170 US dollars, a good 30 US dollars lower than I had expected (200 US dollars), marked the lowest price of Tesla’s share in the recent past, before the strong rebound to over 260 US dollars – until the disappointing figures for the second quarter of 2019 started the reverse.

The basis for this interim rally is the rising sales figures and especially the increased deliveries of Model 3 in the second quarter of approximately 95,000 units (sales declines for Model S and X, based on an increasing number of competitor models). In addition, reports are circulating that suppliers have received larger orders indicating higher production of Model 3.

The general scepticism expressed in analyses by well-known investment banks, however, overshadows the share price development, because a strong increase in growth is not discernible, even though the second quarter was very good in this respect and Tesla reported sales in excess of US$ 6 billion in the quarter – but again with a loss of US$ 408 million, which would have been even higher had Tesla not massively scaled back its investments (CAPEX). Is all this really sustainable?

The further development of the share price will now again be driven by the company figures: In addition to the loss of $408 million, or more than $2 per share under GAAP – significantly more than expected – the cash position was maintained at a healthy $5 billion after the capital increase of $2.7 billion gross. Recent reports have been circulating that Tesla plans to increase production capacity, as demand for Model 3 has grown well and the focus is on the new Model Y (2020), derived from Model 3. The decline in the high-margin Models S and X contradicts this. So is this another marketing trick? In parallel, Tesla introduced various discounts in the last quarter, which would not have had to be granted if sales were going so well, right? However, advance payments have declined sharply. In addition, the tax incentives in the USA (but also in China and other countries) are increasingly disappearing, so that the discounts and reductions in conditions granted for leased vehicles can probably be seen as compensation. The fact that now owners of Model S and X can refuel free of charge again, may be an incentive to buy, but Tesla of course also has higher costs here.

China strategy with conditions

Meanwhile, the construction of the new Gigafactory, which is scheduled to start production of Model 3 as early as 2019, is progressing rapidly. However, China and Shanghai have linked the construction of Tesla’s new Gigafactory there to various conditions. Tesla will have to invest US $ 2 billion in the new factory over the next five years and pay a minimum annual tax of US $ 323 million from 2023. With non-compliance, the property (and the Gigafactory?) will revert to the city of Shanghai. In addition, no production approval for the e-cars is yet to be obtained, which is the condition for the start of production.

Top managers on the run

Tesla also has to struggle with the permanent departure of top managers, such as a former Audi manager and even the co-founder of Tesla and CTO JB Straubel. He ended his position and became a consultant. These key people know more. Rumour has it that even a team of experts consisting of eleven programmers has left the business because the pressure to succeed caused by Elon Musk was too high for them. The Tesla story is not only about the smart electric cars, but also about the complexity of battery production, the development of the subsidiary SolarCity and the general indebtedness and its impact on the cash balance (repayments and interest) and its development (cash burn). According to Elon Musk himself, the 2.7 billion US-$ from the last capital increase should already be “premature” in ten months. And the China strategy may come rather late (too late?), since the People’s Republic clearly prefers the potentials of the fuel cell to those of the battery. The subsidies for the battery will be discontinued and introduced for the fuel cell.

Full-bodied forecasts

Despite all this, 15,000 vehicles per week are Elon Musk’s new declared goal. China is supposed to fix this. In addition, there are loud thoughts about setting up a third Gigafactory in Europe. Musk, however, is relying too much on quantities as on their profitability.

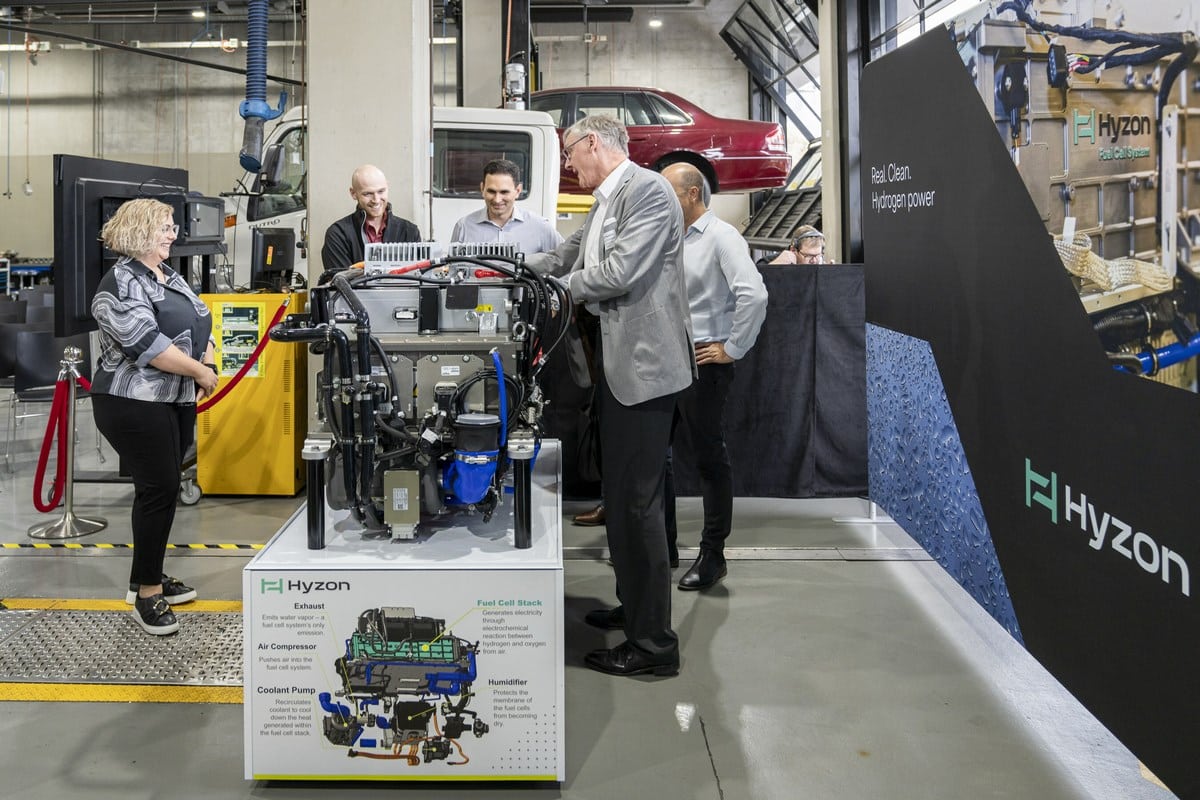

A rethink would be good, but Elon Musk only sees the battery. And it already exists, the Tesla as a hybrid with a fuel cell. Tesla should achieve this after the Dutch team of the company Holthausen, which converted a Tesla on its own initiative to a Hesla (H stands for hydrogen), in order to create the combination of battery and fuel cell via hybrid. This could mean a real revaluation, but Elon Musk unfortunately does not see these potentials of the “Foolcell” (O-Ton) at all.

It’s not too late yet. I would give up my sceptical attitude towards Tesla if the fuel cell was given more consideration. My next course target: 150 US-$.

Risk warning

Every investor must always be aware of his own risk assessment when investing in shares and also consider a sensible risk diversification. The FC companies and shares mentioned here are small and mid-caps, i.e. they are not standard stocks and their volatility is also much higher. This report is not a buy recommendation – without obligation. All information is based on publicly available sources and, as far as assessment is concerned, represents exclusively the personal opinion of the author, who focuses on a medium- and long-term valuation and not on a short-term profit. The author may be in possession of the shares presented here.

Author: Sven Jösting, written mid of August 2019

0 Comments