by Hydrogeit | Oct 31, 2023 | Europe, News, Policy

Guest article by Karl-Heinz Remmers, PV pioneer

For a long time the public has held a deep fascination for solar power and hydrogen. Around the world, both of these technologies have been described as great opportunities and the solution to our energy problems. Indeed, hydrogen is regarded within the current public debate as a cure for all ills. What’s the latest on these solutions? Where does the green power they need come from? And how can (green) hydrogen and photovoltaics more rapidly leverage their huge shared potential?

Advertisements

When we started designing and building solar power plants in 1992, the fascination with hydrogen and solar energy was already immense. However, photovoltaic or PV plants were extremely expensive. In Germany they were only bought by enthusiasts, and even these purchases were dependent on (massive) grants. These (lost) grants came and went, just as the new pilot schemes and flagship projects did. The only relatively stable markets to be found globally were in space flight (no concern about cost) and off-grid, where suitable. Grid-connected photovoltaics didn’t make much progress in terms of scaling up production, and therefore the plants remained expensive and practically irrelevant for energy supply purposes.

In 2000 (global PV market then: 200 megawatts), photovoltaics started to evolve into a mass-use technology, a development that was largely down to the huge international boost provided by Germany’s renewable energy law EEG. In 2023, the global market is expected to reach 380 gigawatts of new installations. The electricity generated around the world by this newly installed capacity would be enough to cover Germany’s current electricity demand.

PV plants have the lowest power-generating costs of all new facilities. These costs have fallen by 95 percent since 2000. It is anticipated that the global PV market will grow tenfold by 2035 – accompanied by further efficiency increases and cost reductions. All this has been made possible through the creation of a market in the earlier stages that can also now in Germany generate solar power without the need for any subsidies.

In our view, we don’t yet have a comparable approach to confidently realize those same (necessary) scaling effects in the hydrogen sector in a way that provides planning certainty for industry. That said, there are hydrogen regions, pilot projects and initial marketplaces springing up all over the place and there is a great deal of goodwill within politics and the media. But when it comes to the market for new hydrogen, things quickly become difficult or just downright impossible. It’s no wonder that large off-takers (e.g., steelworks that have started the conversion to hydrogen) as well as small- and medium-size enterprises are hesitant about purchasing hydrogen, if they are indeed interested at all.

Some can’t get sufficient quantities; others don’t want to pay today’s high prices. For the expectation is that hydrogen will get cheaper. Plus, virtually every day that passes there are fantasies of some – unrealistic – hydrogen import. Or of a bridging technology: blue hydrogen with carbon capture and storage. But nobody has yet stuck a price tag on these potential sources.

The massive success of photovoltaics was previously in having solved this chicken-and-the-egg problem through the EEG. Each energy producer (regardless of size) had a guaranteed off-take over the required payback period along with a price guarantee. Electricity buyers, on the other hand, paid the relevant market prices. As the support scheme was highly degressive, the desired cost reduction was taken into account or given a huge push.

These days, this form of support is barely needed, if at all, and in many areas and countries it is now being aligned with market conditions through the process of tendering. Similar systems for ramping up hydrogen are under discussion in the European Union or are being announced in the form of EU tenders. Just as in the solar and wind industries, contracts for difference or CFDs could be introduced for hydrogen with the establishment of hydrogen exchange prices as a reference point.

Why is that a key issue?

Whoever invests in an electrolyzer (together with storage etc.) can be certain that much cheaper and more efficient equipment will be available to purchase in three to five years’ time. Reliability will also have improved. It’s thus foreseeable that both CAPEX and OPEX, or put more simply, the price per kilogram of hydrogen, will decrease massively. Unless there is a guaranteed off-take at the price needed today, the project quickly becomes bankrupt.

By contrast, the hydrogen buyer from a steelworks or indeed from a municipal energy supplier, for example, will surely refuse to sign a long-term hydrogen purchasing agreement right now when it’s clear that prices will fall massively in the coming years. If an attempt is made to get around this, e.g., through “lost” subsidies or one-off grants, there is the possible threat that, after these measures have been applied, bankruptcy will occur or the electrolyzer will be shut down since the support is indeed “lost.”

What’s more, this type of approach has in the past proved to be highly difficult to get right in terms of how the support is structured. But more than anything, it has always been dependent on the particular budgetary situation of the funding organization.

A “hydrogen CFD” or a similar instrument can incentivize a diverse range of players and also encourage rapid market expansion as well as a quicker pace of innovation.

Application assumptions

If 15 years ago hydrogen-driven cars were the only promising technology for real distances over 100 kilometers (60 miles), then the technological evolution of battery storage has now already superseded this, i.e., prior to mass use. And this has happened despite the fact that the development of battery-based vehicles and their batteries is in its infancy.

