by Sven Jösting | Apr 17, 2024 | Energy storage, Europe, Germany, Stock market, worldwide

Siemens Energy is on the right track, as the latest figures show. Although the wind subsidiary Gamesa, like before, is registering losses, all other divisions are doing well and are profitable – trend rising. That the stock market also sees it that way is shown by the share price being at times over 14 EUR. You must simply give the integration of Siemens Gamesa time. That won’t happen in weeks, but rather in one to two years. Starting 2026, this unit should be profitable again and by then enable a cost reduction potential of 400 million EUR.

At the same time, the market for offshore wind is growing enormously, and there will be more and more synergies, such as with electrolyzers for offshore hydrogen production, visible. Here, things will grow together that belong together, because renewable wind power should be converted into molecules on site, which are then transported by ship and pipeline to consumers. Whether the onshore wind division – and this is where the problems lie at Gamesa – can and should be maintained as an activity is questionable, if the technical problems cannot be solved sustainably.

Advertisements

Siemens is divided into many divisions, all of which are growing at different rates and contribute to the success of the conglomerate. The division Gas Services reported a turnover of 10.9 billion EUR at an operating profit of 1.033 billion EUR. The division Grid Technologies has made 7.2 billion EUR turnover at 0.54 billion EUR profit, and Transformation of Industry had 4.4 billion EUR turnover at 0.228 billion EUR profit. Let me make a simple thought experiment here:

What would happen if Siemens Energy would take one of these divisions public as a spin-off (as a company share), like what parent company Siemens did with Siemens Energy? Could perhaps 30 to 40 percent of Gas Services proportionately be worth 2, 3 or 4 billion EUR on the stock market and Siemens Energy allow this equivalent value via an initial public offering (IPO) as an inflow of capital? With this capital, Siemens Energy could then finance strategic acquisitions from its own resources. New business models could be developed in order to bring together the offshore wind division of Siemens Gamesa with the electrolyzer division, with the aim of producing offshore hydrogen. Wouldn’t it even be interesting, to enter into hydrogen production itself with partners and customers and to bring in hardware from Siemens Energy to projects as assets or contributions in kind? All this would open up new and sustainable sales areas for Siemens Energy, is my purely theoretical consideration.

New on the supervisory board: Prof. Veronika Grimm

The appointment of Prof. Veronika Grimm to the supervisory board of Siemens Energy – criticism came from the ranks of the economic experts due to possible conflicts of interest – I think it is expedient, because this is where expertise from the theoretical field flows into the practical work of a company. Grimm with her expertise in the energy sector has a special position in the council of wise men, because she thinks pragmatically and is open to technology, and also esteems hydrogen with the importance that the supermolecule has. From this Siemens Energy can profit. On topics that directly affect Siemens Energy she will not issue an opinion. In advisory bodies like the economic council sit theorists.

Record order intake

The power plant strategy finally adopted by the German government (see p. 26) leaves rooms for a lot of imagination for Siemens Energy, because many a major order for gas turbines could and should land here, as there are only few capable providers like Siemens Energy anyway. It is a good sign that the first quarter of fiscal year 2024 was able to be concluded with a profit before special effects of 208 million EUR. The impressive 24 percent increase in order intake to 15.4 billion EUR in the quarter catapulted this to a record level of over 118 billion EUR and, if it continues like this, is also expected to reach 140 to 150 billion EUR on an annualized basis (estimate).

Summary: Buy and leave alone. As a full-service provider, the conglomerate is in the right and, above all, high-growth markets of energy production, especially in the area of hydrogen, perfectly positioned.

Disclaimer

Each investor must always be aware of their own risk when investing in shares and should consider a sensible risk diversification. The FC companies and shares mentioned here are small and mid cap, i.e. they are not standard stocks and their volatility is also much higher. This report is not meant to be viewed as purchase recommendations, and the author holds no liability for your actions. All information is based on publicly available sources and, as far as assessment is concerned, represents exclusively the personal opinion of the author, who focuses on medium- and long-term valuation and not on short-term profit. The author may be in possession of the shares presented here.

Author: Sven Jösting, written March 15th, 2024

by Sven Jösting | Apr 15, 2024 | Europe, hydrogen development, Stock market, worldwide

Sven Jösting’s stock analysis

#Shares from the crypto universe and from many technology companies are currently reaching new highs. Armaments are also booming on the stock market in view of the many global, some war-like, political conflicts. Only the topic of hydrogen and fuel cells is still leading a shadowy existence, with prices at crash level, which however – still – fully obscures the prospects of sustainably produced energy, and above all of hydrogen.

The stock exchange also always works according to the principle of group rotation, according to which always exactly these topics slide back into the focus and center of investor interest that have been completely neglected up to now but have excellent prospects. Precisely why I expect that, after almost three years of falling share prices, the trend will now gradually reverse and a sustainable, long-term upward trend on the stock market is beginning that is based on very high company growth.

Advertisements

To many market participants, it is unclear at this time how hydrogen will be available in large quantities, although it is already clear today that production volumes will increase enormously and prices will fall. All this, however, doesn’t happen overnight: Gigantic capacities in electrolyzer technology – PEM, AFC, AEM, SOFC – must arise to be able to produce sufficient hydrogen.

Hydrogen economy is on its way and will come!

“The H2 economy is on its way and will come,” was the conclusion of the H2-Forum in Berlin (Feb. 19 and 20, 2024, see p. 20). One speaker explained that we’ve now come, after overinflated expectations, “out of the valley of the dead” and on solid ground. Now, it’s all about assessing risks and partaking in concrete projects, which would mean investments in the whole area of hydrogen. From talk to action.

If we take a visionary look into the years 2030, 2035 and 2040, it’s clear what technologically needs to be on course today. Green and, temporarily, blue hydrogen (produced by natural gas reforming – 70 percent less CO2) will dominate and replace gray hydrogen from natural gas, eventually CO2-freely. Regeneratively produced hydrogen will be a raw material that receives a market price as a commodity on the stock exchange. Those producers who have large quantities of low-cost renewable energy (solar, wind and hydropower) at their disposal and have the necessary access to water (above all seawater) will get a tradable commodity that they can sell on the world market, with high profit margins, or use themselves.

In the last case, it can be observed that countries with ideal framework conditions are increasingly thinking about using the hydrogen produced locally themselves, by setting up corresponding industries, instead of selling it to countries like Germany, as energy is a very important location factor.

Hydrogen and the stock market

In countries such as China and individual regions like the US state of California are developing hydrogen strategies that have model character and can serve as a blueprint for the world. In China, over 1,200 H2 refueling stations are to be in operation by 2025. Currently, it’s about 400. South Korea wants long-term to establish more than 1,600 H2 refueling stations in the country. Here in Germany are, as before, around 100 in operation.

Companies with capacities for fuel cell stacks and modules for commercial vehicles are in the starting blocks (Bosch, Cummins, Ballard, Hyzon, Toyota, Hyundai, etc.), because these markets will be huge. Several million trucks and buses can be assumed to be converted to battery or fuel cell (also in combination) in the next ten to twenty years. Hydrogen engines are also attracting a lot of attention, as various prototypes have already been developed (Bosch, Cummins, Toyota).

