Since the publication of the National Hydrogen Strategy in 2020, installed electrolyser capacity in Germany has almost quintupled – from 33 megawatts (MW) in 2020 to 114 MW at the end of 2024. A notable achievement. Yet the market is in a transitional phase: while smaller plants have dominated so far, projects with two- to three-digit MW capacity are set to be implemented in greater numbers going forward. This is the finding of a recent analysis by the German Energy Agency (Dena). According to the agency, 185 megawatts of electrolyser capacity are currently in operation in Germany. A further 1.1 GW are under construction – roughly half of which are expected to come online shortly, based on project data.

At BASF’s site in Ludwigshafen, Germany’s largest PEM electrolyser has been operating since March 2025 – following around two years of construction. The plant produces up to one tonne of green hydrogen (H2) per hour. Built in partnership with Siemens Energy, the electrolyser comprises 72 stacks and has the potential to reduce greenhouse gas emissions at BASF’s main site by up to 72,000 tonnes per year.

The hydrogen is fed into the site’s H2 network and supplied to production facilities as a feedstock. In addition to using it as a raw material for chemical products, the chemical company plans to supply hydrogen for H2 buses in the Rhine-Neckar metropolitan region, supporting the development of a regional hydrogen economy.

Rhineland-Palatinate supports Hy4Chem Construction of the plant was funded by the Federal Ministry for Economic Affairs and Climate Action and the Federal State of Rhineland-Palatinate with 124.3 million EUR. BASF’s investment amounts to around 25 million EUR. The project, titled “Hy4Chem,” was selected as an Important Project of Common European Interest (IPCEI) for hydrogen and later received funding as an individual project. “As a state government, we are supporting this process with up to 37.3 million EUR because we are convinced that hydrogen plays a key role in decarbonisation and in safeguarding industrial jobs,” emphasises Alexander Schweitzer, Minister-President of Rhineland-Palatinate.

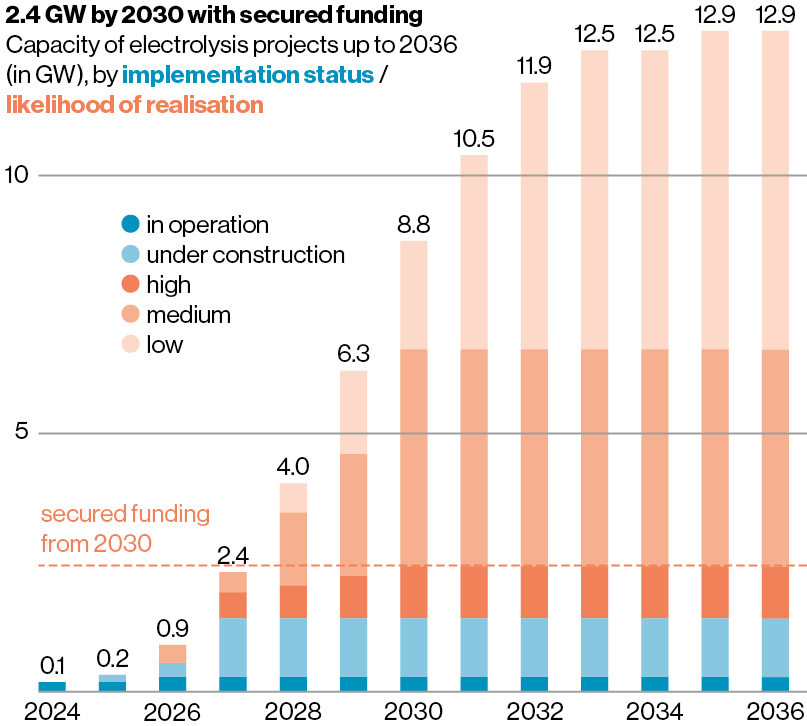

According to the Dena database, projects with a total capacity of 8.8 GW could be realised by 2030. However, given the early stage of the market, Dena expects only 2.4 to 6.6 GW to actually be implemented. Secured financing is decisive for realisation – demonstrated, for example, by a final investment decision (FID), a funding approval or other financial commitments.