By as early as 2025, Germany, too, is likely to witness the price of battery electric vehicles dropping below that of their combustion engine counterparts. Whether you like this reality or not, that proverbial ship has already sailed. If you also take a look at the trend for trucks, the race here will likewise go in favor of batteries.

How things will pan out for commercial vehicles or rolling stock remains to be seen. However, all these categories have a powerful competitor in the form of hundreds of millions of new batteries that are coming on the market globally every year. That’s because these batteries also cushion the grids and make “mass charging” possible. And railroad electrification using common overhead wires is also another real rival when it comes to purchasing and operational costs, as a battery or hydrogen train is not an end in itself.

In my opinion it’s important not to hold onto applications that simply have no real chance of making it big, since it just frustrates people when these promised technologies don’t then materialize. What’s more, using hydrogen for heating in ancient condensing boilers is so nonsensical and expensive that the hydrogen sector should, as a matter of urgency, distance itself from the natural gas sector, which has been pushing this very agenda, so that it can maintain its own credibility and, above all, control the narrative around its own technology.

Applications such as the production of hydrogen-based aviation gasoline or marine fuels and all the other fuel applications as well as hydrogen storage applications – an aspect that desperately needs redefining – are such an enormous future market that there is no need to lament it.

Why do hydrogen storage applications need to be redefined?

In the various long-term scenarios presented to governments by research institutes, there isn’t a single scenario which reckons on the already burgeoning wave of millions of (bidirectional) energy stores in vehicles and the already highly cost-effective medium and large decentralized energy stores. From 2024, no solar farm will be built in Germany that doesn’t have its own storage facility to allow power to be sold at night – and that’s without the need for any funding.

Millions of smaller energy stores are being set up too and these are all significantly extending the actual grid options on offer locally. International developments are taking place at a much faster pace than they once did for PV. Battery storage is making solar energy available “during the night” and “bringing wind to windless days” – for a few hours, then days, then weeks. And this mass availability costs just a few euro cent per kilowatt-hour. This will considerably change all previous scenarios outlined for hydrogen’s use as an energy store.

Off-grid also an option

Hydrogen can also be produced off-grid on a gigawatt scale, provided it is possible to transport the product (hydrogen or an e-fuel) reliably and at a reasonable cost. This is an extremely interesting aspect that is achievable all over the world, with differing proportions of solar and wind power (or, where feasible, other renewable sources). These forms of renewable generation complement each other locally and can, with back-up storage, enable very high running times for electrolysis without costly and time-consuming connection to the power grid. Since their end product is not electricity but hydrogen-based substances. Projects along these lines are happening in various countries, and this has become a realistic option for Germany as well.

Distancing from costly “bridging technologies”

There is a serious ongoing discussion within associations and the media about carbon capture and storage, otherwise known as CCS, and its use in Germany as a bridging technology to obtain blue hydrogen from natural gas by the start of the 2030s. In this case, a technology that is still at the prototype stage after decades of political discussion is being pushed onto a totally unfeasible timeline. And that’s without any discussion of the overall costs of such an option, assuming that (at some point) it is indeed available for large-scale deployment.

Ultimately, CCS has been repeatedly sold as an option for coal power plants since the 2000s and has never come to fruition – for cost reasons. Plus, with such ideas, all the problems of security of supply, costs and the finiteness of natural gas still remain. CCS is a dangerous, insubstantial distraction from the long-term and quickly scalable technology pathway of renewable electrolysis in the EU.

Underrated opportunities

Hardly a day goes by when there isn’t a public discussion of all manner of ideas for the hydrogen economy. It almost doesn’t matter where the German Chancellor or the minister is traveling, it’s nearly always about importing hydrogen. And of course it’s hydrogen at a “bargain price,” with a total absence of debate about the costs or prices. It’s already the case today that a veil is drawn over the massive existing political tensions and risks of potential supplier countries. In fact it’s terrifying how little discussion there is in political and media environments about the EU’s own potential and, especially, the cost of hydrogen options. That’s why I want to make a simple “back-of-the-envelope” comparison, taking into consideration hydrogen minimum costs:

If I want to produce hydrogen “in the desert,” I have to…

– pay (higher) costs than in the EU for electrolyzers, plant engineering, security etc.

– desalinate seawater (CAPEX costs and electricity consumption).

– use wind and solar power at a minimum cost of 1.5 euro cent/kWh, with battery stabilization for high electrolyzer utilization levels on top, albeit the prices will generally be above the costs.

– calculate the losses due to waste heat (20 percent to 40 percent of the electricity used) since the thermal energy will not be used in the local climate.

– calculate the expense of equipment such as the compressors for transportation.

– assess the costs of the pipeline or tanker and their losses in operation.

– adopt a calculated risk strategy for unstable regions.

– …

If I want to produce hydrogen in Germany or in the EU, I have to…

– pay lower costs than in the desert for electrolyzers, plant engineering, security etc.

