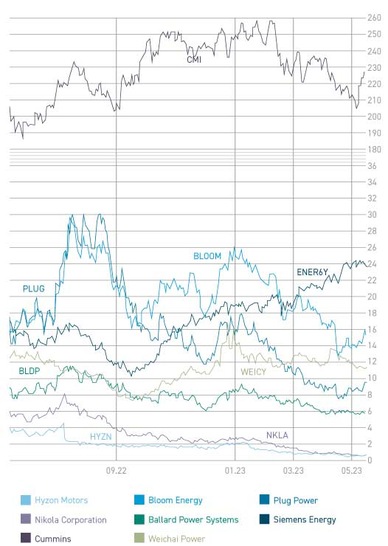

A look at the share prices of hydrogen and fuel cell companies, which have come under severe pressure, suggests that something is not right with the new megatrend hydrogen. What forces are at work here? Short sellers may have an influence, but ultimately it is the markets, the stock exchange and investors that determine the values. Also clear is: The real H2 ramp-up will gain speed in years, not months, and develop sustainably.

At this time, there are concrete projects worldwide to read of that today already correspond to a volume of 320 billion USD and will possibly reach 1 trillion USD per year. The snag is that so far only five to ten percent of these announced projects are in the approval or funding phase or, even, implementation.

Long-term upward trend is foreseeable

At the moment, companies are primarily concerned with positioning, establishing and scaling production, investing massively in research and development, and optimizing. Illustrative are the results and forecasts presented at important congresses such as at the recent World Hydrogen Summit in Rotterdam, at the newspaper-hosted summit Handelsblatt Wasserstoff-Gipfel in Salzgitter, or at Hannover Messe, which as an indicator for H2 and FC technologies, gives a perfect description of the situation.

Then, there are all the country-specific congresses, like the American Hydrogen Summit, which is representative of similar events around the globe. In parallel, numerous specialized events from the DVGW (German association for gas and water standards), Zukunft Gas and Mission Hydrogen for specific individual topics are taking place, which bodes optimism. Things are becoming optimized, researched, developed, and massive, truly gigantic new world markets are emerging to deal in energy security and likewise the issues of climate, the environment, and energy availability for all markets and uses concerned.

There is also criticism, however, with respect to the EU and Germany in particular, as many things are proceeding too hesitantly and the reasonableness of some regulations ought to be examined. Dr. Sopna Sury, executive at RWE Generation, stated at the Handelsblatt hydrogen summit: We’re simply acting and not waiting on politics. This attitude is illustrated at RWE Hydrogen with many individual projects such as an ammonia terminal in Brunsbüttel, but also in various applications of German electrolysis technology, like that of Sunfire, in Lingen.

All this shows: Countries and companies that approach the hydrogen market with many colors and in order to build businesses belong to the success of the ramp-up. Regarding investment in the H2 and FC stocks analyzed here, all of this sets the perfect runway for the companies concerned. Because their valuation and prospects are expressed in the prices of their shares and the performance of these at the stock market.

Current quotes will be quotes of opportunity

While all the companies and their shares discussed here have different valuation criteria, based off of the different business models, technologies and markets, what they all have in common is that they will play a role in and benefit from the new megatrend hydrogen. We are only at the beginning, though, and with every beginning also comes uncertainty. Here especially, as regeneratively produced hydrogen is a new world market.

You read correctly: Money is needed if you want to make use of the very strongly depressed prices for new or further buys. The basic conviction is that this megatrend talked of has only just begun, if trend research is taken as a basis. A megatrend needs 20 years until the breakout, the inflection point. Go back to the period from 2001 to 2003, when hydrogen and fuel cells started to increasingly come into the public eye. A Ballard Power share was priced at over 130 USD.

Take a seat on the H2 train: We have – metaphorically speaking – just left the station and the H2 train is now picking up speed. The pace is increasing, but the cruising speed has still not been reached. Remember the period from 2018 to 2020, when the share prices rose by several hundred percent but then went downhill for two years? Now, though, my opinion, the new trend will transition to a sustainable upward trend that will tend to lead, with fluctuations that are normal, to substantially higher prices for the shares here discussed. Do you already have your ticket for the H2 train?

Disclaimer

Each investor must always be aware of their own risk when investing in shares and should consider a sensible risk diversification. The FC companies and shares mentioned here are small and mid cap, i.e. they are not standard stocks and their volatility is also much higher. This report is not meant to be viewed as purchase recommendations, and the author holds no liability for your actions. All information is based on publicly available sources and, as far as assessment is concerned, represents exclusively the personal opinion of the author, who focuses on medium- and long-term valuation and not on short-term profit. The author may be in possession of the shares presented here.

Written by Author Sven Jösting, June 9th, 2023

graph-7-23.jpg, Source: www.wallstreet-online.de