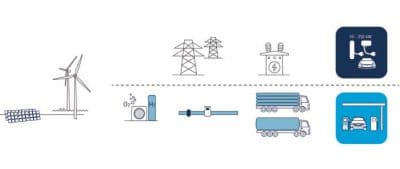

Electric motors are the key to sustainable transportation. One of the features that all-electric and fuel cell vehicles have in common is the absence of local emissions. Their lack of harmful pollutants can improve people’s quality of life, especially in highly populated conurbations. What is needed now is a supply chain to exploit the potential of those technologies.

The Jülich research center has conducted an in-depth analysis of the supply chains for battery electric vehicles and hydrogen fuel cell cars. The study document contains a detailed description of several scenarios, which serve markets of several hundred thousand to several million vehicles, and lists their capital and running costs, efficiencies and emission levels.

Both technologies are still in early development. There is little clarity about what the supply chain for each pathway should look like and which adjustments need to be made based on the size of the relevant market. Likewise, there would need to be options for dealing with surplus electricity, certain to be a frequent occurrence in energy sectors primarily based on renewable power production.

Besides a detailed description of the necessary infrastructure and means of distribution, the paper reveals all the assumptions that served as the starting point for subsequent discussion. This level of transparency is hoped to facilitate an open exchange of information and a fact-based debate, which can lead to improvements to the current knowledge base.

Findings

The scenarios analyzed as part of the study show that both pathways require nearly identical amounts of investment if the size of the relevant market does not exceed several hundred thousand vehicles. During the transition period, hydrogen producers are assumed to make increasing use of the renewable surplus energy and of seasonal storage space designed to bridge a gap in supply for up to 60 days. This concept would allow for green hydrogen to meet demand, although it would be more expensive in the short-term compared to a charging infrastructure.

Seasonal storage is missing from the all-electric scenario, although it could guarantee that production is sourced entirely from renewables. The total capital costs required for supplying 20 million vehicles through an electric infrastructure is EUR 51 billion. The cost of the hydrogen system, on the other hand, is much lower and adds up to around EUR 40 billion (see fig. 2).

High market penetration rates result in similar costs per kilometer for both pathways. On average, they add up to 4.5 cents* for electric charging and 4.6 cents for hydrogen. What nearly offsets the reduced efficiency of the latter is the use of electrolysis to produce hydrogen from the surplus available on-site and, thus, store energy that would otherwise have been lost. [* all amounts in EUR]

The scenario assuming the availability of 20 million fuel cell vehicles requires 87 terawatt-hours of surplus energy for electrolysis, as well as another 6 terawatt-hours from the grid to transport and distribute the hydrogen. Charging 20 million all-electric vehicles consumes 46 terawatt-hours, taken from the transmission lines. Both the charging infrastructure and the all-electric cars show higher efficiencies, but on-demand power is limited to shorter intervals. In energy sectors dominated by renewable production, the excess power required for the two pathways in the high-penetration scenario exceeds demand by a factor of three to six.

…

Download the study: http://hdl.handle.net/2128/16709

Written by Dr.-Ing. Martin Robinius, Prof. Dr.- Ing. Detlef Stolten, both for Forschungszentrum Jülich, Institut für Energie- und Klimaforschung, Jülich, Germany

Agreed H2 is our future clean energy source and it is here now!