– pay for water.

– use wind and solar power at a cost of 4 to 7 euro cent/kWh, plus a bit more for stabilization, whereby avoided curtailments from the power grid can lower the price.

– transfer waste heat for the purposes of district heating or process heat. Then I would have 20 percent to 40 percent lower electricity costs because this can be sold as heat – or equally “written off.”

– calculate the expense of equipment such as the compressors for transportation.

– ensure direct consumption locally or short tanker/pipeline routes (lower losses and costs).

– dispense with the need for a risk strategy for unstable regions.

– …

Finally, I think it would be necessary to refine the above back-of-the-envelope calculation by inserting real figures that take into account the expected massive decline in cost. First and foremost, this would enable realistic assessments to be made (at last) about what green hydrogen can cost in 2030/2040 and which prices are reached based on it – in the EU and beyond – thus staying well clear of outlandish buzz phrases like “hydrogen is the Champagne of the energy transition” or “hydrogen will make heating affordable.”

Author: Karl-Heinz Remmers

by Hydrogeit | Oct 25, 2023 | Germany, News, Policy

German government steps up the pace

Coordination was hard enough when there were “only” four German ministries dealing with hydrogen – now there are six involved in updating the national hydrogen strategy, plus the chancellery. This participation of so many different departments is surely conclusive proof that hydrogen has become a key plank in the energy transition.

“Being a versatile energy carrier, hydrogen will assume a key role in achieving our ambitious energy and climate targets.” This statement shows the German government’s recognition of hydrogen’s immense importance in the future energy supply and in tackling the climate crisis. It’s for good reason that, three years after the national hydrogen strategy was adopted in June 2020, a redraft has now been approved with content and targets adjusted to match changed conditions.

Advertisements

The update to the national hydrogen strategy, which was enacted by the federal cabinet in July 2023, has, in the government’s words, “created a coherent framework for action for the entire hydrogen value chain – from production to transport through deployment and reuse.” The strategy, also referred to as the NWS, is designed to ensure certainty in financial planning, which provides the foundation for future investment, so that the market for green hydrogen technologies can be successfully ramped up.

At the same time, the NWS recalls that the creation of a hydrogen economy is “a task for the whole of society” whose success “requires contribution from all stakeholders.”

“Hydrogen technologies are not only an important instrument for climate change mitigation. They can enable the creation of new branches of industry with a large number of viable long-term jobs and extensive export opportunities. […] The NWS will thus also help German industry retain and further expand its strong position in hydrogen technologies.”

German government

Specific targets defined

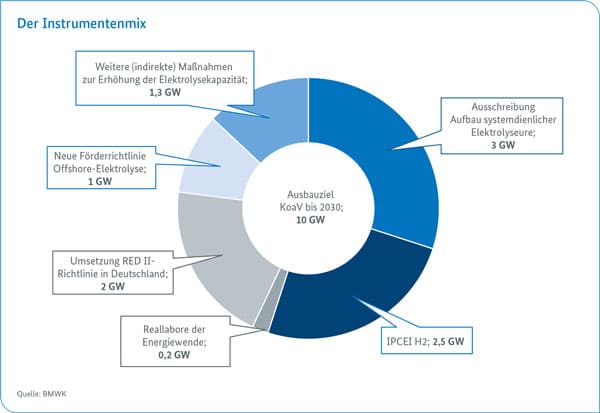

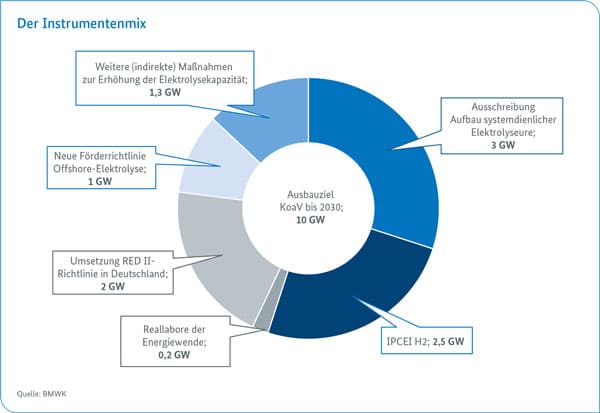

The main 2030 targets outlined in the NWS focus on achieving an accelerated ramp-up of hydrogen and securing sufficient availability of hydrogen and its derivatives. Accordingly, the previous goal of 5 gigawatts of electrolyzer capacity has been raised to at least 10 gigawatts. Remaining demand will be covered by imports which will be the subject of a specially developed import strategy.

What’s more, effective hydrogen infrastructure is to be put place. According to the plans, a hydrogen starter network stretching across more than 1,800 kilometers (1,120 miles) will be got underway by 2027/2028 and supported by funding from Brussels. The network will be composed, in part, of repurposed natural gas pipes as well as newly constructed hydrogen lines. It will form a key part of the European Hydrogen Backbone which will involve hydrogen pipelines covering a total length of around 4,500 kilometers (2,800 miles).

