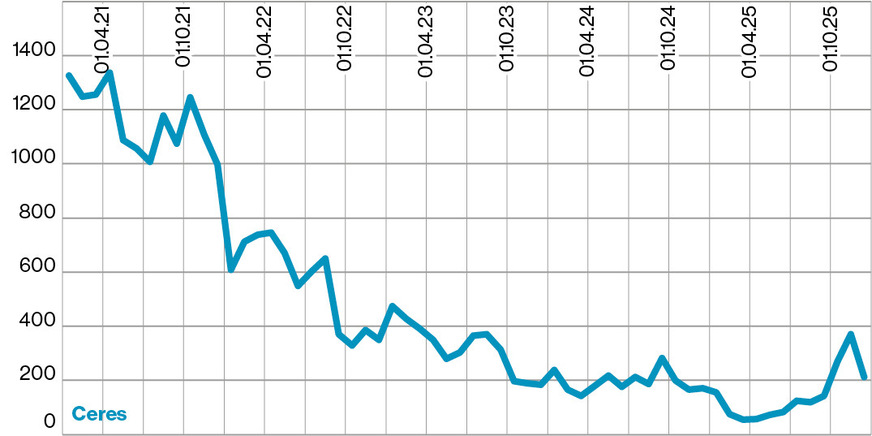

Ceres Power Holdings plc

Founded in 2004, the British company, in which the main shareholder Weichai Power holds a 20 percent stake, develops electrolysis technologies and high-temperature fuel cells: solid oxide fuel cells (SOFC) and hydrogen solid oxide electrolysis (SOEC).

In 2024, revenue rose by over 130 percent to around £52 million, while losses were almost halved to around £28 million. In the first half of 2025, revenue fell by 26 percent to around £21.1 million, while losses fell by a good 30 percent to around £19.6 million.

In December 2025, short selling and price turbulence ensued after Grizzly Research claimed in a report that Ceres Power had misled investors with its high revenue expectations.

© Course data: comdirect.de / Graphics: NEONBOLD

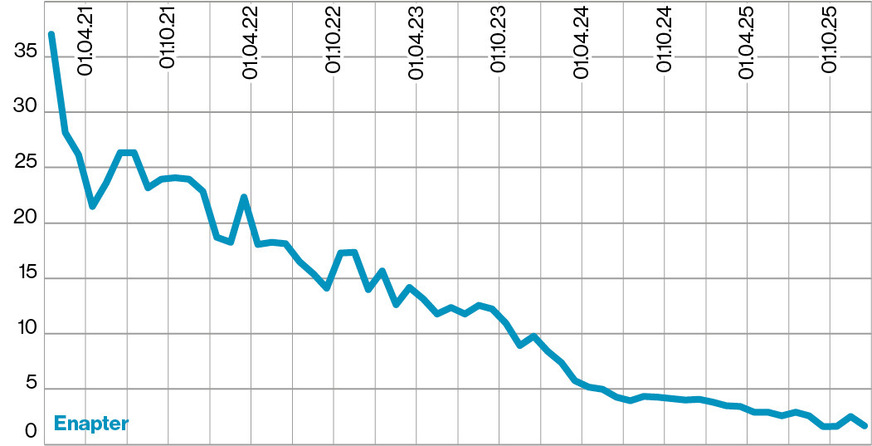

Enapter AG

The company, headquartered in Germany with a research and production site in Italy, has developed electrolysers in single-core and multi-core systems. Its approximately 400 customers in over 50 countries include companies from the energy, transport, heating and telecommunications sectors.

In 2024, sales fell by around a third to €21.4 million, while losses almost tripled to €20.7 million. In the first half of 2025, sales fell by 32 percent to around €5.6 million, while losses rose by over 70 percent to around €13.7 million.