The question of the right H2 shares can be answered well with this context, as primarily companies will win that have a mature technology, operate with robust business models, are able to deliver and possibly profit from the consumable hydrogen itself, if they can produce it themselves at low cost or distribute and use it as a commodity.

Here beckons the prospect of a good profit margin with high growth potential. On the stock exchange, however, there is right now in the area of hydrogen a phase of disappointment, as firstly everything is not going so quickly and secondly setbacks must also be overcome. In addition to questions of implementation speed, there are often also regulatory issues on the timeline. That the stock market has not yet recognized the potential of the companies through their share prices and valuations is easy to see from the current prices. There is no question that there will be a complete reassessment, however, even if it will take longer. Be patient. We are only at the beginning of this new mega-trend – also on the stock exchange. Let’s wait for the group rotation; then, everything will happen very quickly.

Disclaimer

Each investor must always be aware of their own risk when investing in shares and should consider a sensible risk diversification. The FC companies and shares mentioned here are small and mid cap, i.e. they are not standard stocks and their volatility is also much higher. This report is not meant to be viewed as purchase recommendations, and the author holds no liability for your actions. All information is based on publicly available sources and, as far as assessment is concerned, represents exclusively the personal opinion of the author, who focuses on medium- and long-term valuation and not on short-term profit. The author may be in possession of the shares presented here.

Author: Sven Jösting, written March 15th, 2024

by Niels Hendrik Petersen | Mar 18, 2024 | Development, Energy storage, Europe, Germany

Interview with Thomas Korn, CEO of water stuff & sun

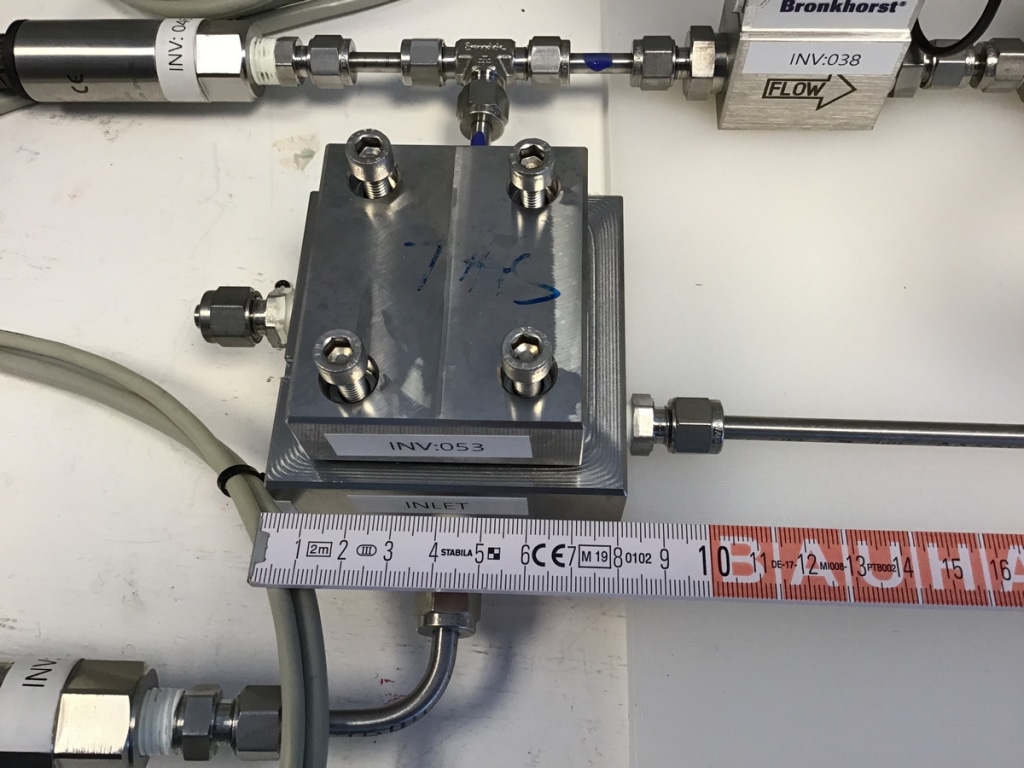

Startup company water stuff & sun has developed a novel technology that is designed to provide a safe and easy way to store hydrogen. The solution’s key component is its microvalve system. A pressure regulator controls the release of hydrogen progressively from 1,000 bar down to just a few bar. H2-international spoke to Thomas Korn, CEO of water stuff & sun, about how it works and the challenges encountered.

H2-international: Mr. Korn, the storage and refueling of hydrogen is a challenging issue. How do you solve that problem?

