In what is known as a bought deal, an underwriter syndicate co-led by investment bank Raymond James has offered Ballard Power [Nasdaq: BLDP] fresh capital for shares. The offer was so popular, the initial USD 250 million target was quickly raised to USD 402.5 million: In late November 2020, the companies agreed on USD 350 million in stock, with an option on another USD 52.5 million, all selling at USD 19.25 per share. Ballard has since exhausted those resources, though more could be on the way soon.

Third-quarter figures were at the lower end of expectations. With total revenue at USD 25.6 million, net loss came to USD 11.2 million, or USD 0.05 a share, mainly because of high R&D expenses and a USD 2.8 million investment in manufacturing facilities in China. Covid-19 has been everything but good for business, the company said, allowing only essential travel and making customers apprehensive of placing orders. Still, Ballard is in a good position. Via an at-the-market program, the fuel cell company raised USD 250 million by Sept. 30, 2020, bringing cash reserves to USD 361.7 million. Factor in another USD 32.7 million that will be added in the fourth quarter and the price of the stock sold in November, and you’ll get to around USD 800 million in cash and cash equivalents at the end of 2020, minus fourth-quarter costs.

During Ballard’s quarterly earnings call, Tony Guglielmin, the company’s then-chief financial officer, said his decision to retire was difficult, even more so because Ballard “stands at an inflection point.” I’d say those who thought the stock reached its peak last year will be in for a surprise.

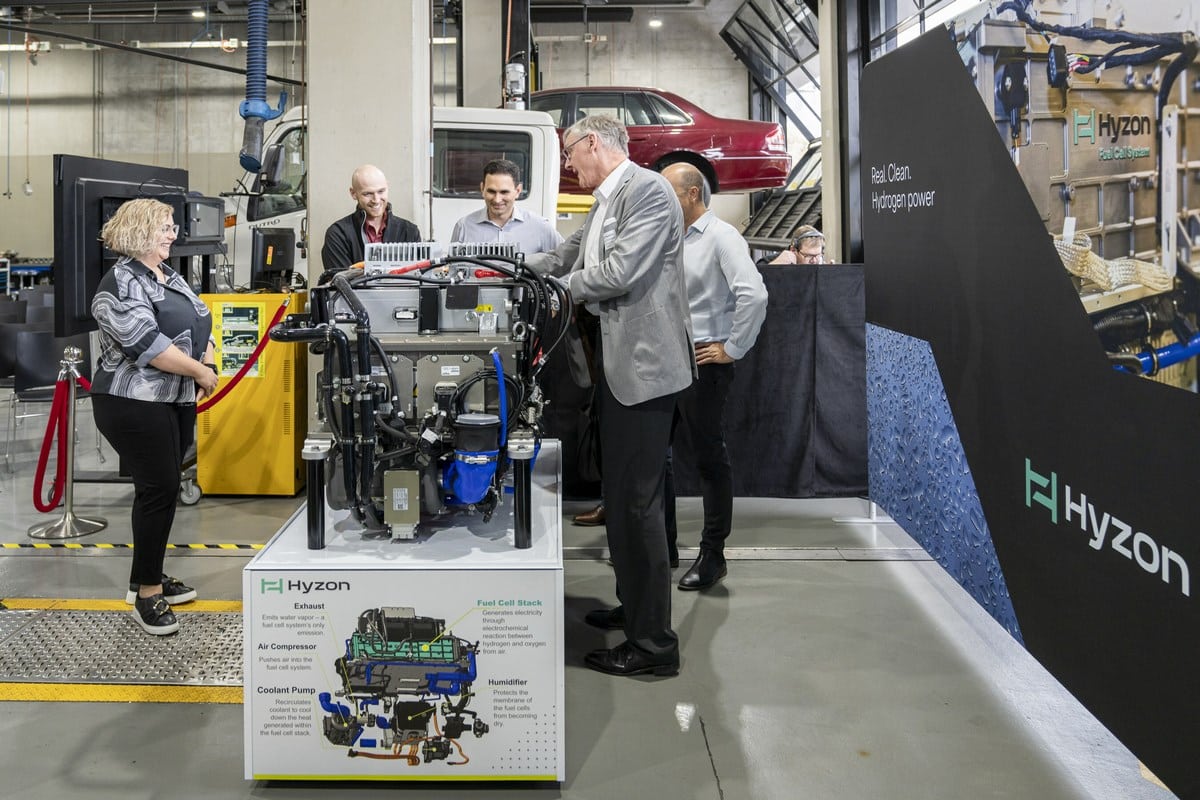

One indication that there’s more to come is Ballard’s partnership with Mahle, a global auto supply heavyweight with revenues exceeding USD 10 billion a year. Over half of all vehicles registered around the world are built using components manufactured by the group, such as temperature sensors or air filters. Ballard’s role in the partnership is to deliver fuel cell systems for commercial vehicles. Turning a collaboration like this into a joint venture may be the next logical step.

Audi exit helps Ballard

Ingolstadt-based Audi was once Ballard’s ideal partner when developing passenger car stacks. The H-Tron concept study is a direct result of their collaboration. What’s more, the German automaker has spent USD 50 million on Ballard IP. Though the partnership is said to continue, it seems to me as if both companies are ready to go their separate ways. Ballard just received, you might say, a missing license for integrating FCgen-HPS stacks, which have so far been used in trucks and buses, into other automakers’ passenger cars. Audi’s, and thus also VW’s, exclusive right to Ballard technology is gone. Meanwhile, the fuel cell maker is free to pursue other ventures.

The companies’ recently signed patent license and technology development agreements, I think, prove Audi intends to collect license fees but has no longer any interest in using Ballard stacks in-house. That’s a good thing for the fuel cell business. Basically, Ballard can now sell FCgen-HPS stacks to anyone on the market – for the right price, of course.

“We don’t have enough carbon-neutral hydrogen available today and we won’t for decades. As a result, I don’t believe there will be a mass market for hydrogen-powered passenger cars.”

Markus Duesmann, Audi’s chief executive

In my view, the above quote expresses a sentiment shared by most automakers. Their sole focus is on all-electric vehicles, not least because of generous public incentives. VW also doesn’t want to confuse consumers by offering several drive concepts at once. The only automakers not following suit, Toyota and Hyundai, are based in Asia.

… Read more in the latest H2-International e-Journal

Risk warning

Share trading can result in a total loss of your investment. Consider spreading the risk as a sensible precaution. The fuel cell companies mentioned in this article are small- and mid-cap businesses, which means their stocks may experience high volatility. The information in this article is based on publicly available sources, and the views and opinions expressed herein are those of the author only. They are not to be taken as a suggestion of what stocks to buy or sell and come without any explicit or implicit guarantee or warranty. The author focuses on mid-term and long-term prospects, not short-term gains, and may own shares in the company or the companies being analyzed.

Author: Sven Jösting, written December 18th, 2020

0 Comments