In addition, various hydrogen applications are to be established in different industries – in the power and industrial sectors, in heavy-duty vehicles as well as in aviation and shipping. To allow this to happen, the intention is to create suitable framework conditions, specifically planning and approvals procedures, appropriate standards and certification systems. The stated aim is for Germany to become the leading supplier of hydrogen technologies by 2030.

“We have once again significantly upped the level of ambition.”

German economy minister Robert Habeck

“Hydrogen is the missing piece in the energy transition puzzle. It offers a huge opportunity to join up energy security, net-zero and competitiveness.”

German education and research minister Bettina Stark-Watzinger

“The global market for hydrogen must be fair and different than how the global fossil fuel industry once was.”

German development minister Svenja Schulze

The German government has now departed from its original approach of only financing green hydrogen through tax revenue, a move that has been particularly welcomed, unsurprisingly, by the gas lobby. Other colors of hydrogen are now also set to receive subsidies, albeit only to a limited degree and under certain conditions defined in the small print.

The update to the NWS states: “We also intend to fund the use of green and, insofar as it is needed in the ramp-up phase, low-carbon blue, turquoise and orange hydrogen on the deployment side to a limited extent while taking into account ambitious greenhouse gas limits, including emissions in the upstream chain and the ability to meet statutory net-zero targets.”

Bettina Stark-Watzinger, German education and research minister, called this a “pragmatic and technologically unbiased” decision that allows initial use of “all climate-friendly types of hydrogen.” This, she explains, will help Germany on its way to becoming a hydrogen nation.

Her colleague, German development minister Svenja Schulze, went one step further by saying: “Wherever wind and solar power is produced for hydrogen, momentum will be given to the energy transition at ground level and the local population will be supplied with electricity. And wherever seawater is desalinated for hydrogen, the nearest town will be supplied with drinking water. From a development perspective it’s clear: Hydrogen from renewables is not only the best choice for the environment, it is a cost-effective domestic energy source that also leads to better development in the Global South. We will therefore help our partner countries have a fair share of involvement in the new international market for hydrogen.”

Existing structures remain

To allow all this to happen, recourse is being made to existing institutions. For example, a “hydrogen guidance center” has already been set up that enables inquirers to receive advice on funding by phone or email. The committee of state secretaries for hydrogen acts as a decision-making body for the NWS and takes corrective action where necessary. It meets on a case-by-case basis as and when needed, which in the past was only rarely. The central body is the National Hydrogen Council, an independent, cross-party advisory committee with 26 high-ranking experts from industry, academia and civil society. The council is supported by the Coordination Office for Hydrogen.

Chair of the National Hydrogen Council, Katherina Reiche, explained: “It is an important milestone that the German government is ambitiously extending its national hydrogen strategy. […] Only hydrogen allows us to maintain value chains and ensure that key industries remain in Germany. […] Companies only invest if they have long-term planning certainty. We must therefore already look beyond 2030. According to council forecasts, the need for hydrogen and hydrogen derivatives will, by 2045, have risen to between 964 and 1,364 terawatt-hours. The Inflation Reduction Act in the USA and similar regulations around the world will accelerate the development of comprehensive value chains on an industrial scale. In view of rapid progress made in other countries, the German government should move away from exclusively focusing on flagship projects. What is more important is to create effective incentives to quickly scale the hydrogen economy and the development of new business models.”

On the subject of the – at times – fierce debate about the use of hydrogen in the heating sector, the council said that it endorses municipal heating plans as a crucial planning tool for encouraging the heating sector to shift away from fossil fuels. In its view, a successful transformation of the heating sector would require all technology options: heat pumps, heating networks, renewable heat and hydrogen. Thus all technologies should be granted equal footing as compliance options in Germany’s building energy law and be considered when undertaking infrastructure expansion.

The council added that rigorous training is needed for the specialist workforce required, both at university level and within the area of vocational training and continuing education.

Criticism and ideas for improvement

While the German government proudly unveiled the NWS update, the opposition, as expected, deems the 34-page document to be a flop. The CDU’s vice chairman, Andreas Jung, explained to German newspaper Tagesspiegel: “Hydrogen is so important for the economy and net-zero that it now needs a double-whammy.” Here Jung apes the “double-whammy” expression used by Chancellor Scholz when announcing his EUR 200 billion relief package to help with the cost of living. Jung’s criticism that the government was acting “halfheartedly” and would operate on the basis of “centrally controlled allocation” falls flat, however, since the targets set are highly ambitious and the NWS is ultimately only putting a framework in place – and does not include technical guidelines.