© Course data: comdirect.de / Graphics: NEONBOLD

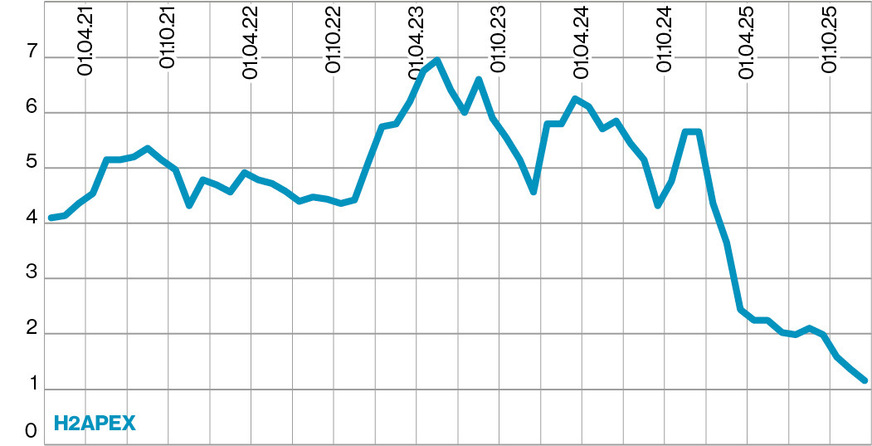

H2APEX Group SCA

Founded in 2000 and based in Rostock, the company (formerly exceet Group) specializes in the “development, planning, and construction of hydrogen-producing plants.” In the first nine months of 2025, revenue fell from €25.2 million to €5.2 million, while losses rose from €18.9 million to €28.1 million. Chief Financial Officer Bert Althaus is nevertheless satisfied in view of the “challenging environment” and has raised the sales forecast for 2025 from €6–8 million to €9–10 million.

In mid-2025, the insolvent HH2E Lubmin was taken over, creating a second location for hydrogen production in Lubmin. In addition, there was a capital increase of €30 million. At the end of 2025, the (often overly optimistic) analyst Karsten von Blumenthal of First Berlin Equity Research continued to recommend the stock as a buy, but lowered the price target from €3.70 to €3.30.

© Course data: comdirect.de / Graphics: NEONBOLD

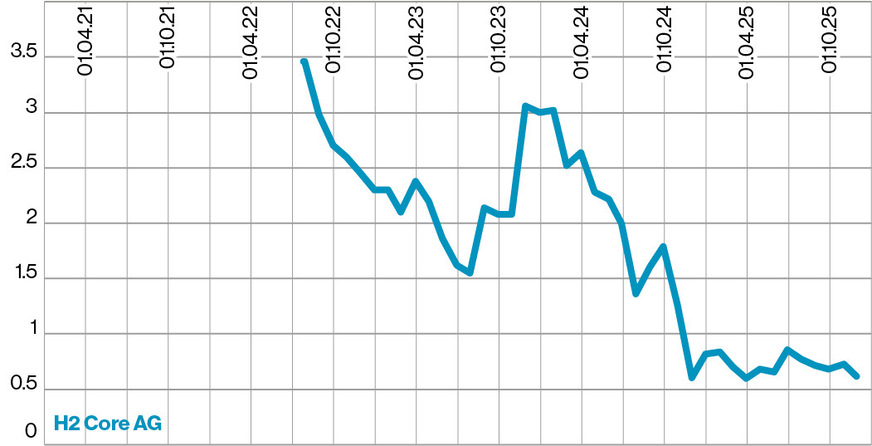

H2 Core AG

H2 Core AG which emerged from Marna Beteiligungen AG, offers H2-based “plug-and-play energy supply solutions” using electrolysis stacks, which are mainly supplied by Enapter AG. In mid-2024, around 325,000 new shares in H2 Core AG were issued at €2.20 each. The share price is now around 70 percent lower. The company fell behind schedule with the publication of its sales figures in 2025 and continues to post losses in the millions.