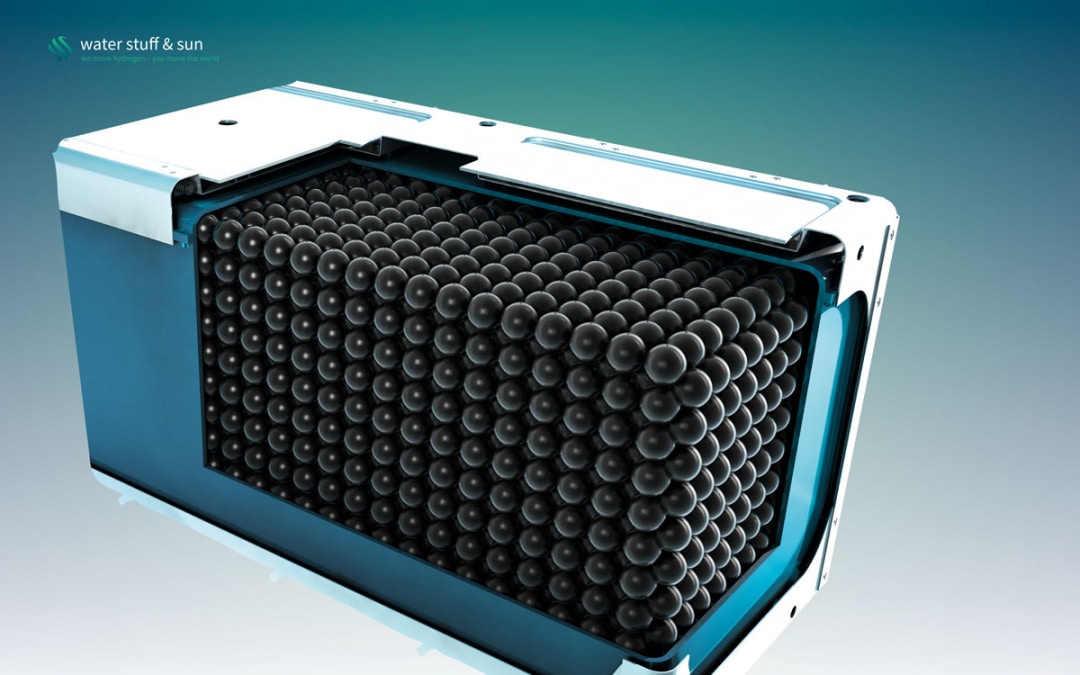

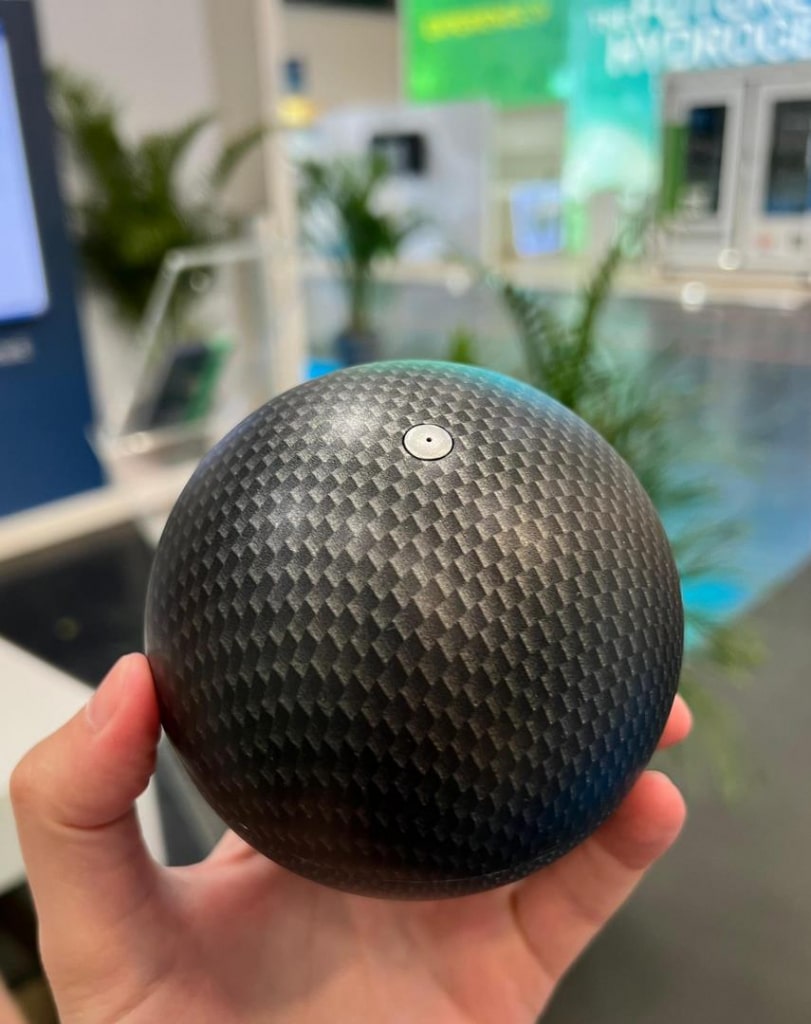

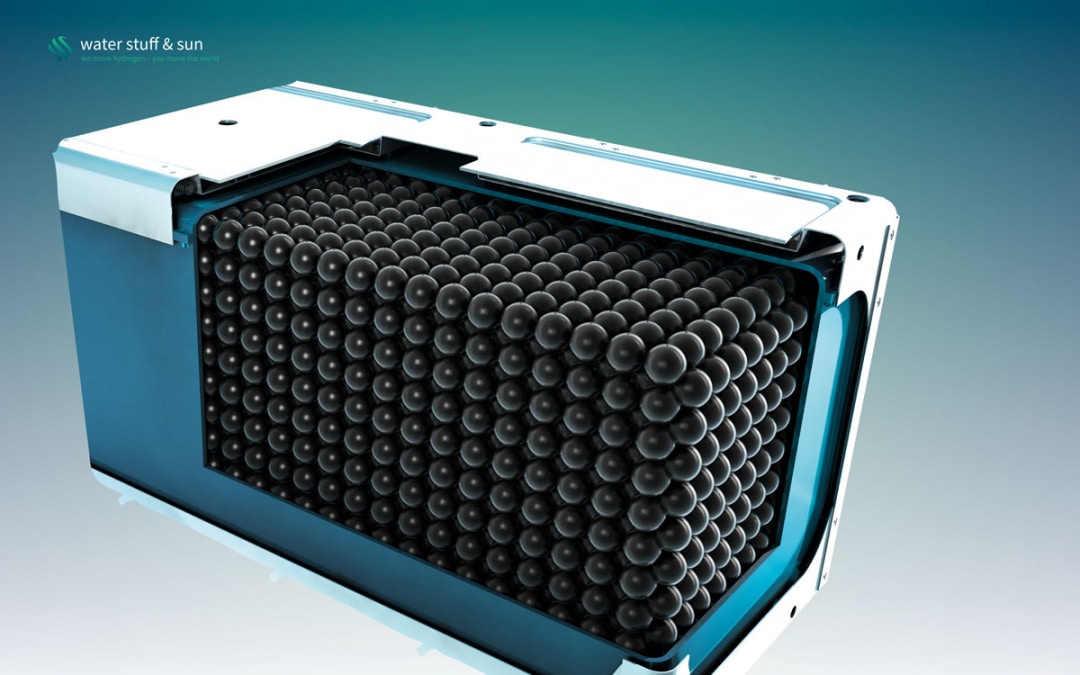

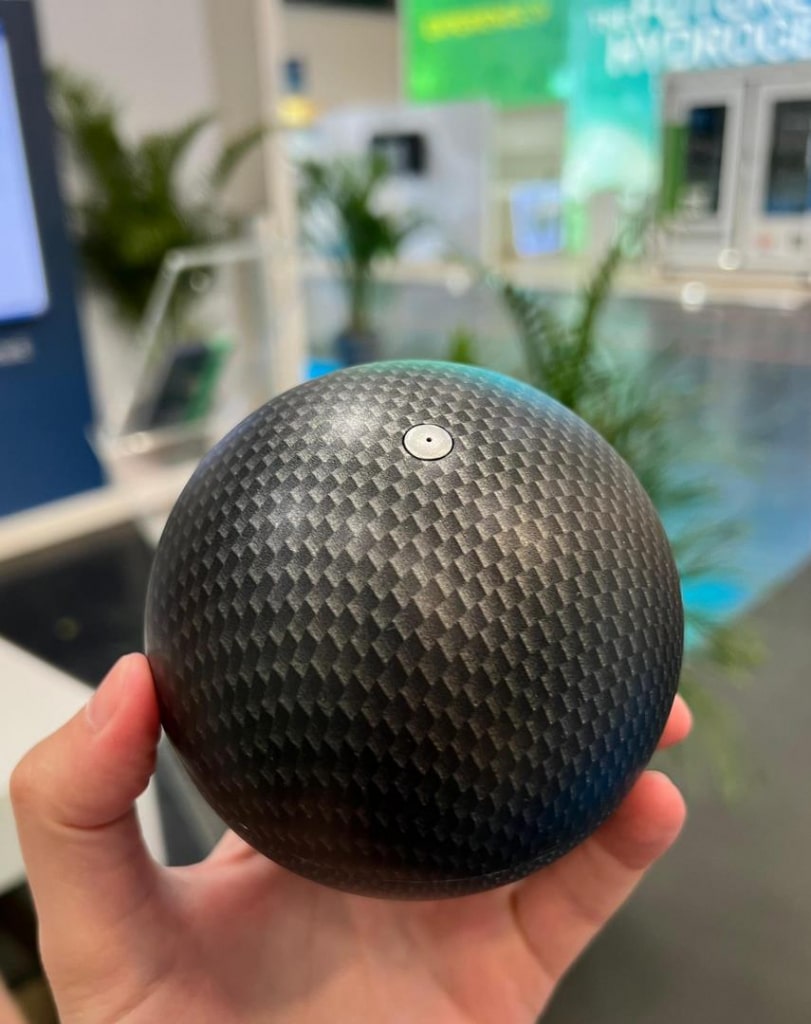

Korn: As it stands, the storage of hydrogen in conventional compressed gas tanks is complex and expensive. There is a trade-off between performance, safety and cost. We have a surprising solution to this: Instead of using a small number of large cylindrical tanks, our technology allows us to store the same amount of hydrogen in multiple spherical carbon-fiber vessels the size of a tennis ball. The silicon microvalve system, which is built into every pressurized ball, means that all the vessels act identically and in unison, just like a large tank. The expense involved in ensuring the safety of hydrogen stores can be significantly reduced if the energy is split into multiple small vessels. As a result, we save almost half the carbon fiber material compared with a standard pressurized tank. We call these ball-shaped high-pressure storage vessels Sfeers.