For example, it is understood that a “hydrogen acceleration law” will get off the ground this year to enable the installation of “further terminals only for hydrogen or its derivatives” as previously with LNG terminals. A “national port strategy” is expected to pinpoint the relevant hubs for the future hydrogen economy.

Jorgo Chatzimarkakis, CEO of Hydrogen Europe, therefore believes Germany is on the right course to be able to achieve “the broad use of green hydrogen in industry and the heating sector within nine years.” However, he thinks specific improvement measures are necessary, for instance better integration of H2 Global into the EU’s hydrogen bank in order to leverage European Union tendering processes as well as off-take agreements for temporarily nationalized companies, such as Uniper, that can contribute toward security of supply.

Additionally, Chatzimarkakis sees the need to shorten the IPCEI approval times at EU level and in Germany. He also suggests launching an “EU tax credit club” for hydrogen – as a semi-response to the Inflation Reduction Act in the USA, which cannot be introduced in the EU in a similar form due to tax regulations.

Contributions to the NWS 2.0 were made by the following German government departments: the economy ministry, the transportation ministry, the education and research ministry, the environment ministry, the development ministry as well as the foreign office and the chancellery.

Author: Sven Geitmann

by Hydrogeit | Oct 16, 2023 | Germany, worldwide

Dear readers

In recent years, hydrogen has managed to move out of its niche and onto the political main stage. Not just in Germany and Europe but across the world, the energy sector is bracing itself for change as we move from the fossil fuel age to a renewable era.

Advertisements

While some regions are only slowly preparing themselves for the real energy transition, many countries in central Europe as well as nations like the United States and Japan are right in the thick of it. The introduction of the Inflation Reduction Act saw the US roll out a huge financial package. Such a step has yet to be taken in China. The People’s Republic has long been at the forefront of electric transportation but the political framework for instigating a hydrogen economy remains a work in progress (see p. 48).

Germany, on the other hand, was at the cutting edge when it coined the term “energy transition” many years ago, an expression that now, around the globe, epitomizes this transformation process. And by phasing out coal and nuclear power and cutting back on oil and gas, Germany finds itself in a good position, but we are no longer at the forefront when it comes to tackling the climate crisis.

For a long while, Germany was ahead of the field when it came to the environment – leading on solar and wind technology as well as hydrogen and fuel cells. The hope is for a better result this time when establishing its own hydrogen and fuel cell industry than was the case for photovoltaics.

The German government recently adopted the update to its national hydrogen strategy, thus making clear its support for the course it set three years ago (see p. 14). What’s more, Germany is now getting a steering committee for hydrogen standardization so it can launch a standardization road map for hydrogen technologies (see p. 6).