© Course data: comdirect.de / Graphics: NEONBOLD

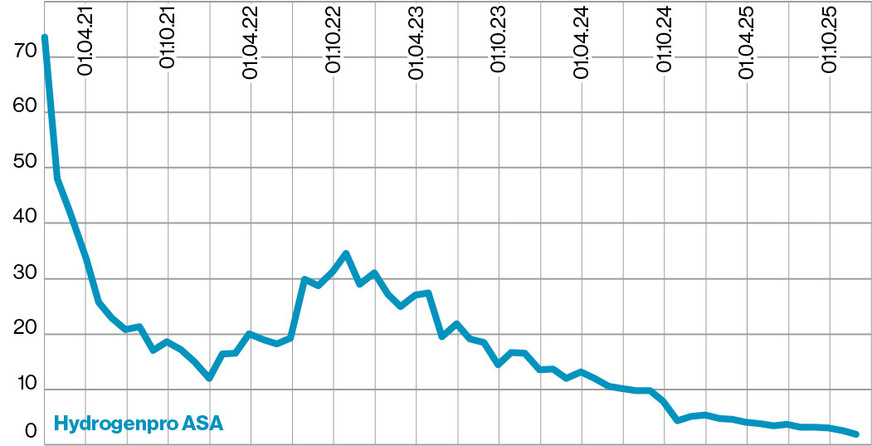

Hydrogenpro ASA

An alkaline high-pressure electrolyzer is the main product of the company, which specializes in hydrogen and renewable energies. Its main shareholders are Austria’s Andritz AG and Mitsubishi Heavy Industries from Japan. In 2024, losses amounted to around NOK 196 million, which was just as high as sales, which had been NOK 568 million a year earlier. In the first three quarters of 2025, revenue fell by 44 percent to around NOK 70.1 million, while the loss for shareholders rose by 27 percent to around NOK 194 million.

© Course data: comdirect.de / Graphics: NEONBOLD

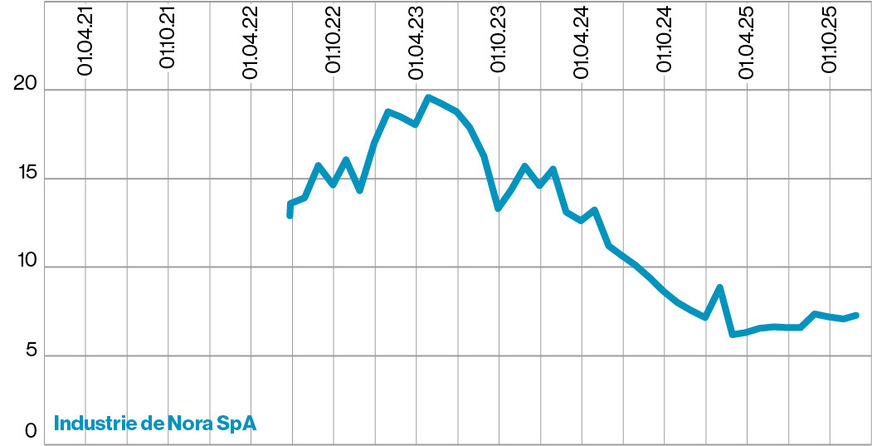

Industrie De Nora SpA

Founded in 1923 and listed on the stock exchange since 2022, the Milan-based company is one of the world market leaders in the field of electrochemistry. Its product range includes components for water electrolysis, electrodes and coatings for various industries, such as chlorine chemistry, as well as electronic components, water filters and disinfection technologies. Industrie De Nora is the second-largest shareholder in Thyssenkrupp Nucera AG & Co. KGaA after the Thyssenkrupp Group. In 2024, sales of €863 million (+1 percent) generated a profit of €83.4 million (-64 percent). In the first nine months of 2025, sales rose by 5 percent to around €631 million, while profit increased by 15 percent to around €60 million.

