As third-quarter results faded in the rear-view mirror, Bloom Energy stock rebounded with a vengeance following a temporary slump. Natural disasters, including storms and floods, prevented the completion of 41 projects, pushing revenue below the anticipated USD 225 million to USD 200 million, And yet, the company’s USD 12 million in the red means Bloom [NYSE: BE] performed much better than expected. The net loss was “only” USD 0.09 per share instead of USD 0.16 and including non-recurring revenues, that loss shrank to as little as USD 0.04 a share.

Bloom took advantage of the good mood to raise fresh capital via green convertible senior notes, aiming to redeem a portion of already issued high-interest bonds. This included a call on some senior secured notes, which were converted into shares, turning debt into equity. With Bloom paying a premium, it was a sweet deal for stockholders. Adding in restricted funds, the business now has USD 504 million in the bank. dramatically lowering interest costs. The increase in equity, on the other hand, will nicely prop up the company’s balance sheet.

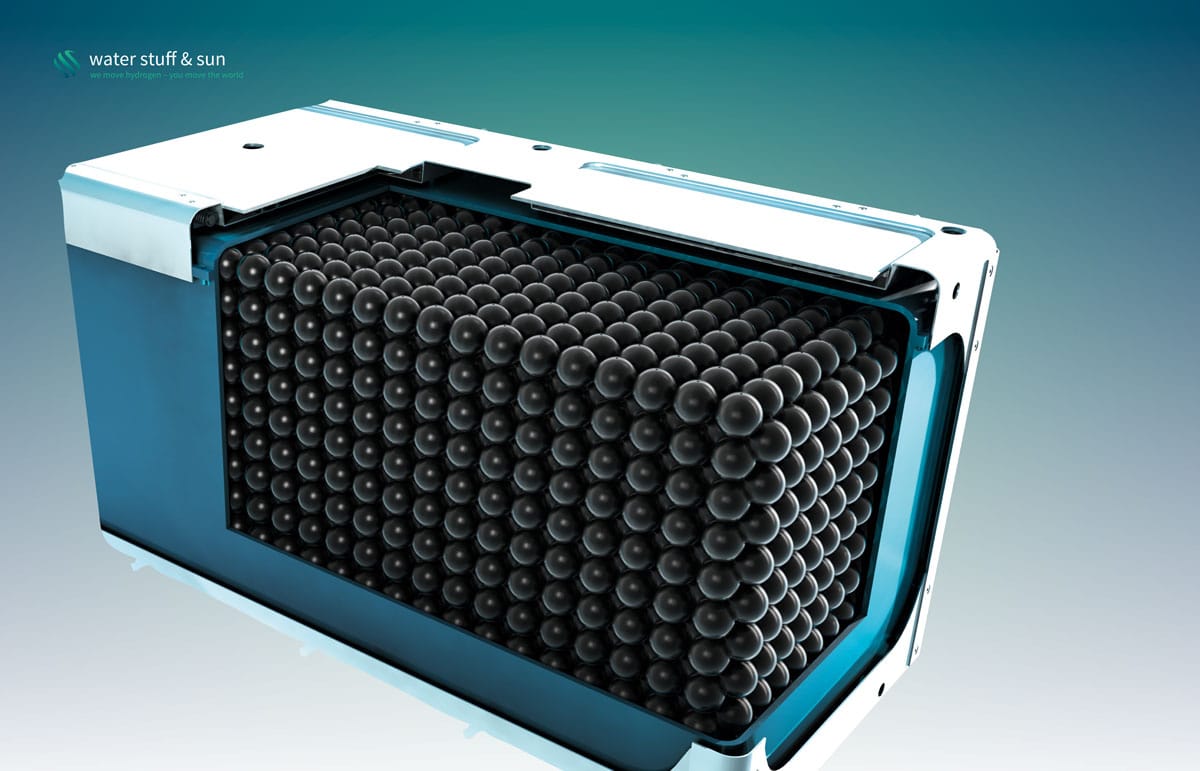

A while ago, Bloom presented new “skids” for improved energy box handling, making them easier to install, and announced plans for a USD 50 million to USD 75 million increase in production capacity. On Nov. 18, 2020, Bloom unveiled a new, more efficient electrolyzer. The company further stated its long-term intention to sell and produce greater hydrogen quantities, with annual revenues from this submarket expected to hit USD 750 million by 2025. According to some estimates, prices for either green or blue hydrogen will drop below USD 2 a kilogram in the next five to 10 years. Additionally, Bloom said the new electrolyzer equipment will make servers up to 50 percent more efficient.

My conclusion is that Bloom will benefit from the growing concerns over global warming. The company provides fuel cell plant technology to tackle the challenge. And the incoming US government will do its part to promote the sector, having already announced a USD 2 trillion climate plan. A boon, to be sure, though the firm’s success doesn’t depend on the plan passing. The company said there is large potential for growth in all corners of the globe. In my view, Bloom is one of the fuel cell industry’s most underrated stocks. Sooner or later, shares could well reach USD 35 or more.

Risk warning

Share trading can result in a total loss of your investment. Consider spreading the risk as a sensible precaution. The fuel cell companies mentioned in this article are small- and mid-cap businesses, which means their stocks may experience high volatility. The information in this article is based on publicly available sources, and the views and opinions expressed herein are those of the author only. They are not to be taken as a suggestion of what stocks to buy or sell and come without any explicit or implicit guarantee or warranty. The author focuses on mid-term and long-term prospects, not short-term gains, and may own shares in the company or the companies being analyzed.

Author: Sven Jösting, written December 18th, 2020

0 Comments