“We are working diligently through our filings to target the Nasdaq deadline of 2/13/2023. We look forward to updating the investor community in due course” was the statement from Hyzon. This presumably means that Nasdaq has accommodated the company’s schedule by giving this deadline and with it given Hyzon Motors time to provide clarity. Prior to this was an investigation that had uncovered accounting irregularities, which made a complete reevaluation of the company’s figures necessary. In the course of the audits, the CEO had to vacate his post immediately, which gives an idea of the scope – we’ve reported.

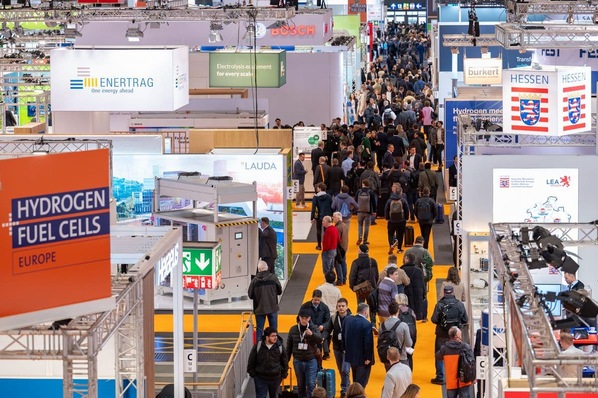

A positive, however, is that Hyzon again had a presence at trade fairs (at IAA Transportation for example) and has also notified of deliveries of its vehicles. Recently, a truck was sent out to the leading Belgian tank transport company Vervaeke. Hyzon is also advertising job openings, which should be viewed as positive.

Summary: There’s nothing to do until all the facts are on the table. As the company, before the accounting scandal, had over 400 million USD in liquid assets and over 60 percent of the company is held by insiders (founder, management), we are optimistic about the future, even if it is for sure a highly speculative investment. The calculated stock market value of around 400 million USD includes, as we see it, many negative developments. Nearly 20 million shares have been sold short, which will have little impact on the share price in the event of positive news, even if short sellers certainly have a major influence on the price development and price fluctuations.

Disclaimer

Each investor must always be aware of their own risk when investing in shares and should consider a sensible risk diversification. The FC companies and shares mentioned here are small and mid cap, i.e. they are not standard stocks and their volatility is also much higher. This report is not meant to be viewed as purchase recommendations, and the author holds no liability for your actions. All information is based on publicly available sources and, as far as assessment is concerned, represents exclusively the personal opinion of the author, who focuses on medium- and long-term valuation and not on short-term profit. The author may be in possession of the shares presented here.

Author: written by Sven Jösting December 12th, 2022