© Course data: comdirect.de / Graphics: NEONBOLD

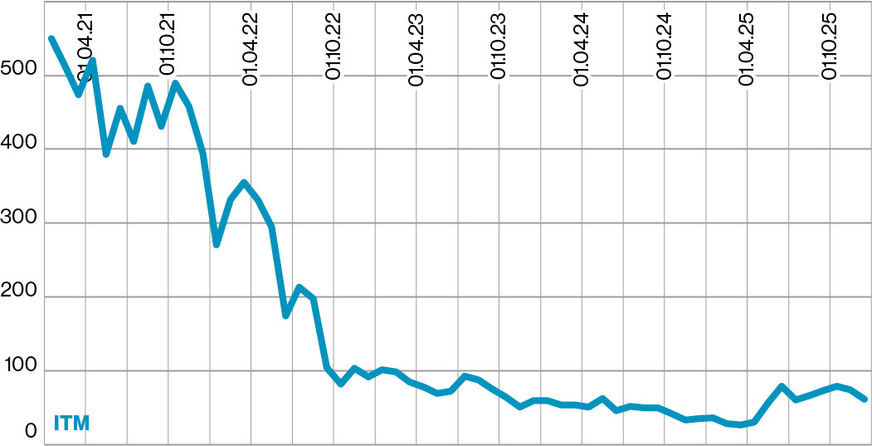

ITM Power PLC

Founded in 2001, the British company has major shareholders such as Linde and is one of the best-established companies in the European electrolysis industry. However, in the 2024/25 financial year, losses of £45.5 million were once again far higher than revenues of £26 million. Although revenue rose by 28 percent to around £18 million in the first half of 2025/26 (as of October 31, 2025), the company still incurred a double-digit million loss. Hopes are pinned on the new, highly scaled 50 MW PEM electrolyzer “ALPHA 50” for industrial applications.

© Course data: comdirect.de / Graphics: NEONBOLD

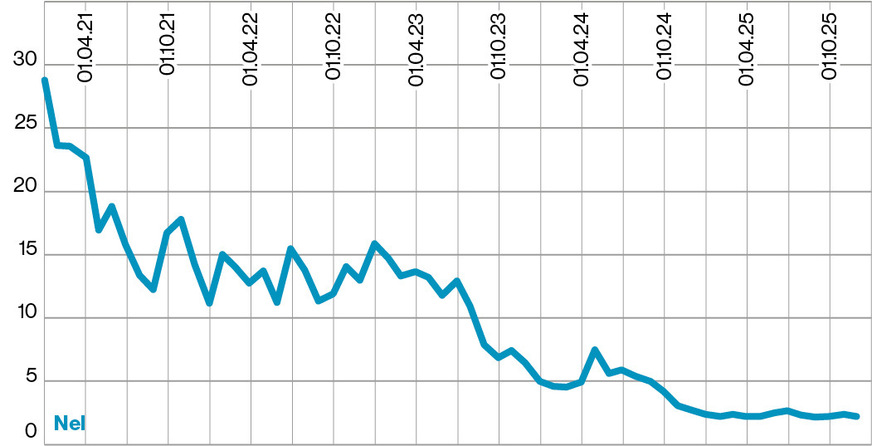

Nel ASA

Founded in 1927, the Norwegian company specializes in electrolysis and transport infrastructure, and is involved in the construction of H2 filling stations and refueling systems, among other things. In 2017, it merged with Hexagon Composite (hydrogen storage) and PowerCell Sweden AB (fuel cells) to form the joint venture Hyon, with the aim of supplying the maritime sector with FC drives.

Nel generated revenue of just under NOK 1.4 billion (-17 percent) in 2024 and a loss of NOK 258 million (after NOK 855 million in the previous year). In the third quarter of 2025, it posted a loss of NOK 85 million on sales of NOK 349 million. Due to “limited synergies between the refueling and electrolyzer businesses,” the refueling division was spun off in 2024 under the name Cavendish Hydrogen and listed separately on the Oslo Stock Exchange. In 2024, Cavendish generated revenue of NOK 361 million (+9 percent) with around 250 employees, posting a loss of NOK 265 million (-20 percent).

