Unfortunately, it must be stated so: the global increase in the price of oil and gas or LNG, which is also fueled by Russia’s bellicose actions here in Europe, is beneficial for the ramp-up of the hydrogen economy, since at the end of the day, aside from climate and economic policy issues and price, it’s about the ensured availability and delivery of energy. So there is a winner in this crisis: hydrogen – green hydrogen.

Because hydrogen is set to become a new commodity, a tradeable good, in more and more regions of the world. And in large quantities, for better and better negotiation conditions. It is therefore growing into a serious competitor of the battery, since the raw materials for such are becoming scarcer and more expensive, as is the price for electricity. Its assumed advantages, lower costs for travel, are increasingly losing meaning.

The current crisis situation is letting investments in hydrogen – production, warehousing, transport, markets – rise dramatically, where much still needs to be done before a sufficient guarantee of availability is reached. In a sense, the markets around hydrogen and fuel cells have been dealt a favorable hand, which in turn benefits the shares of the listed companies in this industry.

Energy prices skyrocket

On the stock market, the first few months of the year have produced only very weak share prices for the listed companies discussed here. Nevertheless, there have recently been noticeable upward trends again, even if the solid prices from the beginning of 2021 – still – seem very far away. Some short sellers have also made their contribution to this and additionally depressed weak prices. This is now coming to an end and the direction is finally changing, as the companies are very well positioned and publish thoroughly satisfying news with respect to their growth prospects, new products, partnerships and JVs, and above all, strongly increasing influx of orders for their production sites (e.g. stacks, electrolyzers).

While the shares of oil companies in particular rose sharply because of the skyrocketing energy prices, this group has the potential to be replaced by those of the hydrogen economy in the long run. However, it should be added that at the same time very large corporations from the fossil industry (gas and oil) have recognized hydrogen’s potential and have massively invested in this area, since hydrogen will replace oil and natural gas, even though this could still take many decades. The journey is the destination.

Market momentum picks up – worldwide

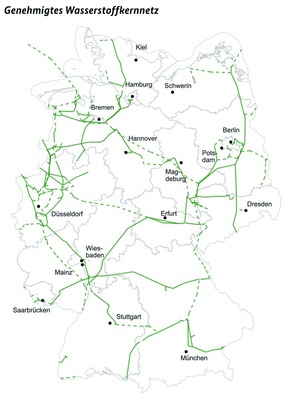

Daily, reports come in about new major projects and initiatives in countries all over the world involving the production of hydrogen, especially the green kind. In addition, countries such as India have now also announced very ambitious hydrogen programs. This year, 26 nations are to publicly share their country-specific H2 strategy or news about their implementation. In 2021, it was already 21.

Author: Sven Jösting, written March 15th, 2022