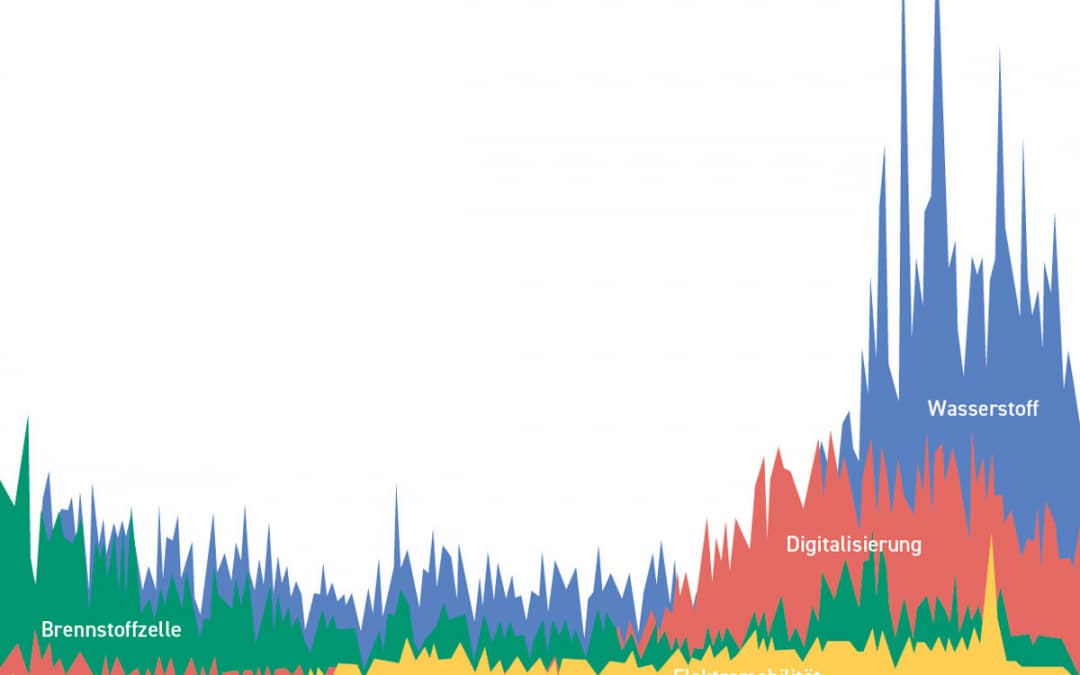

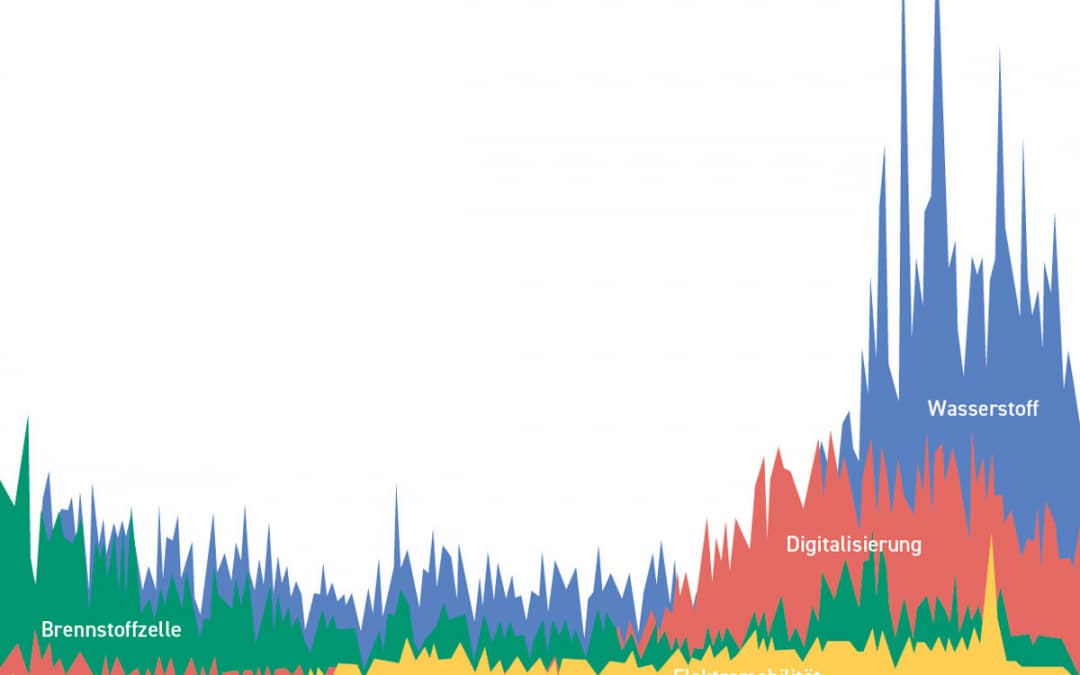

With so much happening, it will come as no surprise that, in the German-speaking world especially, the word for “hydrogen” (Wasserstoff) has for many months been a popular term in online searches. Interest in hydrogen began to grow at the end of 2018 – well before the market started to ramp up, as research using Google Trends clearly shows (see p. 7). At that point, the number of inquiries using the Google search engine increased considerably, exceeding the 2004 level in early 2019.

Since then, the US corporation has recorded ever-higher numbers of searches for this particular keyword. In early and mid-2020 and early 2021, hydrogen inquiries overtook searches for the German equivalent of “photovoltaic” by a wide margin. Over the years, “hydrogen” almost always outperformed German inquiries for “fuel cell,” “electric mobility” and “digitization” (see cover graphic for German search results with keywords translated into English).

Globally the situation is a little different: Throughout the past two decades, a comparatively high number of Google users have looked up the word “hydrogen” in English – far more frequently than the English words “fuel cell,” “photovoltaic” or any spelling of “digitization.” Only “PV” enjoys a similar popularity to “hydrogen.”

Of course, this kind of trend analysis isn’t rigorously scientific, but it does give a representative indication of the interest level in hydrogen now, and how that compares with the past. Our analyst Sven Jösting, who has been monitoring the stock market performance of hydrogen and fuel cell companies for many years (see p. 47), has for a long time talked about a “megatrend.”

To all the critics who say it’s just another hydrogen hype, I can confidently reply: It is extremely likely that this time we’re looking at a proper hydrogen boom. And we’re right at the start of it.

For it’s only early days as we still don’t have a functioning hydrogen market. Except, that is, if we look at hydrogen as an industrial gas for conventional applications (welding, medicine, etc.). Preparations are underway, however, by H2Global to set up a trading platform that will enable hydrogen to be bought and sold in large quantities in a similar way to how the European Energy Exchange operates.

It’s also true that we don’t yet have a market for electrolyzers or fuel cells. Unless, of course, you count the hitherto low production volumes and capacities. This is essentially negligible in view of the quantities and capacities that we will potentially need. Hopefully we’ll be able to report on the latest sales and installation figures in the February 2024 edition of H2-international.