© Course data: comdirect.de / Graphics: NEONBOLD

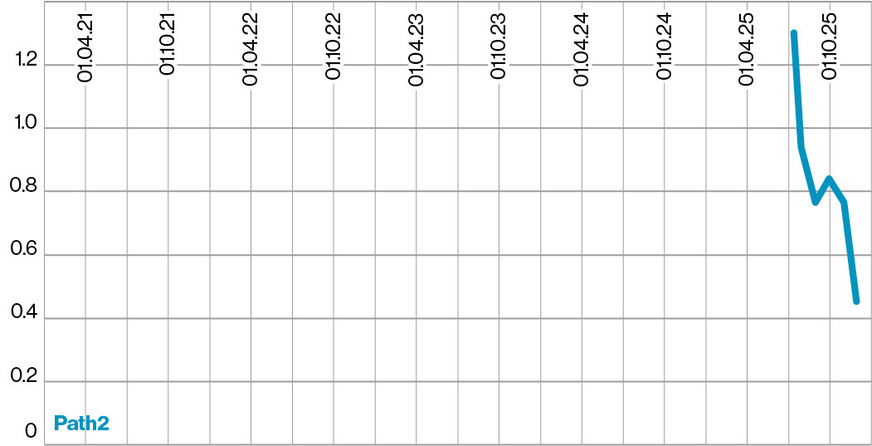

Path2 Hydrogen AG

Founded in 2001 as H5 B5 Media AG, the company has since been renamed five times and was most recently called Philomaxcap AG. One of the company’s holdings, the Swiss AmeriMark Group AG, was listed in Vienna until 2021 and was active in the trade and leasing of used cars for subprime customers through Rymark Inc. in the US. In terms of the balance sheet, this investment (48.5 percent) is still a large item, but its value depends on a legal dispute over ownership rights in the US.

The holding company, renamed Path2 Hydrogen AG in 2025 and with Josh McMorrow as its new CEO, intends to develop and market “hydrogen liquefaction and storage facilities” with its US subsidiary GenH2 (www.genh2.com), which was contributed as a non-cash contribution with around 95 million shares. GenH2 generated revenues of US$0.7 million and US$0.8 million in 2023 and 2024, respectively, while posting losses of US$12.4 million and US$9.6 million. Now, Canadian company ProtonH2, which has developed a technology for H2 production from former oil and natural gas storage sites, is also to be acquired.

© Course data: comdirect.de / Graphics: NEONBOLD

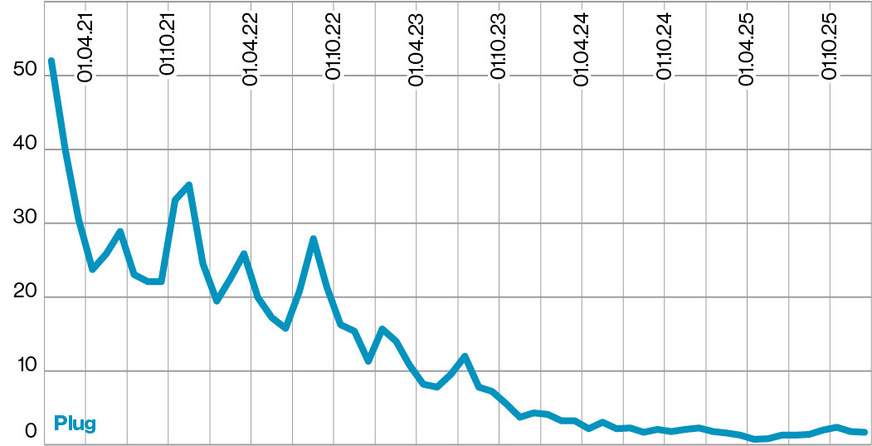

Plug Power

The US company is one of the world’s largest buyers of liquid hydrogen. However, since acquiring United Hydrogen (2021), it has also been producing it itself. In 2023 and 2024, revenues of $891 million and $629 million respectively resulted in losses of $1.37 billion and $2.10 billion. In the first three quarters of 2025, revenue rose to $485 million (+11 percent), while losses increased to $786 million (+2 percent).

