Cummins has supplied the company Atura Power with a 20-MW PEM electrolyzer for its Niagara Hydrogen Centre in Niagara Falls, Ontario. The electrolyzer is to go into operation at the beginning of 2024 and produce green hydrogen, for supply to industrial customers, with the help of hydropower. The share price has had good development recently. Cummins is going several ways (engines, fuel cell, electrolysis) in its commitment to hydrogen.

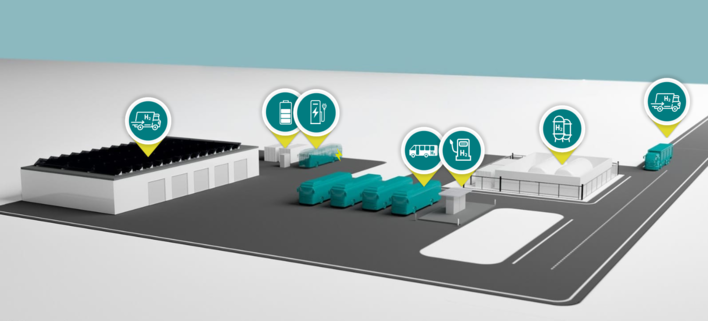

The Indiana-based company with a 100-year history (largest diesel engine producer in the USA) covers many areas of the hydrogen value chain. It deals in PEM as well as in SOFC and alkaline electrolysis, and builds prototypes of H2 engines as well as fuel cell stacks for commercial vehicles, rail vehicles, trucks and construction machines. Here, scaling is proceeding through the construction of large production facilities for ramp-up.

In addition, Cummins is approaching new markets in hydrogen, like waste-to-value customers. And over 600 projects are in the pipeline. For example, in China, together with Sinopec, it is building large-scale electrolysis capacities to supply 1,000 H2 fueling stations. Clear is that the costs for production need to go down, which however will come with scaling.

Summary: The stock market has driven the price of Cummins share sharply upwards, which is surely due to the orientation toward FC/H2 markets. Perhaps Cummins will promote further growth of the corporation in this area through strategic acquisitions, which would be seen as very sensible. In terms of valuation, the company is very well positioned – in direct comparison to Chinese company Weichai Power. Maybe it should take the price gain and reinvest it in China, since there too hydrogen and fuel cells are setting off.

Disclaimer

Each investor must always be aware of their own risk when investing in shares and should consider a sensible risk diversification. The FC companies and shares mentioned here are small and mid cap, i.e. they are not standard stocks and their volatility is also much higher. This report is not meant to be viewed as purchase recommendations, and the author holds no liability for your actions. All information is based on publicly available sources and, as far as assessment is concerned, represents exclusively the personal opinion of the author, who focuses on medium- and long-term valuation and not on short-term profit. The author may be in possession of the shares presented here.

Author: written by Sven Jösting December 12th, 2022