Even in the mobility sector, sales are still extremely modest, which is why no real acceleration of the market can be assumed before 2025. That said, this will only initially affect the commercial vehicle sector, i.e., hydrogen trucks and buses. In all probability, hydrogen automobiles will only be produced and sold in significant quantities at the end of the decade – if that does indeed happen at all. It will take even longer for rail vehicles, ships and airplanes.

The outlook, however, is clear: As the world shifts increasingly away from fossil resources, so renewable energy becomes ever more important. The upshot is that we need a lot more solar power plants and wind turbines. And hydrogen will be essential in bringing this vast quantity of green power to the different energy sectors.

Admittedly, it’s a pretty basic description of the energy transition. Though it does plainly show that hydrogen, far from being just a megatrend, is something that the energy sector simply can’t function without.

Best wishes

Sven Geitmann

Editor of H2-international

by Hydrogeit | Oct 10, 2023 | Germany, News

H2UB brings together fledgling businesses and investors

Startups are a byword for innovation – and for newcomers who use disruptive techniques to bring new products or services to the world. What they all have in common is the need for cash to launch their companies and build up their businesses. But where to source the money in the first place? In this case, investors are not just useful but an essential means of turning ideas into reality. Various agencies and events are on hand to help startups and investors find one another. One such organization is H2UB, which staged the Hydroverse Convention on June 20, 2023, in the German city of Essen.

Advertisements

The location was quite literally colossal: the Colosseum Theater in the Westviertel area of Essen – once an industrial hall used by the company Friedrich Krupp. In attendance was Nordrhein-Westfalen’s economy minister Mona Neubaur along with over 350 investors, developers and decision-makers from the European hydrogen industry.

At the center of the event was a total of 20 startups, twelve of which took part in a pitching competition which entailed briefly presenting their ideas and answering questions posed by a panel of judges. A broad range of companies was represented, from a one-man band to a European bus manufacturer.

Emerging victorious from the male-dominated contest was the only woman who took part: Flore de Durfort (see image). The CEO and co-founder of Point Twelve, she presented her concept with confidence and style, describing how she, along with her business partners, can help companies get their hydrogen products certified quickly and easily in a largely automated process. De Durfort explained to H2-international: “The IoT and SaaS platform offered by Point Twelve makes it possible for manufacturers of energy-intensive products to easily and continuously certify and monetize their production as green. By automating old, manual, opaque and unscalable certification and verification processes, we generate a process time saving of up to 90 percent and create trust in green products.”

She added: “The initial difficulty lies in the certification of sustainable gases and fuels, particularly those produced from green, renewable power and hydrogen. We made a conscious decision to start with hydrogen certification – a key element in industrial decarbonization and where problems around certification and readiness to outsource are at their greatest.”

The Hydroverse Convention was organized by H2UB, an Essen-based company with eight members of staff that is dedicated to fostering links between corporations, universities, research institutes and investors. The company receives support from the economy ministry of Nordrhein-Westfalen as well as from its four shareholders: OGE, RAG-Stiftung, TÜV Süd and the German Aerospace Center.