© Course data: comdirect.de / Graphics: NEONBOLD

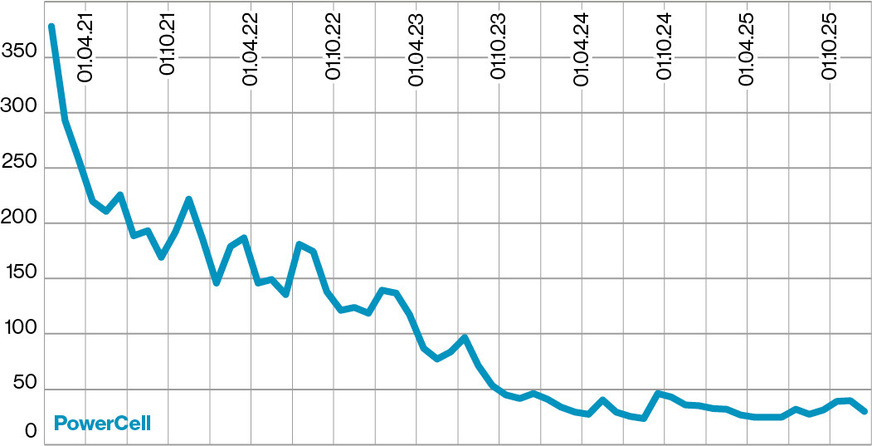

PowerCell Sweden AB

Founded in 2008, the company manufactures fuel cell systems that can convert both fossil fuels and renewable energy sources into hydrogen. It has consistently generated losses to date, with one exception in 2019: that year, the sale of an exclusive production and distribution license for the “PowerCell S3 fuel cell stack” to Robert Bosch GmbH generated proceeds of around €50 million.

From January to September 2025, sales rose by 52 percent to over SEK 290 million. Losses fell from around SEK 50 million to less than SEK 9 million. In December 2025, CEO Richard Berkling announced that the operator of a data center in the US wants to lease two “PowerCell PS190” fuel cell systems. This will be done on a trial basis for six to twelve months under a leasing agreement in order to achieve “reliability, scalability, and emission-free operation.”

© Course data: comdirect.de / Graphics: NEONBOLD

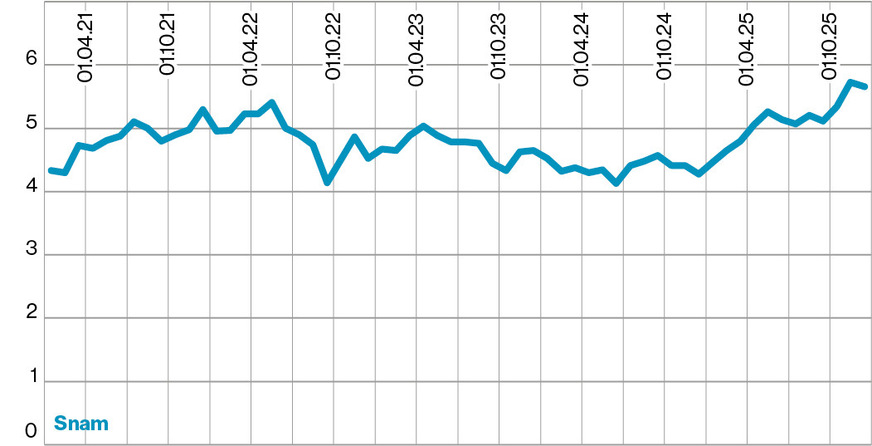

Snam SpA

The company, which was spun off from the energy group Eni in 2001, operates a natural gas transport network of around 38,000 km within and outside Italy, as well as gas storage facilities accounting for around 15 percent of European natural gas reserves. In the hydrogen sector, it has a joint venture with the company Industrie De Nora Spa, and in the major “SouthH2 Corridor” project, Snam is a partner of Gas Connect Austria GmbH, bayernets GmbH, and TAG GmbH.

In the third quarter of 2025, revenue rose by seven percent to €2.85 billion, partly due to higher LNG imports, while adjusted profit rose by ten percent to €1.1 billion. In 2025, Snam sold its six percent stake in Adnoc Gas Pipelines. The plan to acquire just under 25 percent of Essen-based Open Grid Europe GmbH, which operates Germany’s largest gas transmission network with a length of around 12,000 km, failed in November 2025 due to concerns on the part of the German authorities regarding security of supply (the State Grid Corporation of China has an indirect stake in Snam).