Advertisements

They allow hydrogen cells to be scaled as required and integrated into hydrogen batteries of any shape. Green hydrogen can thus be used in a variety of motive and stationary applications such as trucks, drones and airplanes. The next generation of these energy stores will be 95 percent lighter and up to 30 times cheaper than lithium ion batteries – while still carrying the same amount of energy.

Fig. 2: Doing the rounds: a Sfeer ball at the EES trade fair in Munich

How does the hydrogen battery work?

Hydrogen batteries are low-pressure hydrogen tanks containing Sfeers which are filled at up to 1,000 bar. The hydrogen battery enclosures are designed for low pressures and can therefore be perfectly adapted to the available installation spaces in a wide array of mobility products. When hydrogen is extracted, the pressure in the hydrogen battery enclosure decreases and activates the microvalve system in all the Sfeers once the pressure drops below a mechanically programmed ambient pressure range. These then release hydrogen, together providing the energy required for a hydrogen engine or a fuel cell.

The pressure in the hydrogen battery rises again above the pressure activation level that is set during the manufacture of the micromechanical components. Once the pressure level has been reached, all the microvalves close. The pressure in the battery stays constant or reduces further if the consumer withdraws more hydrogen. The activation pressure is set to the supply pressure of the consumers. The hydrogen battery can be thought of as a low-pressure tank, but with the capacity of a high-pressure tank.

The concept increases the safety level while at the same time reducing the amount of material used. Since their highly adaptable shape means they can make best possible use of the available space, hydrogen batteries outperform conventional pressurized tanks in terms of volumetric and gravimetric power density.

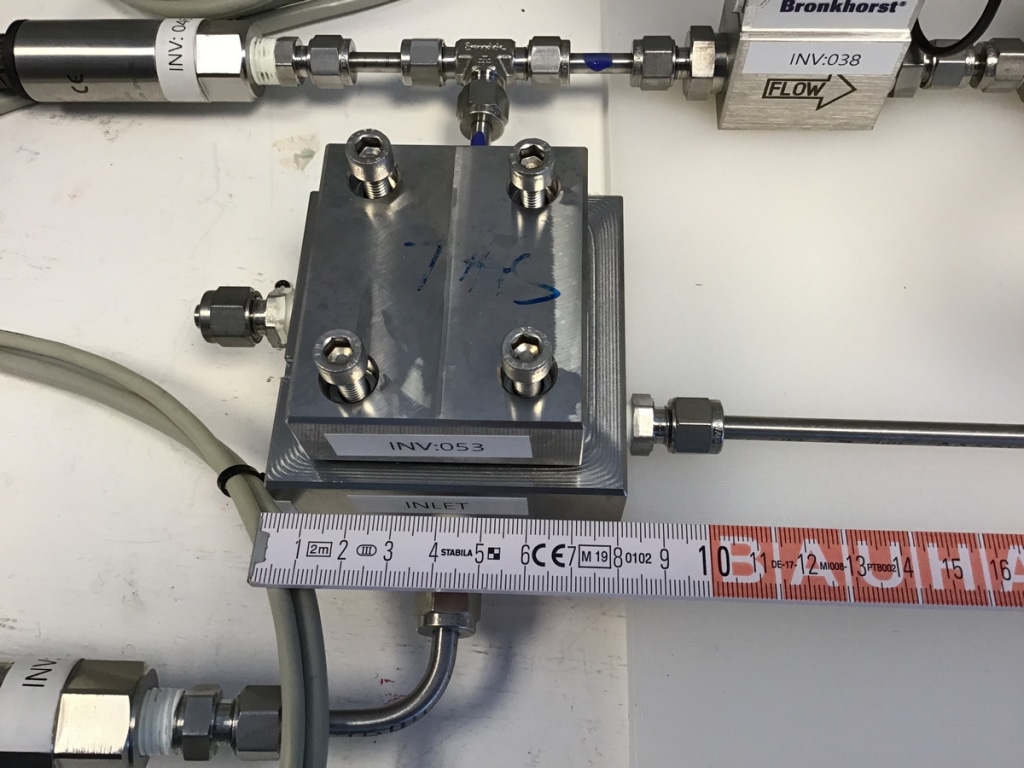

Microvalve technology has its origins in satellite technology. How is this technology produced?

Satellites have a gas propulsion system that secures their position within the communication window. Even in the early days, industrial developers started to use microsystem technology to regulate gases due to financial pressure to make ever smaller and lighter satellites. Our innovation centers on the development of micromechanical switching elements that don’t need electrical energy for their control; instead they are controlled passively by the ambient pressure. As in semiconductor engineering, highly industrialized manufacturing processes are used that can create thousands of identical parts on large silicon wafers. Valves, gas channels and the five-stage pressure regulator are produced and joined in four silicon layers. All chip components are built into a space measuring 4 x 4 x 2.5 millimeters (0.16 x 0.16 x 0.1 inches).

How did you come up with the idea of spherical high-pressure vessels?

The technology was invented by Prof. Lars Stenmark, who taught microsystem engineering in the Ångström Laboratory at Uppsala University and who had already applied earlier inventions to the aerospace industry. When he told me about his hydrogen storage invention, I was all for it. A physical hydrogen storage vessel that combines two existing technologies and resolves the trade-off between safety, cost and performance in hydrogen tanks – we couldn’t resist and founded the company water stuff & sun in January 2017.

Fig. 3: A view of the lab shows the test setup for microchip evaluation

Is there already a prototype?

We have already produced and tested prototypes of switching valves and the key element of the valve system – the pressure regulator – in the clean room of the Ångström lab in Uppsala. We have also put a carbon fiber Sfeer prototype through a burst test and validated our simulation model with the results. At the moment we are building the first system prototype of a hydrogen battery with three Sfeer cells. The prototype and its use in a micromobility application will reach technology readiness level 5 in the first half of 2024. At that point we’ll start to develop hydrogen batteries for specific mobility products with several manufacturers and go on to industrialize them in the next stage. There is a great deal of interest from industry. For example, we have already submitted a joint funding project with an aircraft manufacturer and the German Aerospace Center. We are working with our partner Keyou to develop hydrogen batteries for converting and retrofitting trucks and buses. Additionally, we’ve managed to stimulate interest from a mining machinery manufacturer and a truck OEM.

