H2-international Blog

Current information about hydrogen and fuel cells as well as energy storage and electromobility.

The blog covers topics relating to hydrogen and fuel cells, as well as electromobility, energy storage, renewable energy and alternative fuels

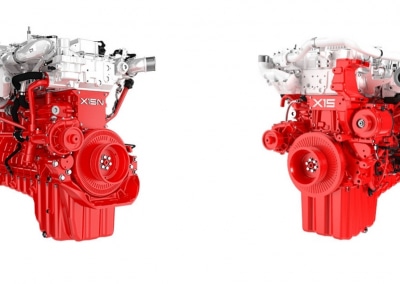

Cummins Engine – Emissions scandal ended by payment

Ceres Power with strong partners

Group rotation will drive hydrogen forward

Wissing releases former NOW chief from duties

Bloom Energy convincing in the long haul

Ballard – Prospects better than current market valuation

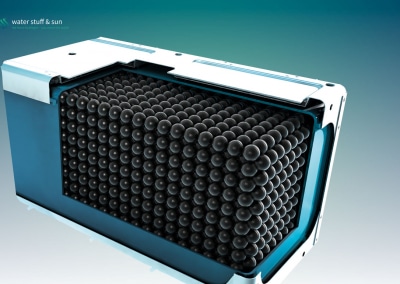

Search for the ideal hydrogen storage

Is exponential growth slowing down?

Welcome to H2-international – your ultimate destination for all things hydrogen and fuel cells.

Immerse yourself in the captivating realm of renewable energy, electric mobility, and alternative fuels. Our comprehensive blog delves into the latest advancements in the energy industry, keeping you well-informed and engaged.

Explore the myriad applications of hydrogen and stay updated on cutting-edge innovations in this fascinating field. With captivating articles covering a wide range of topics including fuel cells, energy storage, hydrogen development, and more, H2-international is the trusted e-journal that ensures you never miss out on important information. Join us today and unlock the limitless potential of hydrogen and fuel cell technology.