© Course data: comdirect.de / Graphics: NEONBOLD

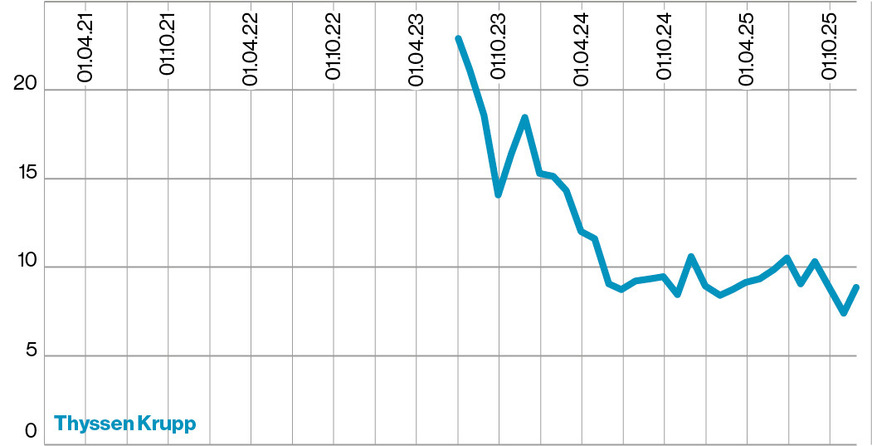

thyssenkrupp nucera AG & Co. KGaA

In 2024, the electrolysis company spun off from thyssenkrupp AG gained Fraunhofer IKTS as a strategic partner. In May 2025, the two companies opened an SOEC pilot production plant for high-temperature electrolysis stacks in Arnstadt, Thuringia.

In the 2024/25 fiscal year (as of September 30, 2024), the company acquired the Danish high-pressure electrolysis company Green Hydrogen Systems and generated a profit of around €5 million on sales of €845 million (down two percent).

In the previous year, the figure was €11 million, but due to lower interest income, the financial result fell from €26 million to €17 million. In the Green Hydrogen segment, CEO Dr. Werner Ponikwar expects annual sales to more than halve: from €459 million to €150–220 million.

© Course data: comdirect.de / Graphics: NEONBOLD

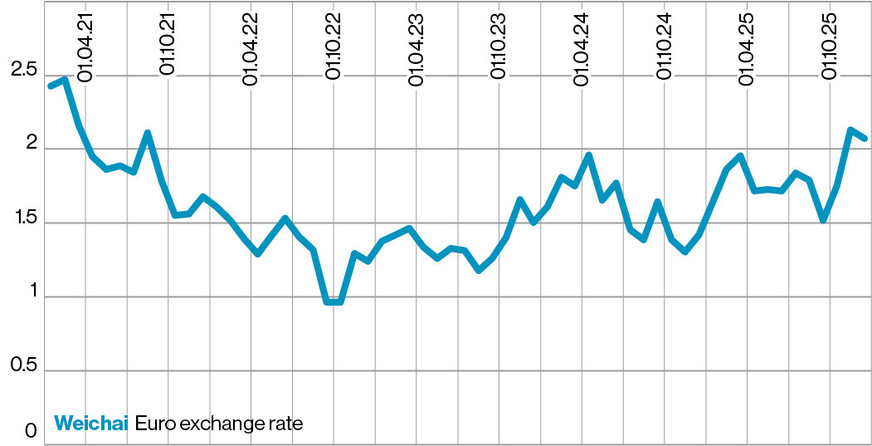

Weichai Power

Founded in 1953, the automotive engineering group was known as Weichai Diesel Engine Factory until 1992 and still manufactures diesel engines in China today. However, through its investments in Ballard Power and Ceres Power, Weichai Power is now also involved in hydrogen applications. The prices of H shares, which are also listed on German stock exchanges, have fluctuated between €0.93 and €2.78 in recent years, most recently at around €2.10.

In the first three quarters of 2025, revenue rose by 5.3 percent to over 170.6 billion renminbi (RMB), while profit rose by 5.7 percent to 8.9 billion RMB. Weichai Power is by far the largest of the 16 companies in the table, ranks among the top three in terms of share price growth in 2025, and has attractive key figures. However, the hydrogen sector is not the group’s main source of revenue.