Returning to the refueling process: Am I right that you are intending to swap the tanks?

Hydrogen batteries don’t need to be refueled in the vehicle; they are exchanged at swap stations or, in the case of small applications, they can also be exchanged by hand. That way, refueling can take place quickly and cost-effectively. The empty hydrogen batteries are refilled at central compressor stations and returned to the swap stations. The low operating pressure and the limited quantity of H2 in the hydrogen battery enclosure makes this ease of handling possible. In comparison with conventional high-pressure or liquid hydrogen refueling stations, the expense and complexity are significantly reduced, which in turn lowers the capital and operating costs and thereby also the hydrogen price. For heavy-duty vehicles, for instance, with hydrogen, several hundred liters of fuel energy equivalent need to be compressed, cooled and transferred. By simply swapping the hydrogen battery, the process can be completed in just a few minutes.

The financing required will be considerable. What are the next steps for your company?

The need for capital in a tech startup is always an issue – it’s a continuous process. We have just started a new financing round in which our existing investment partners, such as the investment arm of Kreissparkasse Esslingen-Nürtingen, or ES Kapital for short, the company Besto, run by the entrepreneurial Beyer and Stoll families, and machinery and tooling factory Nagel, have already registered an interest. I would refer to them as relatively down-to-earth, regional investors that have been involved from an early stage. The plan is to invest the new cash in the development of a prototype in the motive application area, as mentioned earlier, among other things. The raw materials for the production of semiconductor chips are all affordable. Carbon fiber and silicon are readily available on the market. That is an advantage in terms of further scaling. If everything goes according to plan, we will see the first of our batteries in a vehicle or aircraft by 2025.

Fig. 4: The H2 battery should be quick and easy to swap in and out of a truck

When and how will the market for your solution evolve?

The transformation of energy systems is well under way. Infrastructure for natural gas- and oil-based fuels is being replaced by hydrogen and liquid hydrogen derivatives such as ammonia, methanol or synthetic fuels. The competition for technology leadership and, ultimately, energy leadership began long ago. In China and the USA, many billions of euros are now being invested in hydrogen technologies and their infrastructure; we Europeans are attempting to counter this with the Green Deal. Hydrogen projects are sprouting up all over the place. As far as we are concerned, the market has already started; we’re currently concluding cooperation agreements with initial vehicle and machinery manufacturers.

Where will the first market be that manages to develop?

We need to take a multitrack approach and are therefore also looking at the USA and the Arab world. The country that achieves the lowest hydrogen prices by investing will attract a lot of companies and investment. In the EU and Germany I hope that the greenhouse gas quota gives us an instrument that is competitive.

You won a prize at the World CleanTech StartUPs Awards, otherwise known as WCSA 2023. What particularly impressed the judges?

Firstly, the award as a platform is a very interesting network in itself. Applications for WCSA 2023 were invited by ACWA Power in strategic partnership with Dii Desert Energy and the French institute for solar energy CEA-INES, among others. The judging panel recognized the transformative potential of the hydrogen battery. The innovation could create an efficient and flexible infrastructure for H2. The electricity costs for hydrogen production from renewables are very low in Dubai. That’s why ACWA invited us again at the end of 2023 to present our solution locally. That will be extremely exciting.

In November we received two awards at the Global EnergyTech Awards: the prize for the Best CleanTech Solution for Energy and a special prize for Best Stand Out Performer. We were the only winners from Germany. That helps.

Interviewer: Niels Hendrik Petersen

Fig. 5: Thomas Korn

Thomas Korn has been working in the hydrogen field since 1998. The engineer’s experience includes work at BMW on fuel cell development. In 2015, he co-founded the hydrogen startup Keyou in Munich. The startup water stuff & sun was launched in 2017 in Unterschleißheim, Bavaria. The fledgling company now has 15 members of staff and a branch in Uppsala, Sweden.

by Hydrogeit | Mar 15, 2024 | Development, Europe, international, News

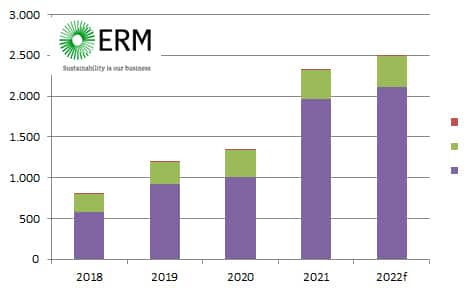

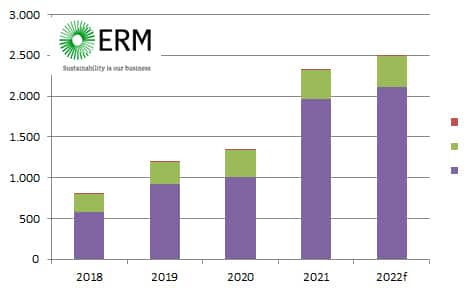

Fuel Cell Industry Review 2022

Year 2022 saw fuel cell shipments creep up over 2021 numbers, though the latter was a remarkable year. When 2021 exceeded 2020’s MW numbers by over 70%, we thought we were finally seeing the uptick that had been anticipated – the classic “hockey stick” pattern. But the structure of the industry – and its reliance on only a few players for the majority of shipments – means that growth comes in spurts.

E4tech’s eighth annual Fuel Cell Industry Review showed just under 86,000 units shipped in 2021, or just over 2,300 MW, even with the COVID pandemic still hanging over markets. But this rapid growth was largely due to the activities of two vehicle OEMs, Hyundai and Toyota, together accounting for over 70% of the megawatts. But even after taking these out of the picture, growth continues – slowly but surely.

Advertisements

E4tech is now part of ERM and the team is continuing to research and write the Review. The ninth FCIR shows that 2022 shipments were similar to the year before – with the continued but slow growth still led by Hyundai and Toyota, at over 60% of MW shipments, and by fuel cell buses and trucks into China. In 2022, we estimate nearly 89,200 fuel cells to have been shipped, amounting to almost 2,500 MW.

Analysis by region

For vehicles (which by far is the largest contribution, at 85% of all shipments by megawatts), much of the demand was localized to China and South Korea. China saw over 4,150 units being shipped, across all modes of mobility (including forklifts, now slowly taking off in the country), while South Korea saw nearly 10,400 deployments, dominated by Hyundai’s Nexo. Together with 831 Toyota Mirais going into the home market of Japan, Asia now accounts for around 15,600 units into transportation markets, or 17% of global shipments of fuel cells by number, but rather more impressively some 1,500 MW (60%) of the shipped megawatt count.

Hyundai is benefitting from the 50% subsidy for fuel cell vehicles in South Korea. South Korea is now also the single largest market for large stationary units, in CHP and prime power modes. Stationary shipments into the country grew from 147 MW in 2021 to 196 MW in 2022 (8% of the global MW count). These numbers illustrate the importance of South Korea for fuel cell shipments – and, moreover, the key role of sustained policy and subsidies in helping fuel cell companies and OEMs to achieve volume.

