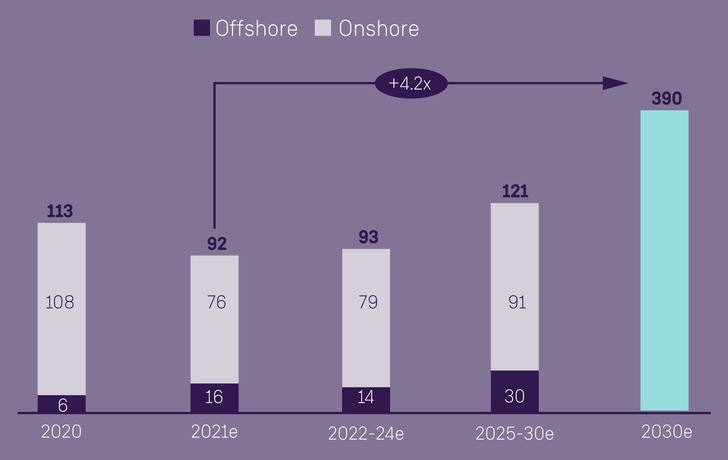

On the other hand, Siemens Energy can generate great potential in all areas. New gas power stations that are H2-ready are becoming increasingly important, just considering Germany’s goals alone of shutting down coal-fired power plants as well as nuclear energy. The global demand for electrolyzers should also keep the order books of Siemens Energy full, so the current share price performance ought to be classified under “buy on bad news.”

Warning

Each investor must always be aware of their own risk when investing in shares and should consider a sensible risk diversification. The FC companies and shares mentioned here are small and mid cap, i.e. they are not standard stocks and their volatility is also much higher. This report is not meant to be viewed as purchase recommendations, and the author holds no liability for your actions. All information is based on publicly available sources and, as far as assessment is concerned, represents exclusively the personal opinion of the author, who focuses on medium- and long-term valuation and not on short-term profit. The author may be in possession of the shares presented here.

Author: Sven Jösting, written March 15th, 2022