Despite the fuel cell industry’s recent growth spurt, the market still looks like a pyramid. At the top, you will find the stack and system manufacturers which offer commercial products and have a clear understanding of the costs involved and the wishes customers may have. These businesses are either driven by policy, as in Japan, or the forces of a free market, like FuelCell Energy. But of the worldwide more than 200 stack and system providers, fewer than 30 have made it this far.

The second tier consists of businesses that are close to market ready or are quasi-commercial now and are drawing up the financial sections of their business plans. Similar to tier 1 companies, they are seeing investment from the private sector and are growing their customer base. This tier is populated by fewer than 60 enterprises.

The bottom of the pyramid entails the majority of stack and system companies. Focused heavily on RD&D, they are still miles away from the cost structure of stacks and systems in later stages.

What this means for the fuel cell industry is that we will see another split between tier 1 and 2 companies on one side and the rest of the industry on the other. The former will continue to contribute the biggest chunk of sales and receive the largest portion of investment, whereas the latter will be an easy target for M&A. This split became increasingly clear last year, with a rise in consolidations and buyouts.

Overall, the number of fuel cell businesses has been growing. One of the factors for this growth is a reduction in barriers to entry, especially at system level. Historically, 4th Energy Wave’s rule of thumb has been that a PEM fuel cell system required around USD 1 billion for R&D and commercialization, and an SOFC unit somewhat more. But now, as we see the start of stack standardization, initial costs are falling. Obviously, there is still a long way to go, but as innovative and standardized concepts reduce financial barriers to entry, we should see an increase in the number of smaller market entrants.

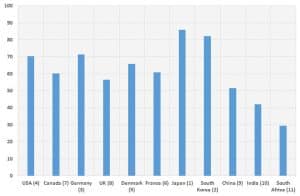

Country Attractiveness Index

The Country Attractiveness Index, launched by 4th Energy Wave this year, has made it possible to clearly and unambiguously identify Japan as the leading country for fuel cells, with South Korea second and Germany third …

Japan is the only nation to steadily move forward with implementing a hydrogen society. It is known globally for a government that pursues a long-term, stable and well-coordinated approach to the development and creation of a local fuel cell industry. What has led to this country outstripping any other in developing a strong, domestic fuel cell market is the length of time of sustained investment, a clear policy direction in product development and market introduction, renewed and agreed-upon targets, as well as coordinated activities and focus.

Most fuel cells developed in Japan today are PEM-type stacks and systems. This is somewhat understandable, considering the country’s policy focus on residential buildings. But as the data is replotted over the coming years, this – as 4th forecasts – is likely to change, with an increasing number of companies to work on high-temperature systems.

Unit sales

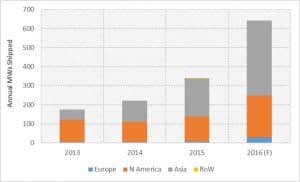

If we turn to shipments by region (see fig. 1), we see that in terms of megawatts, the Asian-Pacific markets have stepped up their lead, and …

Europe still lags far, far behind the rest of the world in terms of system manufacturing. The companies that offer commercially available products either manufacture them outside of Europe or produce small units with a capacity of up to 5 kW. The one area that Europe is very strong in is the portable fuel cell market. If we base the chart on the number of shipped systems in this field, the picture will look somewhat different.

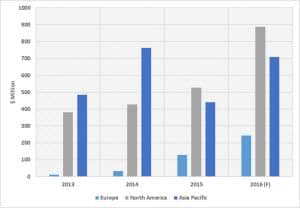

In terms of revenue, 4th Energy Wave focuses on money generated from the sale of complete fuel cell systems. Figure 3 shows that North America was the region with the highest revenue in this segment in 2015. It marks a shift in position from 2014, when Asia had dominated the market. Sales in North America were boosted by a number of high-profile deals, including the sale of Ballard fuel cell buses to China and the US Pepperidge Farm purchase of a 1.4 MW CHP plant by FuelCell Energy. Revenue in North America is forecast to jump again in 2016 to some USD 900 million, primarily thanks to stationary installations for which contracts were signed last year and revenue recognition is due in this one (see also FuelCell Energy: Decision on Beacon Falls).

Conclusion

It was a difficult 2015 for fuel cell companies. It again illustrates the challenges companies face when transitioning from an industry focused on RD&D to one of complete commercialization. Market actors will have to …

The “Fuel Cell and Hydrogen Annual Review” is the continuation of the Fuel Cell Today’s “Fuel Cell Annual Review” report started by Kerry-Ann Adamson and her team in 2008. The dataset combines both historical data from FCT and fresh data collected and collated by 4th Energy Wave. It makes this year’s review the ninth publication of its kind and the third one by 4th Energy Wave, a fully independent, distributed energy strategy, analysis and advisory firm.

Download the review (76 pages and chartbook, incl. graphics) for free on: www.4thenergywave.com

Reference

Adamson, K.-A., 4th Energy Wave Fuel Cell and Hydrogen Annual Review, 2016

Author and figures: Dr. Kerry-Ann Adamson, Kerry-ann@4thenergywave.com

0 Comments