In context of the Japan’s Ene-Farm program, across all markets (stationary, mobility and portable), Asia accounts for 60,850 units (two-thirds of global shipments) and 1,770 MW (71% of global shipments). Behind Asia is North America, with around 14,550 fuel cell shipments (nearly 485 MW, or 19% of global shipments in megawatts), led by Toyota and Bloom Energy shipments to the United States. Europe accounted for roughly 13,250 of fuel cell shipments in 2022, down from just over 14,000 units in 2021. The fall in unit shipments followed the completion of the PACE program of the US Inflation Reduction Act and the imminent closure of KfW-433 grant funding by Germany. In megawatts, the count slightly increased, from a corrected 204 MW in 2021 to 228 MW in 2022, about 9% of the global market. Fuel cell vehicle shipments to Europe are lower than for Asia and the US because of the low subsidies provided by the national governments.

Analysis by application

Fuel cells for mobility, primarily cars, continued to dominate the overall count. Across all modes of mobility (including forklifts), 85% of shipments (2,100 MW) fell into this category in 2022, 150 MW more than in 2021. In units, mobility accounted for 35% of shipments in 2022, a slight fall from 2021’s share. So, the message is transportation is growing, but other fuel cell markets are growing too.

The next main contributor to vehicle shipments is China, with a record 3,789 units (buses and trucks) being shipped over 2022. Together, these are estimated as contributing 387 MW to the overall count in 2022.

While nearly 1,000 fuel cell buses were shipped into China in 2022, fewer came to Europe in 2022 (only 99 registrations). According to CALSTART figures, as many as 82 new fuel cell buses were fielded in the US in 2022, mostly in California. Outside China, fuel cell truck shipments globally in 2022 remained minuscule. This could change, given the business plans of Cellcentric, Plastic Omnium, Hyzon and others.

Fuel cells for ships and for aviation remains exploratory, now with a growing emphasis on propulsion rather than hotel loads or auxiliary power. Forklifts continue to be a major application for fuel cells, albeit with fewer unit shipments in 2022 (over 9,650 units) compared to 2021 (over 13,400 units). Prime power and CHP comprise a large part of the remaining demand, in unit numbers and in MW. By number, micro-CHP still dominates, with Japan leading with its Ene-Farm program. ACE shows 42,877 units being installed in 2022, over 3,000 units more than the previous year. Outside Japan and Europe, micro-CHP shipped in negligible numbers, further demonstrating the criticality of country-to-country policy in supporting fuel cells. Together, prime power and CHP across the power range contributed 364 MW shipments in 2022, up from 335 MW in 2021. Although a growing emphasis for developers, fuel cells for grid support and off-grid power has remained subdued, at 14 MW (for both years). Shipments of portable fuel cells (including smaller ported APUs, less than 20 kW in power output) showed an increase, from just over 6,000 units in 2021 to nearly 8,000 units in 2022. These are supplied globally, but most feed into European and North American industrial and consumer markets.

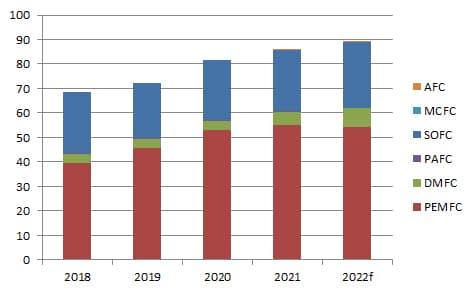

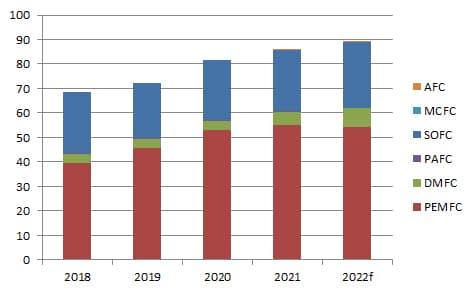

Shipments by fuel cell type

PEM continues to outweigh other fuel cell types in shipments, both in volume and in MW capacity. Of the nearly 90,500 fuel cells shipped in 2022, over 55,000 were PEM. By megawatts, PEM fuel cells recorded 2,151 MW, 86% of the overall volume of shipments.

High-temperature PEM, generally utilizing methanol rather than hydrogen as a fuel, continues to grow, led by Advent Technologies. While still a fraction of overall PEM units at present, shipments are set to grow more aggressively given the improved logistics and increased runtimes enabled by the methanol fuel. DMFC (direct methanol) had a good year, with nearly 8,000 units shipped over 2022, mostly from SFC Energy.

SOFC (solid oxide) grew to nearly 27,000 units in 2022 (mostly micro-CHP, by number). The MW count grew from 207 MW in 2021 to 249 MW in 2022. Much of this is attributable to stronger sales from Bloom Energy. PAFC (phosphoric acid fuel cell) shipments fell, and while no new MCFC (molten carbonate) system placements were recorded over 2022, FuelCell Energy continues to produce significant volumes of stacks, for mid-life refurbishment of systems. AFC (alkaline) shipments increased to over 100 units in 2022, way down on other fuel cell types despite the lower cost potential, both for the fuel cell stack and the hydrogen purity requirement.

Summary

Fuel cells had a good year in 2022. Despite shipments being dominated by a few key suppliers into just a few countries, we are at last beginning to see shipments into Australia and South America, buoyed by the greater interest in hydrogen generally. And while interest is helpful, it remains the case that fuel cells have yet to break through the high capital cost threshold, and (for the hydrogen-fueled units) high fuel prices. We are slowly seeing this happen, through big changes to the supplier landscape, the IPCEI initiative in Europe, significant capacity upgrades to fuel cell production, and the Inflation Reduction Act in the US. But for now, the message remains the same: sustained support from governments is still needed to allow fuel cells to fully support the energy transition. Some fuel cell companies are now also purposing their designs to electrolysis, to help push the market, and with it the hockey stick.

ERM’s Review, a digest of the year’s activity, together with an analysis of fuel cell shipments by region, type and application year on year, is available at http://FuelCellIndustryReview.com. The 2022 edition is delayed, but coming soon. We would like to thank all the fuel cell shippers who graciously provide shipment numbers to us each year, which helps underpin our review.

Author: Stuart Jones, ERM, London, UK, Stuart.Jones@erm.com

by Hydrogeit | Mar 7, 2024 | Development, Europe, Germany, News

Interview with Dr. Kai Fischer, Director at RWTH Aachen

The efficient scaling of green hydrogen production technologies is an essential step in making hydrogen an economically sound part of the energy transition. With regard to this necessary and massive capacity expansion, the plastics industry has a lot to offer as far as the hydrogen industry is concerned, because plastics are high-performance materials whose property profile can be engineered very precisely for the intended application. Additionally, the processing technologies in the plastics industry allow high-tech components to be produced efficiently and in large numbers. Dr. Kai Fischer, scientific director at the IKV and responsible for the topic hydrogen economy, explains in this H2-international interview why the exchange between the two industries is so important, what significance plastics have for the scaling of hydrogen technologies, and how the cooperation between the participating industry partners is to be continued in the “Hydrogen Business and Technology Forum”.

Advertisements

H2-international: Following the hydrogen study produced in the past two years, there now is the “Hydrogen Business and Technology Forum” to intensify the exchange between the hydrogen industry and the plastics industry. Why is that now important?