Long-term PPAs are key

Discussions with project developers reveal that long-term offtake agreements – commonly known as PPAs – for hydrogen are critical for investment decisions. Contract terms of ten to fifteen years are considered ideal. Project developers are therefore calling for swift transposition of the revised Renewable Energy Directive (RED III) into national law. This directive sets binding quotas for the use of hydrogen and its derivatives in the industrial and transport sectors. At the same time, developers criticise the strict EU requirements for green hydrogen, arguing that these increase production costs and thus undermine project viability.

As of the end of 2025, the Dena database covers around 250 electrolysis projects with planned or completed commissioning since 2007. According to Dena, more than 80 percent of electrolysers currently in operation are publicly funded. Around 40 percent of installed capacity is accounted for by projects under the IPCEI Hydrogen initiative and the Reallabore der Energiewende (real-world laboratories for the energy transition). The share of Reallabore is expected to decline by 2030, however, as they primarily support smaller demonstration projects.

Funding central to market ramp-up One third of the capacity planned for 2030 is currently backed by national or European funding programmes. However, many projects are competing for limited funds in tenders. In the first auction round of the European Hydrogen Bank, German projects were unsuccessful due to higher bid prices.

In the second round, two projects initially received awards but withdrew their bids before the funding agreement was finalised. Dena experts expect national projects to become more competitive as the market matures and demand grows. Nevertheless, targeted funding programmes remain necessary to support the market ramp-up.

The strategic importance of European electrolyser technology is growing overall. The year 2025 was also marked by geopolitical tensions and fragile trade dependencies. In this environment, resilience, industrial strength and technological sovereignty are increasingly coming into focus. Green hydrogen plays a central role here: as a locally producible energy carrier, it enables greater independence.

© Bosch

Strengthening competitiveness in Europe

Installed electrolyser capacity in Europe will rise by around 50 percent year on year in 2025, reaching approximately 600 MW, while annual electrolyser manufacturing capacity will exceed ten gigawatts for the first time. Electrolyser companies have done their homework and established manufacturing capacity in Europe, says Nils Aldag, CEO of Sunfire. “We stand ready to meet the demand for green hydrogen in Europe and to contribute to a strong, resilient and competitive Europe.”

At the same time, Europe faces the challenge of maintaining its technological leadership. Long-term and reliable demand through implementation of the RED III targets in the transport and industrial sectors, along with strengthening European resilience in electrolyser technologies, will be decisive factors.

Yet there are already positive signals for green hydrogen from Europe: the Centre for Solar Energy and Hydrogen Research Baden-Württemberg (ZSW) and Holst Centre in the Dutch province of Noord-Brabant are working together on innovative approaches to advance the design and production of more cost-effective and scalable AEM electrolysers. The “genAEMStack” project is testing new components and manufacturing processes. The goal is an electrolyser stack with a high share of European value creation. Both partners aim to strengthen their regions as development platforms for proprietary product development and the establishment of regional value chains.

This is also why the Ministry of Economic Affairs of the Federal State of Baden-Württemberg is funding ZSW with around 1.6 million EUR from the European Regional Development Fund (ERDF). The project has a duration of 2.5 years. “Water electrolysis is the key technology for climate-neutral, green hydrogen – and central to fulfilling the EU regulation on Strategic Technologies for Europe (STEP). Hydrogen produced in Europe through electrolysis does not need to be imported and avoids dependencies on supplier countries outside Europe. This is particularly valuable when electrolysers are deployed that make a significant contribution to industrial value creation in the EU,” explains Marc Simon Löffler, Head of the Electrolysis Development Department at ZSW.

