Meeting the German federal government’s ambitious climate target, that is, a 95 percent reduction in GHG emissions until 2050 compared to a 1990 baseline, will require a decarbonized transportation sector. Cars powered by conventional engines must be replaced by low-emission versions. The two most promising substitutes are battery-electric vehicles or BEVs and fuel cell vehicles or FCEVs. Of course, their zero-emission refueling requires power, either directly for BEV charging or indirectly when hydrogen is generated through electrolysis. An increase in the market penetration of these technologies will likewise generate more demand for electrical energy, which could then put constraints on the national energy grid.

A study by the Reiner Lemoine Institute examined the impact of zero-emission passenger transportation on a system supplied exclusively with renewable energy sources. Four scenarios were used to create optimized grids that need to cover today’s power consumption in Germany and meet additional demand from zero-emission transportation. These scenarios differ in their level of market penetration and the number of BEV charging options. To analyze simulation results, a comparison was drawn to an optimal energy grid that shows no power consumption from transportation (base scenario).

BEV or FCEV

It is not yet clear how successful these technologies will be on the market. Studies by Reiner Lemoine Institute see a combination of both as the best opportunity for establishing a future-proof energy grid. BEVs are most suited for frequent short-distance travel, as they need less energy per mile. FCEVs, on the other hand, are the better option for long-distance routes because of their higher range and shorter refueling times. These assumptions have been confirmed by findings from a vehicle analysis during the PIOnEER project. A simulation of Enertrag’s fleet cars showed that BEVs prove insufficient for 60 percent of the driving profiles in the 3.5-ton vehicle category, making FCEVs a necessity [1]. However, a contrasting opinion states that advantages in efficiency and expected technical advancements will be the reason why the transportation sector of the future will consist exclusively of BEVs. The following paragraphs will explicate the issue based on scenarios that have BEV and FCEV market penetration ratios at 50:50 and 100:0.

Methods

At present, it cannot be said with certainty how BEVs can be integrated into a future energy grid. If charging times are primarily linked to grid load, road users may find it more difficult to adapt. For this reason, we examined two types of charging. In the table below, “No flexibility” means that BEVs need to be fully charged after use. In contrast, “High flexibility” will allow drivers to charge their BEVs at any given time as long as the battery level is high enough to start driving again. A scenario providing a high degree of flexibility also allows for bidirectional energy flows between BEVs and power grids (vehicle-to-grid), so that battery-electric vehicles can be used as electricity storage.

…

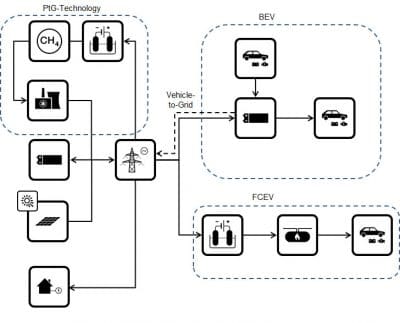

In these scenarios, renewable energies comprise PV and wind power systems, hydropower plants and geothermal and biogas power stations. Storage includes batteries and pump storage systems as well as power-to-gas technologies. An increase in renewable energy use and in the number of pump storage systems was limited to the relevant technical potential (see fig. 1).

Findings

Passenger transportation at 100 percent BEV market penetration will have power demand rise by 90 terawatt-hours per year, a 17 percent increase compared to power consumption in the base scenario, where there is no zero-emission transport of people. If, however, the ratio of BEVs to FCEVs is on par, power demand increases by 169 terawatt-hours per year, which translates into a 33 percent jump compared to the base scenario. The higher demand in the second scenario is a result of efficiency losses resulting from electrolysis and fuel cell use. Still, the energy required by added renewable capacities is not necessarily proportional to rising demand.

…

The influence of FCEVs on creating the best possible energy network setup depends on BEVs’ charging flexibility. Figure 3 shows that additional demand in scenarios that provide no charging flexibility is met through an increase in PV and wind power systems. The FCEV scenario slightly raises the need for renewables, but storage capacities decrease. A high degree of charging flexibility will lead to considerable growth in PV installations, but will reduce the number of new wind power units. In contrast to scenarios that provide no charging flexibility, FCEV shares in passenger transportation will result in increased demand for storage compared to BEV-only settings.

Conclusion

These findings show that the degree of flexibility provided by hydrogen production and BEV charging will lower surplus energy amounts and lead to a better utilization of volatile renewables. Likewise, demand for storage will decrease. In conclusion, a future zero-emission energy grid needs some flexibility, which the new BEV and FCEV technologies can provide in addition to stationary storage.

…

The demand for and the importance of grid balancing across the energy grid will grow together with the expected increase in renewable energy use. FCEVs offer the opportunity to meet part of this demand. An improved FCEV market ramp-up could raise the degree of flexibility in transportation alongside an increase in the use of renewables.

Authors: Marlon Fleck, Oliver Arnhold, Dr. Kathrin Goldammer, Fabian Grüger, Birgit Schachler

All from Reiner Lemoine Institut, Berlin, Germany

0 Comments