Fischer: Hydrogen is intended to become the backbone of the energy turnaround. Today, approx. 96 % is obtained from fossil resources such as natural gas and coal. Only 4 % is produced by electrolysis. For this – as some people may remember from school – water is broken down into hydrogen and oxygen using electricity. Electrolysis is the way to produce “green”, i.e. climate-neutral, hydrogen. And even for this 4 % electrolysis, only a small proportion of renewable energy is currently being deployed. Consequently, only a very, very small part of the production capacity is at present suitable for producing green hydrogen. Yet all today’s projections are aimed at producing green hydrogen. It is indeed important to see that a great deal needs to be done here with completely new development work. Large numbers of electrolysers and the corresponding infrastructure have to be put in place. That again means working with large numbers, and large numbers are always predestined for plastics. For this reason, we believe that plastics are the enablers to make hydrogen production economically scalable.

And that is why you believe the plastics industry must get together with the hydrogen industry to exchange information and ideas?

Exactly. The people in the hydrogen industry are familiar with all the requirements of the process engineering plants, the media, the temperatures, the pressures etc. But, of course, they think not in plastic but in metal. It is not the case that the construction can simply be switched from metal to plastic. That would not bring any advantages. In order to find new solutions for the requirements of systems, it is necessary to go beyond substituting single metal components with single plastic components, and to look at functional integration. Precisely for this, this application know-how must be communicated so that the plastic value chain can say how solutions would ideally look in plastics.

Are there already examples in the hydrogen industry?

Yes of course. As an example, let us look at the end plates of a fuel cell. Here, many media have to be conveyed, both gaseous and liquid. Connections also have to be integrated. If they are made of metal, it means that a very large number of individual components have to be mounted. In the meantime, there are some applications in which this is solved by a single large injection-moulded part in which all media lines, connections, electronics etc. are already integrated.

This means that the hydrogen industry is not yet aware of the possibilities offered by the plastics industry?

These are two completely different worlds. The facilities for producing or converting hydrogen are classic process engineering plants. They consist predominantly of stainless steel with stainless steel pipes. The producers of such plants are indeed only seldom aware of the possibilities offered by plastics. For this reason it is important to bring the hydrogen OEMs with their knowledge of the requirements together with the plastics specialists with their know-how and their technical capabilities. Only in this way can we start to think in terms of highly integrated products that can be automatically manufactured in very, very large numbers. This is an absolute necessity if the scale-up of green hydrogen technologies is to succeed within a reasonable time and at reasonable cost.

How did the idea of a network forum come about?

The idea of a network forum came because, in 2021, we at IKV launched a market and technology study in cooperation with more than 20 companies in order to deal with this issue holistically. The study is, however, only really the basic package. Our aim was always to operate a continuous exchange to identify how plastics can help in establishing hydrogen. For this, we need continuity, and we have now implemented this in the form of this forum, which will meet regularly twice a year. These meetings will be supplemented by continuous technology monitoring. At the kick-off meeting, we also decided that there would be individual workshops on special topics between the meetings.

What were your impressions of the kick-off meeting and what did you think of the content?

It was a great event! We had a total of 50 participants in the room and four keynote presentations that were divided in equal parts between users of hydrogen systems and solution providers from the plastics value chain. We had very open and transparent discussions. In the breaks, the business cards were flying around and everyone was networking on a grand scale. As part of the event, we also charted the course for defining, according to the requirements, the elements of further cooperation for these two target groups.

As far as the content was concerned, I felt that a very lively demand exists for understanding the systems in the various segments – especially on the part of the plastics industry. I also felt that there are many companies who, irrespective of the competition in their hydrogen systems, are prepared to talk about the challenges because they hope for the push of the open-innovation approach – in other words the push from the supplier industry – and want to create competitive advantages through this in future.

Another aspect that I took from the meeting is that the companies in the plastics value chain, some of which are competing with each other, are very open to cooperation. For example, we discussed the fact that we would sound out in the consortium which testing and characterisation processes are available in which companies so that the companies can supplement each other. In this way, it will also be possible to identify supplementary demands and derive measures to realise them. It was truly noticeable that everyone is keen on baking this large pie together instead of generating competition and trying to grab the biggest slice of a small pie. This seemed to me to reflect the spirit of the meeting generally.

As you said at the beginning, the market and technology study forms the basis for this network. What are the most important things you have taken from this?

The hydrogen industry is still driven very much by traditional process engineering plants. An important finding is, however that we do not have to revolutionise the plastics industry in order to offer solutions to the hydrogen industry. Plastics can be compatible and there are numerous applications and good examples for the implementation of highly integrated and function-integrated components. This means that if the scale-up is necessary and the number of pieces must increase, the plastics industry can offer these solutions without reinventing the world. It is possible to transfer a lot from other industries, but it is naturally not necessary to be familiar with the specific applications in order to be able to suggest suitable solutions for the hydrogen industry. The good news is that we do not now have ten years of development ahead of us and the plastics industry must not fundamentally change or develop completely new products. For each industry it can take what is already there in order to further develop it and transfer it.

What happens now?

Our Forum member Freudenberg held theme workshop in August in addition to our half-yearly meetings to discuss the questions that the Forum participants had addressed fairly openly at the kick-off. The idea for specific workshops was born during the kick-off because the participants deisred an exchange on how to bring plastics expertise specifically into the development of new systems. Furthermore, the team is now starting the Market & Technology Monitor in order to continuously observe the market. We have agreed that it should be more than simply collecting the available information. The information should be questioned, evaluated and categorised. We will look exactly how reliable it is and how realistic the implementation scenarios are. In this way we will draw up an organised list of information, that we will pass on at three-month intervals to the partners in the forum.

Is it still possible to join?

Yes, it is. We naturally want this network to grow, and are pleased to have both small and large companies from the plastics value chain and naturally companies from the hydrogen value chain. Through the synergies of both industries, we can master a scale-up for green hydrogen and make it economical.

Hydrogen Business and Technology Forum

Dr. Kai Fischer leads the „Hydrogen Business and Technology Forum“

With its “Hydrogen Business and Technology Forum”, the Institute for Plastics Processing (IKV) in Industry and Craft at RWTH Aachen University has established a close network between the hydrogen economy and the plastics industry, where it regularly fosters the connection of requirements and application know-how with material and production know-how.

The “Hydrogen Business and Technology Forum” emerged from a market and technology study on plastics in the hydrogen economy initiated by the IKV and completed in November 2022. About 20 industry partners were already involved in the study. With regular workshops and a continuous Market & Technology Monitoring, the work is now being continued in the “Hydrogen Business and Technology Forum”. The kick-off for the Forum was 16 May 2023. The first thematic workshop dealt with “Testing and Analysis of Plastics in Hydrogen Applications” and took place on 9 August 2023 and was hosted by the Forum member Freudenberg. On 19 October 2023 Forum members met again at the IKV for its second regular Workshop. The Forum is still open to new members. Information at H2@ikv.rwth-aachen.de

by Hydrogeit | Mar 7, 2024 | Europe, Germany, international, News, Policy

Interview with Jorgo Chatzimarkakis, CEO of Hydrogen Europe

There is a lot that needs sorting out at a political level: A large number of industry representatives are waiting for politicians in Brussels and Berlin to put regulatory safety nets in place so they can make appropriate decisions about their investments. H2-international asked Jorgo Chatzimarkakis, Europe’s “Mister Hydrogen” and CEO of Hydrogen Europe, about the European Union’s revised Renewable Energy Directive (RED III) and its Important Projects of Common European Interest (IPCEIs). The interview also touched on Germany’s 37th Ordinance on the Implementation of the Federal Immission Control Act (37th BImSchV) as well as the recently revealed problems with fuel cell buses and their refueling stations. His guest article about H2Global appears on page 48.