Bringing innovations to market faster

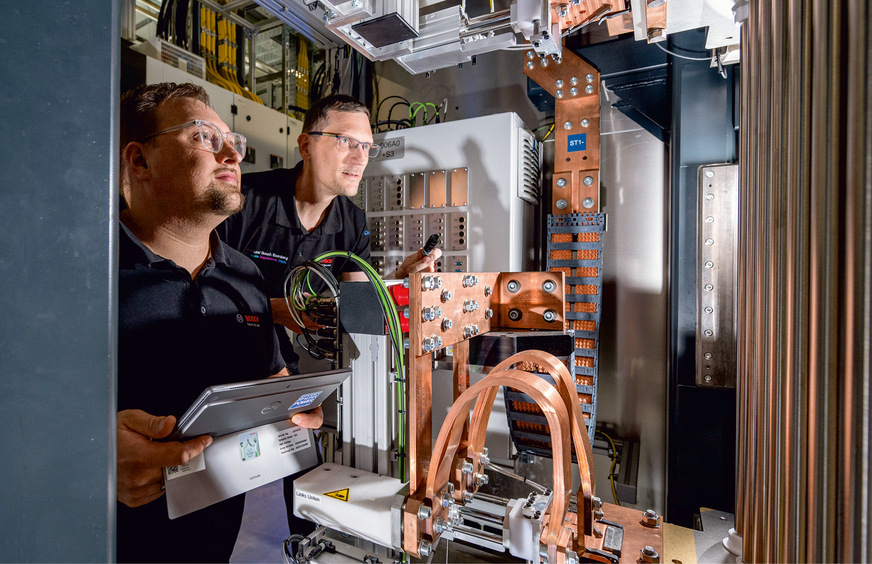

At the end of 2025, Bosch commissioned an electrolyser with two Hybrion PEM electrolysis stacks at its Bamberg site. The plant has a total capacity of 2.5 MW and meets EU requirements for renewable hydrogen. Both Hybrion stacks were manufactured at the Bosch plant in Bamberg and produce around 23 kilograms of hydrogen per hour. The electrolyser was built by the company Fest, based in Goslar. At full load, it can generate more than one tonne of hydrogen per day.

The commissioning marks the start of an entire hydrogen landscape in Bamberg. The site demonstrates how hydrogen can be produced, stored and utilised. A 21-metre-high tank stores the hydrogen from the electrolyser at up to 50 bar. The Hybrion stack features high modularity, enabling applications ranging from decentralised electrolysers for commercial operations to central industrial solutions with capacities of several hundred MW. “Our design is based on decades of experience from the automotive sector, particularly from fuel cell technology,” says Carola Ruse, Head of the Electrolysis Product Division at Bosch. A stack consists of more than 100 electrochemical cells and achieves an efficiency of up to 50 kWh per kilogram of hydrogen.

Economic viability depends not solely on plant size, but on additional key factors. “Operating costs are of central importance and are largely determined by electricity costs and annual full-load hours,” emphasises Ruse. Capital expenditure (CAPEX) for the overall system is another factor. Bosch aims to reduce this through scaling and automated manufacturing. “In addition, we are continuously working to improve products and manufacturing processes – for example through reduced material usage, higher quality and optimised production processes.”

© Bosch

Materials research and ageing analysis

A further focus is optimising the service life and maintenance intensity of PEM electrolysis stacks. This ranges from intensive materials research and ageing analyses to testing under real operating conditions. An international team at several Bosch locations is working on stack development: in Linz (Austria) and in Feuerbach, north of Stuttgart, there is dedicated test infrastructure capable of testing full-size electrolysis stacks. “A decisive advantage, since typically only much smaller test samples are used,” explains Ruse. The results of these extensive tests feed directly into further development. In Tilburg, the Netherlands, a team focuses on materials research and detailed analysis of ageing processes in the materials used.

In Bamberg, Bavaria, the Hybrion PEM electrolysis stacks are manufactured and tested under real operating conditions. Bosch is thus gaining valuable experience. “This enables us to comprehensively analyse and optimise aspects such as service life and maintenance intensity under real load profiles,” says Ruse. At the same time, she calls for clear political signals and reliable framework conditions. These are essential for resilience, jobs and competitiveness in the global technology race for hydrogen. Ruse advocates greater pragmatism and flexibility in the ramp-up phase to avoid blocking investments. A key aspect is the design of the EU criteria for electricity sourcing for the production of green hydrogen via electrolysis. The options for sourcing renewable electricity must be designed to both promote decarbonisation and enable the scaling of the hydrogen economy. Ruse: “The technology is ready. The regulatory framework must now enable the ramp-up – not hold it back.”