Author: Sven Geitmann

by Hydrogeit | Oct 5, 2023 | Germany, News

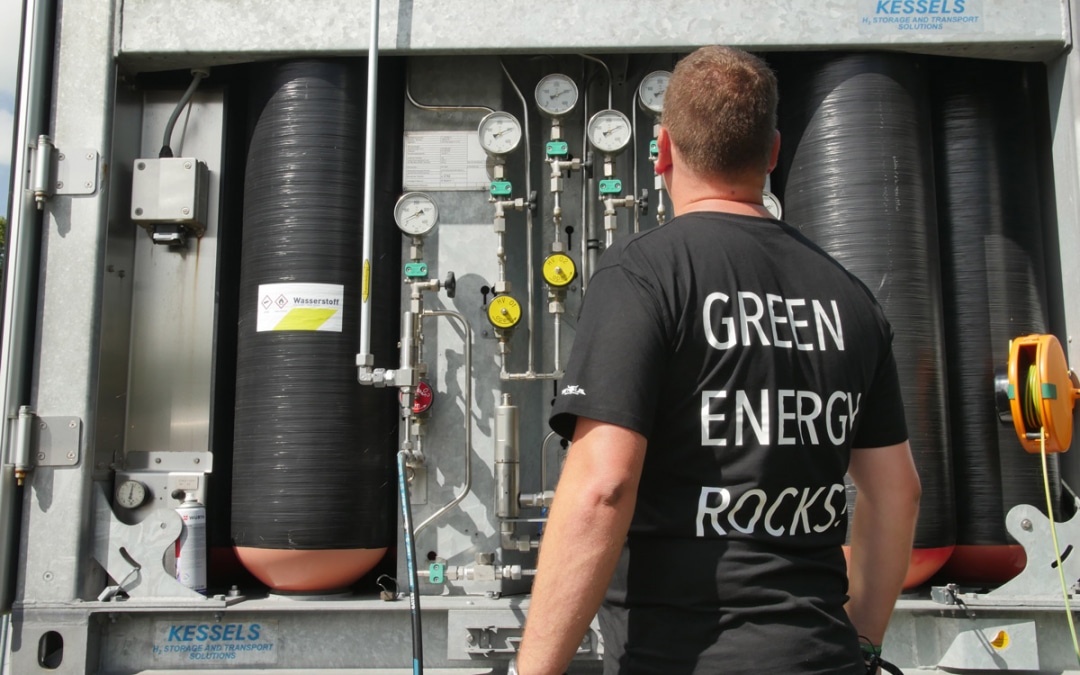

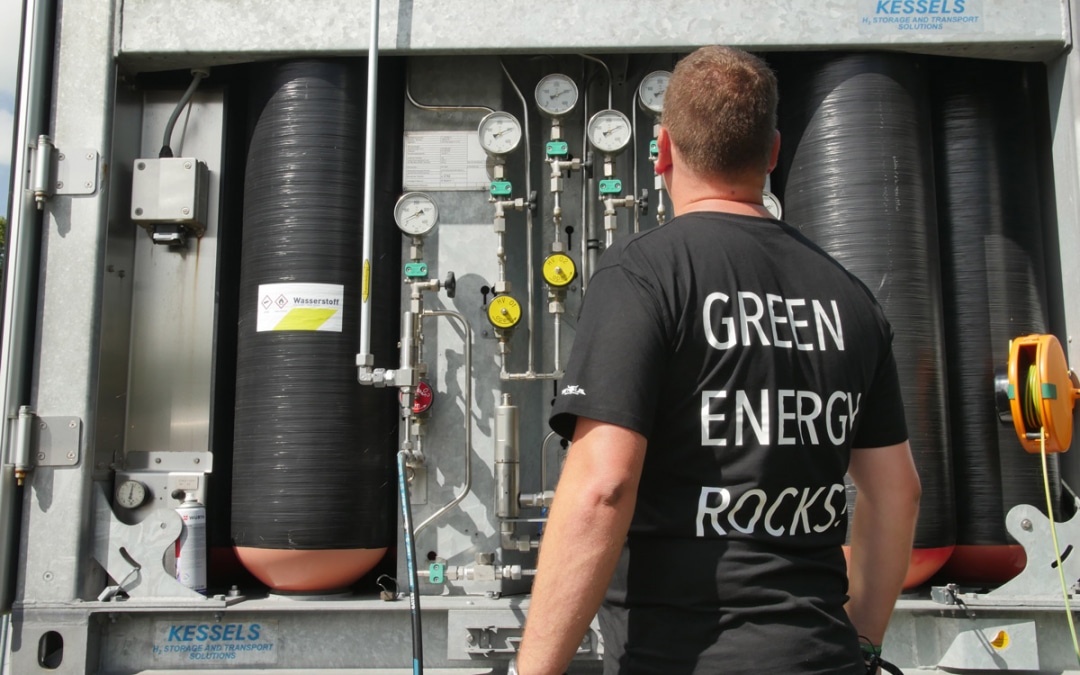

Increasingly more festivals are committing to sustainability. Not only in Wacken, which this year – once again – made headlines due to the mud fights there, has not only green electricity but also hydrogen been employed. Also in Lingen at this year’s Lautfeuer festival on July 7 and 8 were the stage, lighting and other equipment almost entirely powered with green electricity from hydrogen-run generators.

Since 1981, an “Abifestival” has taken place every year in Lingen that attracts up to 20,000 guests under the motto of “Umsonst & Draußen” (free and outdoors). In collaboration with the H2 Region Emsland and with support from the City of Lingen as well as the respective regional district, an energy concept was developed already last year in which a fuel cell is used instead of conventional diesel generators. “For this novel approach, Lautfeuer received the German event industry’s innovation prize,” notified Ines Fischer, chairwoman of Abifestival seit 1981 e.V. This year, a second fuel cell was added, so nearly everything was able to be powered this way.

Advertisements

GP Joule has been supporting Wacken Open Air as early as 2018 and supplies the metal festival in Northern Germany with electricity from green hydrogen. The self-produced H2 gas is converted to electricity in two H₂Genset modules from SFC Energy. The electricity obtained from renewable energy will then be used from the opening on Monday, July 31 until the end of the festival. Additionally, GP Joule is deploying one of its eFarm hydrogen buses as a shuttle for the guests.

CEO Ove Petersen stated, “Green and black – that goes together in the North. Wacken Open Air and GP Joule are proving it.” Peter Podesser, CEO of SFC Energy, supplemented, “Fuel cells based on green hydrogen are a perfect solution for secure, mobile energy supply for open air events.”