Advertisements

H2-international: Mr. Chatzimarkakis, fortunately the adoption of RED III didn’t take as long as RED II. What do you think of the outcome?

Chatzimarkakis: The adoption of RED III is a positive step for the hydrogen industry in Europe. It provides clarity and the basis for funding and developing hydrogen projects and applications. That said, it’s important that it’s swiftly implemented so that the sector has the necessary planning certainty to make investment decisions.

The extremely arduous procedure for IPCEI projects has been a massive headache for the H2 industry. Apparently there should now be some movement. Can you confirm that and shed some light on it?

Yes, the delays in IPCEI projects have troubled the industry, caused by bureaucracy at either a European or national level. The consequence has been that funding recipients have to wait too long and then they back out. That harbors the risk that projects could be carried out in the USA, for example. We can’t afford to lose any time as the creeping deindustrialization process is accelerated by such unnecessary delays. To counteract this, I was able to get things moving for one process or another. The IPCEI initiatives are crucial for the development of the hydrogen economy and the funding of innovation. It’s important that the bureaucratic hurdles are surmounted so these projects can move forward.

What feedback do you get from your members? Do they regret having applied in the first place?

Some of our members have expressed concerns about the long delays for IPCEI projects. They have invested considerable resources in the applications and are waiting for the green light in order to move their projects forward. It’s understandable that they are frustrated by the continuing uncertainties.

What’s your advice? To forgo funding and start something quickly themselves or to continue to wait?

The decision whether to forgo funding and start independently or to wait depends on each company’s individual circumstances. However, it’s important that funding is released as quickly as possible to support urgently needed hydrogen projects and accelerate rollout.

Sadly, the production of green hydrogen is still associated with high capital expenditure and financial risks. Despite funding, the long-term operation of a plant for producing green hydrogen on an industrial scale is often not viable. That’s why we still need alternative hydrogen production pathways which can produce more competitively.

Let’s turn our attention to Germany: Many have been waiting a number of years for the 37th BImSchV. To your knowledge, when will there be a new ordinance and what, to your knowledge, will it contain?

It’s regrettable that the revision of the 37th BImSchV is taking so long. Unfortunately, I don’t have any precise information on when a new ordinance is expected or what it will contain exactly. However, it’s essential that the ordinance takes into consideration the needs of the hydrogen industry and the requirements for reliable and efficient hydrogen production.

Allow me to ask two or three questions about the open letter that Hydrogen Europe recently received (H2-international has a copy). In it, various high-ranking industry representatives from the JIVE, JIVE 2 and MEHRLIN project consortium ask for an “improvement to the hydrogen refueling infrastructure for FC buses.” Did you receive this letter?

Yes, we received the open letter. We take the concerns of the industry representatives very seriously. Improving the hydrogen refueling infrastructure for fuel cell buses is of critical importance to support the spread of eco-friendly means of transportation. Waste-to-hydrogen, in particular, could be a piece in the puzzle. That’s because the costs of production, for example from biogas, are two to three euros per kilogram. Combined with the GHG quota, that quickly becomes viable.

The letter also says: “The members of the consortium are convinced that FC buses can be a practicable option for public transport throughout Europe. They have proven themselves to be reliable and have been well received by both passengers and bus drivers. However, the consortium is of the opinion that the technical readiness and the capabilities of hydrogen refueling stations (HRS) fall well below the requirements for the operation of an FC bus fleet. The consortium believes that this represents a huge obstacle and a limitation for the commercialization and proliferation of FC buses and could in fact represent a challenge for FC vehicles across Europe and perhaps, indeed, the world.” You are urged in this letter to recognize the significance of this problem and to conduct talks with industry about possible solutions as a matter of urgency. What’s your response to this?

The consortium’s concerns are justified. We’re supporting efforts to improve the hydrogen refueling infrastructure for fuel cell buses. For instance, we and our member companies are actively involved in standardization in this area – for example with ISO and UNECE. It’s important that industry and political decision-makers work together to find solutions to this challenge and to ensure that fuel cell buses are able to realize their full potential.

What’s more, AFIR [Alternative Fuel Infrastructure Regulation] is sure to have a very positive effect on the ramp-up in refueling. It obliges EU member states to build hydrogen refueling stations at central European intersections and in city hubs. We’ve calculated that up to 600 refueling stations in total will need to be built within the EU by 2030. That will give a considerable boost to users of fuel cell buses.

Does that mean you will address this problem – including in the interests of your association members?

Yes, Hydrogen Europe is actively addressing this issue and is advocating for the improvement of hydrogen refueling infrastructure. We are committed to representing the interests of our association members and driving forward the development of the entire hydrogen economy in Europe.

Interviewer: Sven Geitmann

Extracts from the open letter

“If there is something needed for the commercial operation of buses in public transport systems, then it is an HRS that is reliable and available for operation. This basic standard is frequently unmet at current refueling units. Almost all sites in the JIVE, JIVE 2 and MEHRLIN projects experienced considerable downtimes for the refueling unit, meaning that vehicles were not deployable.”

“It took many months to achieve a reliable and robust refueling process, and during that time numerous faults occurred in the course of the refueling process which took considerable time to be remedied by the supplier – and this despite the inherent redundancy of the station.”

“Consortium members report problems with a range of essential hydrogen dispensing equipment. These problems are surprising given the extensive experience of hydrogen handling in industry.”

“Furthermore, the problems and comments are similar to those reported in numerous projects in the early 2000s. It is remarkable and extremely disappointing that the performance of compressors for the refueling of FC buses has clearly not yet reached the level necessary for the operation of a commercial fleet.”

“The project sites have reported that data transmission is often interrupted which causes refueling to stop or leads to refueling taking longer than necessary. The sensor in the nozzle is not robust. If it fails, the entire fuel nozzle unit has to be replaced at a cost of EUR 10,000.”

“Significant problems occurred in buses when tanks were converted from Type 3 to Type 4. At least in some cases, this appears to be due to information from the bus manufacturers not being passed on to the HRS OEMs.”

“Indeed, the HRS availability targets of above 98 percent had already been met, e.g., by some sites in the CHIC project; yet this level of performance was only achieved with considerable deployment of staff and financial input, in other words with higher costs.”

“Commercial operators require their vehicles to be available whenever and wherever they are needed (and at reasonable operating costs). This is perhaps the most important variable considered by operators if they are contemplating investments in new or additional vehicles. If they cannot be certain that the vehicles can be refueled when needed, none of the plans for expanding the fleet of FC buses will go ahead.”

“It is our opinion that the continuing refueling problems must be resolved if the EUR 407 million that have been invested in FC buses over the past 20 years from EU public funds as well as funds from industry, bus operators, SMEs and research partners is to result in the long-term commercialization of the buses. We are convinced that they can be quickly resolved if they receive the necessary attention and the requisite resources.”